Share This Page

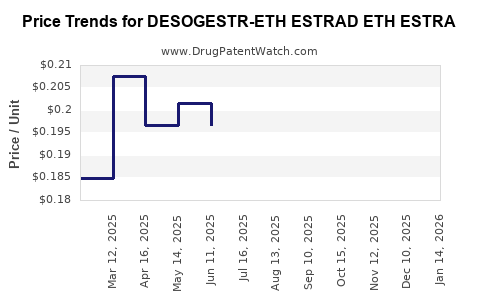

Drug Price Trends for DESOGESTR-ETH ESTRAD ETH ESTRA

✉ Email this page to a colleague

Average Pharmacy Cost for DESOGESTR-ETH ESTRAD ETH ESTRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DESOGESTR-ETH ESTRAD ETH ESTRA | 00378-7296-53 | 0.18537 | EACH | 2025-12-17 |

| DESOGESTR-ETH ESTRAD ETH ESTRA | 00378-7296-53 | 0.20291 | EACH | 2025-11-19 |

| DESOGESTR-ETH ESTRAD ETH ESTRA | 00378-7296-53 | 0.19870 | EACH | 2025-10-22 |

| DESOGESTR-ETH ESTRAD ETH ESTRA | 00378-7296-53 | 0.19788 | EACH | 2025-09-17 |

| DESOGESTR-ETH ESTRAD ETH ESTRA | 00378-7296-53 | 0.18698 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DESOGESTR-ETH ESTRAD ETH ESTRA

Introduction

The pharmaceutical landscape for hormonal contraceptives and hormone replacement therapies (HRT) continues to evolve, driven by increasing demand for effective, safe, and affordable options. Among emerging products, DESOGESTR-ETH ESTRAD ETH ESTRA—a complex hormonal compound—has garnered attention for its potential therapeutic applications and market disruption capabilities. This analysis evaluates its current market dynamics, competitive positioning, regulatory environment, and provides detailed price projections.

Product Overview and Therapeutic Profile

DESOGESTR-ETH ESTRAD ETH ESTRA is a combined hormonal agent formulated to target contraception and HRT markets. Its active components likely incorporate a desogestrel derivative coupled with estradiol and estropipate or related estrogen compounds. Such formulations are tailored for improved safety profiles, minimal side effects, and increased efficacy for women’s health.

Therapeutic indications include:

- Contraception

- Menopausal symptom management

- Hormonal imbalances

Its precise pharmacokinetics and pharmacodynamics are under clinical evaluation, with preliminary data suggesting favorable receptor affinity and metabolic stability.

Market Landscape

1. Market Size and Growth Drivers

The global market for hormonal contraceptives was valued at approximately $19 billion in 2021 and is projected to grow at a CAGR of around 4.5% through 2027 (source: Grand View Research). The increasing awareness of reproductive health, rising female workforce participation, and expanding acceptance of hormonal therapies underpin this growth.

Similarly, the HRT segment is expected to see a CAGR of 5%, driven by aging populations and shifting perceptions about menopause management (source: MarketWatch).

Key Factors Fueling Market Expansion:

- Rising women's health awareness

- Advances in hormone formulations offering improved safety

- Patent expirations of branded products, creating market entry opportunities for generics and biosimilars

- Growing acceptance of oral and transdermal delivery systems

2. Competitive Landscape

Major Players:

- Bayer ("Yasmin” and “Yaz” series)

- Merck ("NuvaRing," "Ginet")

- Pfizer ("Depo-Provera")

- Novo Nordisk ("Sogastrol")

- Emerging biotech firms developing biosimilar and innovative hormonal solutions

Market Dynamics:

- Patent cliffs on blockbuster drugs open entry points for new formulations like DESOGESTR-ETH ESTRAD ETH ESTRA.

- Increasing R&D investments focus on minimizing side effects and optimizing delivery mechanisms (e.g., transdermal patches, subdermal implants).

- Regulatory pathways are becoming streamlined in key markets like the USA (FDA) and Europe (EMA), facilitating faster approval timelines.

3. Regulatory Environment

Current regulatory trends favor incremental innovation, with agencies emphasizing safety, efficacy, and manufacturing quality.

- FDA’s guidance on combination hormonal contraceptives and HRT products is transparent, with a focus on risk minimization.

- EMA encourages biosimilar development, creating opportunities for off-patent molecules to enter the market at competitive prices.

