Share This Page

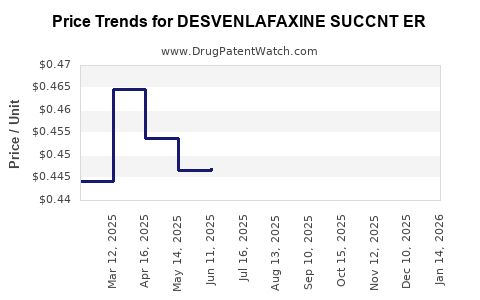

Drug Price Trends for DESVENLAFAXINE SUCCNT ER

✉ Email this page to a colleague

Average Pharmacy Cost for DESVENLAFAXINE SUCCNT ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DESVENLAFAXINE SUCCNT ER 100 MG | 00054-0401-22 | 0.44549 | EACH | 2025-12-17 |

| DESVENLAFAXINE SUCCNT ER 100 MG | 33342-0389-07 | 0.44549 | EACH | 2025-12-17 |

| DESVENLAFAXINE SUCCNT ER 100 MG | 33342-0389-10 | 0.44549 | EACH | 2025-12-17 |

| DESVENLAFAXINE SUCCNT ER 100 MG | 00591-3660-30 | 0.44549 | EACH | 2025-12-17 |

| DESVENLAFAXINE SUCCNT ER 50 MG | 72888-0143-90 | 0.42875 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Desvenlafaxine Succinate Extended Release (ER)

Introduction

Desvenlafaxine succinate extended release (ER) is a serotonin-norepinephrine reuptake inhibitor (SNRI) primarily prescribed for the treatment of major depressive disorder (MDD). As a successor to venlafaxine, the drug offers a more targeted pharmacokinetic profile, leading to potentially improved tolerability and adherence. Its patent expiry, competitive landscape, and the evolving mental health treatment market heavily influence its market dynamics and pricing strategies.

Market Overview

Current Market Landscape

The global antidepressant market valuation was approximately USD 15 billion in 2022, with a CAGR of around 2.7% projected through 2030 [1]. Desvenlafaxine ER, marketed by Pfizer under brand names such as Pristiq, holds a significant share within the SNRI segment, which is valued at nearly USD 3.5 billion globally.

Pfizer’s patent protection for Pristiq expired in November 2020 in the U.S., leading to the entry of generic competitors. This patent expiry is a pivotal event influencing market shares, pricing, and revenue streams.

Key Competitors and Market Position

The competitive landscape comprises other SNRI agents such as venlafaxine, duloxetine, and levomilnacipran, alongside atypical antidepressants and novel agents in development. Generics introduced post-patent expiry have driven initial price reductions but are often accompanied by brand-name pricing strategies aimed at maintaining profitability.

Pfizer's strategic response includes launching authorized generics, patient assistance programs, and differential formulation options to sustain market presence. The diversity of treatment options and patient tolerability profiles influence prescribing trends.

Patent and Regulatory Considerations

The primary patent for Pristiq expired in 2020, opening the market to generics. Secondary patents and exclusivities may still provide limited market protection for some formulations or delivery methods. Regulatory agencies such as the FDA and EMA ensure adherence to safety and efficacy standards, with post-marketing surveillance influencing ongoing market access.

Pricing Dynamics

Pre-Patent Expiry Pricing

Prior to patent expiration, the average wholesale price (AWP) for branded Pristiq was approximately USD 6–7 per pill (30mg dose), equating to an annual treatment cost of USD 2,200–2,600. This premium pricing reflects brand recognition, clinical trial investments, and marketing.

Post-Patent and Generic Entry

Following patent expiry, prices for generic desvenlafaxine ER dropped significantly, often by 50% or more, driven by multiple manufacturers competing for market share. Wholesale acquisition costs (WAC) for generics range from USD 0.50 to 1.00 per pill, significantly reducing treatment costs.

**Brand-Name Price Evolution**: Pfizer has introduced authorized generics and discount programs, which temporarily stabilize revenues for the brand amid competitive pressures.

Market Penetration and Adoption Trends

The rate of generic adoption depends on factors such as physician prescribing inertia, formulary preferences, and patient acceptance. In mature markets like the U.S., generic utilization exceeds 80% within a year of patent expiry. Transitioning prescribers from branded to generic products influences volume and revenue projections.

