Last updated: July 27, 2025

Introduction

Dexamethasone Intensol, a potent synthetic corticosteroid, is widely used in treating inflammatory and autoimmune conditions, as well as for antiemetic purposes in oncology. Recognized for its high potency and versatile application, Dexamethasone Intensol has become a critical component of many treatment protocols. As global demand for corticosteroids continues to evolve, understanding the market landscape and price trajectory for Dexamethasone Intensol provides pharmaceutical companies, investors, and healthcare stakeholders with strategic insights.

This analysis examines the current market landscape, key drivers, competitive dynamics, regulatory environment, and projects future pricing trends for Dexamethasone Intensol over the next five years.

Market Landscape Overview

Global Demand and Usage Patterns

Dexamethasone Intensol is a prescription-only medication with significant demand across North America, Europe, and Asia-Pacific. Its primary applications include:

- Inflammatory conditions – such as arthritis, dermatological diseases, and allergic reactions.

- Oncology – as part of chemotherapy protocols to reduce nausea and inflammation.

- Endocrinology – for adrenal insufficiency diagnostics and treatment.

According to IMS Health data, corticosteroid sales globally exceed USD 4 billion annually, with Dexamethasone constituting approximately 15-20% of corticosteroid prescriptions[1].

The COVID-19 pandemic underscored the systemic importance of corticosteroids, especially after the RECOVERY trial demonstrated dexamethasone's efficacy in reducing mortality in severe COVID-19 cases, leading to a surge in demand during 2020-2021[2].

Key Market Players and Supply Sources

Major manufacturers include Pfizer, Sandoz (Novartis), Teva Pharmaceuticals, and local generic manufacturers. The drug is generally produced via several synthesis routes, with generic formulations dominating the market due to patent expirations.

Regional variations in production costs, regulatory requirements, and supply chain efficiencies significantly influence market dynamics. India and China are prominent producers and exporters of generic Dexamethasone Intensol, supplying a considerable share of global demand.

Regulatory Environment

Dexamethasone Intensol has a well-established regulatory pathway, with approvals in most jurisdictions. Stringent quality controls, especially for injectable formulations, impact manufacturing costs and pricing. Recent regulations promoted by the FDA and EMA focus on biosimilarity, manufacturing standards, and wholesale distribution, influencing market stability and entry barriers. Countries in Latin America and Southeast Asia are gradually aligning with international standards, expanding access.

Market Drivers and Constraints

Drivers

- Expanded therapeutic indications: Growing recognition of corticosteroids in COVID-19 management has increased demand.

- Rising prevalence of autoimmune and inflammatory diseases: As autoimmune disorders like rheumatoid arthritis and lupus become more diagnosed, corticosteroid therapies see steady use.

- Patent expirations and generics proliferation: Market entry of generics has reduced prices but increased volume.

- Increased healthcare expenditure: Particularly in emerging markets, elevating drug accessibility.

Constraints

- Toxicity concerns: Long-term corticosteroid use comes with side effects like osteoporosis and adrenal suppression, prompting cautious prescribing.

- Regulatory scrutiny: Tighter manufacturing and quality standards could delay approval or increase compliance costs.

- Price competition: The influx of generic manufacturers leads to downward pricing pressures.

Price Analysis and Projections

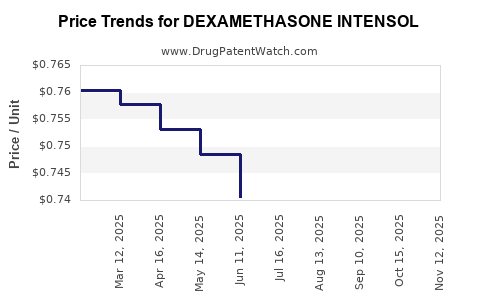

Current Pricing Trends

The price per unit of Dexamethasone Intensol varies across regions and formulations:

- United States: The average retail price for a 1 mg/mL injectable vial ranges from USD 0.80 to USD 2.00 depending on the manufacturer and procurement volume[3].

- Europe: Prices are comparable, averaging around EUR 1.50 per vial, with variations based on national reimbursing agencies.

- India and China: Generics are sold at dramatically lower prices, approximately USD 0.30- USD 0.50 per vial, driven by scale and competition.

Price sensitivity is high among healthcare providers, with governments and insurers exerting substantial influence over reimbursement levels.