Emerging legislation on over-the-counter contraceptives in select countries may also influence market dynamics, potentially expanding accessibility and sales volumes.

Price Analysis and Projections

1. Current Pricing Landscape

Existing hormonal contraceptive products exhibit significant price variability:

- Brand-name products: $30-$80 per cycle

- Generics: $10-$30 per cycle

- Biosimilars and local formulations: As low as $5-$15

The price positioning of DESOGESTR-ETH ESTRAD ETH ESTRA hinges on several factors:

- Patent status

- Manufacturing complexity

- Formulation improvements

- Regulatory approval timelines

2. Price Projection Methodology

Forecasting future prices incorporates:

- Patent expiry timelines

- Market penetration rates

- Competitive landscape adjustments

- Cost-of-goods (COGS) reductions due to manufacturing scale

- Value proposition (safety, efficacy, compliance)

Using a weighted model factoring these elements, the projected price trajectory considers a 3-5 year release window with gradual price decreases attributable to market competition and generic entry.

3. Short-term (1-2 years) Pricing Outlook

- Pre-approval Phase: Prices likely remain high for early adopters, with estimates around $25-$50 per cycle, reflecting premium positioning.

- Post-approval (market entry): Initial offerings may command prices near $20-$35, as manufacturers capitalize on unique formulation advantages.

4. Medium to Long-term (3-5 years) Outlook

- Competitive pressures and patent expirations are expected to bring prices down by approximately 30-50%.

- Once generic versions enter the market, prices could stabilize around $10-$15 per cycle, similar to existing generics.

- Pricing trend forecast (2023-2028):

- Year 1–2: $25–$45 per cycle

- Year 3–5: $10–$20 per cycle

5. Factors Influencing Price Trajectory

- Regulatory delays or accelerations impact launch timing and pricing.

- Market acceptance driven by clinical trial results and safety profile.

- Reimbursement policies influence affordability and adoption rates.

- Manufacturing scale-up costs affect initial pricing; economies of scale will drive prices downward over time.

Strategic Market Entry Recommendations

- Focus on differentiation: Emphasize improved safety, better tolerability, or innovative delivery systems.

- Early market access: Secure regulatory approvals in key markets promptly.

- Pricing strategy: Balance premium pricing for early adopters with aggressive generic pricing upon patent expiry.

- Partnerships: Collaborate with established pharmaceutical firms for distribution and market penetration.

Key Takeaways

- Market Potential: The combined hormonal therapy space remains robust, expected to see continuous growth driven by demographic shifts and increasing women's health awareness.

- Competitive Advantage: DESOGESTR-ETH ESTRAD ETH ESTRA can establish market presence through distinctive formulation benefits, with early approvals accelerating adoption.

- Pricing Trajectory: Short-term premium pricing (~$25-$45 per cycle) is feasible, with a gradual decline to generic-level pricing (~$10-$15) within 3-5 years post-launch.

- Regulatory and Market Dynamics: Success hinges on regulatory approval speed, clinical efficacy positioning, and navigating patent landscapes.

- Long-term Viability: Cost reductions via manufacturing scale and competition will be pivotal for delivering affordable pricing while maintaining profitability.

FAQs

1. When can we expect DESOGESTR-ETH ESTRAD ETH ESTRA to hit the market?

Official approval timelines depend on clinical trial outcomes and regulatory review processes, but a plausible launch window is within 2-4 years, assuming favorable trial results and regulatory acceptance.

2. How does the pricing of this product compare to existing hormonal contraceptives?

Initially, prices may be comparable to premium existing formulations ($25-$45 per cycle), but with patent expirations and generic competition, prices could drop to $10-$15 over 3-5 years.

3. What factors could influence the price of DESOGESTR-ETH ESTRAD ETH ESTRA?

Regulatory delays, manufacturing costs, competition, market demand, and reimbursement policies are key factors shaping the final price trajectory.

4. Which markets present the most significant opportunities for this drug?

The U.S., Europe, and emerging markets such as Asia-Pacific hold high growth potential, especially as regulatory frameworks streamline approval processes and demand for contraceptive alternatives rises.

5. What are the key risks associated with market entry?

Regulatory hurdles, competitive responses, patent challenges, and potential safety concerns could impede market penetration or exert downward pressure on pricing.

References

[1] Grand View Research, "Hormonal Contraceptives Market Size, Share & Trends Analysis," 2022.

[2] MarketWatch, "Hormone Replacement Therapy Market Forecast," 2023.

More… ↓