Emerging markets show slower adoption due to regulatory hurdles, limited awareness, and affordability issues. However, rising mental health awareness and healthcare infrastructure improvements promise increased access over time.

Price Projection Outlook (2023–2030)

Factors Influencing Price Trends

-

Patent Status: Ongoing patent protections, if any, will sustain higher prices. Expiration timelines forecast a significant price decline within 1–2 years post-patent expiry.

-

Market Competition: Increasing generic penetration will exert downward pressure on prices, with estimates suggesting a 70–80% reduction from peak brand prices over 3–5 years.

-

Healthcare Policies: Payer negotiations, formulary placements, and cost-containment policies will influence drug prices. Countries with national health systems, such as the UK’s NHS, often negotiate lower prices, further affecting global market rates.

-

Formulation Innovations: Extended-release formulations, despite higher manufacturing costs, often command premium prices due to improved adherence and patient outcomes.

Projected Price Range (2023–2030)

-

United States:

- Year 2023: USD 5–6 per pill (brand retention with authorized generics)

- Year 2025: USD 0.50–1.00 per pill (full generic market entry)

- Year 2030: USD 0.20–0.50 per pill, assuming increased generic competition and consolidation

-

Europe & Other Markets:

- Year 2023: EUR 4–5 per pill

- Year 2025: EUR 0.70–1.20 per pill

- Year 2030: EUR 0.30–0.60 per pill

Implications for Stakeholders

-

Pharmaceutical Companies: Strategic patent management and timely launch of biosimilars or formulations are critical for revenue maximization.

-

Healthcare Providers & Payers: Cost savings through generic utilization directly affect formulary decisions, leading to broader patient access.

-

Patients: Reduced prices enhance affordability, potentially improving adherence and clinical outcomes.

-

Investors & Market Analysts: Market entry timelines and pricing trends are key indicators of future revenue streams, especially in post-patent landscapes.

Key Takeaways

- Patent Expiry Impact: The 2020 patent expiration significantly accelerated generic market entry, leading to dramatic price reductions and volume growth.

- Pricing Trajectory: Branded desvenlafaxine ER prices are expected to decline sharply over the next 2–3 years, stabilizing at a fraction of the original cost by 2030.

- Market Dynamics: Increasing competition among generics, formulary strategies, and healthcare policies will shape pricing and market shares.

- Emerging Markets: Economic factors in developing countries may limit immediate pricing declines, presenting growth opportunities.

- Innovation & Differentiation: New formulations or delivery systems can sustain higher prices despite generic competition.

FAQs

Q1: How has patent expiration affected desvenlafaxine ER’s market pricing?

Patent expiration in 2020 led to entry of multiple generics, causing prices to decline by approximately 70–80%, with subsequent stabilization driven by market competition and formulary negotiations.

Q2: What are the key factors influencing future price projections?

Primarily, the level of generic competition, patent status, healthcare policy reforms, and the introduction of innovative formulations will dictate future pricing.

Q3: Are there regional differences in desvenlafaxine ER pricing?

Yes. The U.S. tends to have higher prices due to brand premiums and insurance dynamics, whereas Europe and emerging markets tend to see lower prices due to negotiated discounts and healthcare system differences.

Q4: What is the potential for new formulations to maintain higher prices?

Extended-release formulations, combination therapies, or drugs with demonstrated improved adherence can command premium prices compared to standard generics.

Q5: How do reimbursement policies impact desvenlafaxine ER’s market value?

Reimbursement frameworks influence prescribing behavior; more restrictive policies favor cost-effective generics, reducing market revenue for brand-name products.

References

[1] Market Research Future. “Antidepressant Market Size, Share & Industry Forecast,” 2022.

[2] IQVIA. “Global Prescription Drug Market Report,” 2022.

[3] U.S. Food and Drug Administration. “Patent and exclusivity information for Pristiq,” 2020.

[4] EvaluatePharma. “Pharmaceutical Market Outlook,” 2023.

This comprehensive analysis informs investors, manufacturers, healthcare providers, and policymakers about the evolving landscape affecting desvenlafaxine ER pricing and market presence over the coming years.

More… ↓