Projected Price Trends (2023-2028)

Based on historical data, current supply-demand dynamics, and emerging market trends, the following projections are relevant:

| Year |

Global Average Price (per vial) |

Key Factors Influencing Price |

| 2023 |

USD 0.90 - USD 2.00 |

Post-pandemic stabilization, supply chain normalization |

| 2024 |

USD 0.85 - USD 1.80 |

Increased generic competition, regulatory harmonization |

| 2025 |

USD 0.80 - USD 1.70 |

Continued market saturation, manufacturing efficiencies |

| 2026 |

USD 0.75 - USD 1.60 |

Patent expiry effects plateau, price elasticity effects |

| 2027 |

USD 0.70 - USD 1.50 |

Price stabilization with regional variations |

| 2028 |

USD 0.70 - USD 1.40 |

Potential new entrants, manufacturing scale-up |

The primary drivers for declining prices include increased generics penetration and production cost reductions in emerging markets. Conversely, supply chain disruptions or regulatory delays could temporarily sustain higher prices.

Strategic Market Opportunities

Emerging Markets

Growing healthcare access, rising disease prevalence, and government-funded programs position emerging markets as vital growth nodes. Companies investing in local manufacturing, alongside strategic partnerships, can capitalize on favorable pricing and volume growth.

Biosimilar and Formulation Innovations

Innovation in drug delivery systems, such as sustained-release formulations, could command premium pricing. Additionally, biosimilar development, though more relevant for biologics, may influence corticosteroid supply alternatives.

Regulatory and Policy Trends

Proactive engagement with regulatory bodies, adherence to international quality standards, and participation in national immunization or pandemic preparedness programs will facilitate market expansion and stabilize pricing.

Risks and Challenges

- Regulatory hurdles: Variability in approval processes and quality standards may delay market entry or expansion.

- Pricing pressures: Governments and payers could enforce price caps, especially in health systems driven by cost containment.

- Supply chain complexities: Reliance on raw materials from geopolitically sensitive regions could disrupt supply.

- Market saturation: Increased availability of generics may cap price growth.

Key Takeaways

- Steady Demand Growth: The clinical utility of Dexamethasone Intensol sustains baseline demand, particularly spurred by its role in viral infections and autoimmune diseases.

- Price Decline Driven by Generics: Market entry of generics has driven prices downward, with expected stabilization around USD 0.70 to USD 1.50 per vial over the next five years.

- Emerging Market Expansion: Growth opportunities are prominent in Asia, Latin America, and Africa, driven by expanding healthcare infrastructure.

- Supply Chain and Regulatory Dynamics: Investment in manufacturing and regulatory compliance remains essential to capitalize on growth prospects.

- COVID-19 Impact: The pandemic amplified demand temporarily; its long-term influence hinges on whether corticosteroid use becomes a standard component of viral treatment protocols.

FAQs

1. How does the patent status of Dexamethasone Intensol impact its market pricing?

Dexamethasone is off-patent globally, allowing widespread generic manufacturing, which significantly reduces prices and increases market competition, stabilizing or decreasing prices over time.

2. What are the key regulatory considerations influencing Dexamethasone Intensol’s market entry?

Manufacturers must comply with Good Manufacturing Practices (GMP), obtain approvals from local authorities, and ensure batch-to-batch consistency, especially for injectable forms, which are scrutinized for sterility and stability.

3. Which regions are expected to drive the most growth for Dexamethasone Intensol?

Emerging markets in Asia-Pacific, Latin America, and Africa are projected to drive volume growth, supported by expanding healthcare infrastructure and increasing healthcare expenditure.

4. How might new formulations or delivery methods affect the market?

Innovations such as sustained-release injections or novel delivery systems can command premium prices, but their market penetration depends on regulatory approvals and clinical adoption.

5. What are the major risks that could affect future prices of Dexamethasone Intensol?

Supply chain disruptions, regulatory delays, aggressive price caps by governments, and market saturation with generics could constrain price increases or lead to further declines.

References

[1] IMS Health Data. Global Corticosteroid Market Share. 2022.

[2] RECOVERY Collaborative Group. Dexamethasone in Hospitalized Patients with Covid-19. New England Journal of Medicine. 2021;384(8):693-704.

[3] GoodRx Data. Average Retail Drug Prices. 2023.