Last updated: July 27, 2025

Introduction

Desloratadine, a second-generation antihistamine, is widely prescribed for allergic rhinitis and chronic idiopathic urticaria. Since its market authorization, it has gained a robust footprint globally due to its favorable safety profile and minimal sedative effects. This report provides a comprehensive market analysis of desloratadine, examining current trends, competitive landscape, future demand drivers, and price projections through 2030, to aid pharmaceutical stakeholders, investors, and healthcare policymakers.

Market Landscape Overview

Global Market Size and Growth Trends

The global antihistamine market, valued at approximately USD 4.8 billion in 2022, is projected to reach USD 6.5 billion by 2030, growing at a compound annual growth rate (CAGR) of about 4.2% (2023–2030) [1]. Desloratadine accounts for roughly 15–20% of this segment, reflecting strong adoption owing to its efficacy and safety profile.

The increasing prevalence of allergic rhinitis—estimated to affect over 1.2 billion people worldwide—and rising awareness about treatment options propel demand. The market growth is further supported by the expanding availability of generic formulations, especially in mature markets such as North America and Europe.

Geographical Market Dynamics

-

North America: The dominant market, driven by high healthcare expenditure, widespread awareness, and mature prescription habits. The US captures the largest share, with a significant shift toward OTC sales of desloratadine.

-

Europe: A mature market with steady growth, where regulatory approvals for OTC use and increased prevalence of allergies bolster demand.

-

Asia-Pacific: The fastest-growing region, with a CAGR of approximately 6%, fueled by increasing urbanization, pollution, and improving healthcare infrastructure in China, India, and Southeast Asia.

-

Latin America and Middle East & Africa: Emerging markets showing moderate growth, constrained by access issues but benefitting from expanding healthcare access.

Competitive Landscape

Key players include Sanofi (Clarinex), Teva Pharmaceuticals, Mylan, Sandoz, and regional manufacturers producing generic formulations. Patent expiration in many jurisdictions has facilitated a surge in generics, pressuring branded prices.

Innovations in drug delivery and formulations are ongoing, with sustained-release tablets and combination formulations entering the pipeline. Such developments aim to improve patient compliance and expand therapeutic applications.

Market Drivers and Challenges

Drivers

- Rising Prevalence of Allergic Conditions: Increasing allergic rhinitis and urticaria cases globally, especially in urbanized and polluted environments.

- Expanding OTC Availability: Regulatory shifts facilitate OTC sales, broadening access.

- Aging Population: Older adults frequently suffer from allergy-related conditions, augmenting demand.

- Advances in Formulation Technologies: Enhanced bioavailability and patient preference through novel dosage forms.

Challenges

- Price Competition: Entry of generics reduces premiums for branded products.

- Regulatory Hurdles: Variability in approval processes impacts market entry timelines.

- Market Saturation: Mature markets exhibit slower growth due to established competition.

- Limited Innovation: Slower pipeline development compared to newer antihistamines or biologics targeting allergies.

Pricing Dynamics

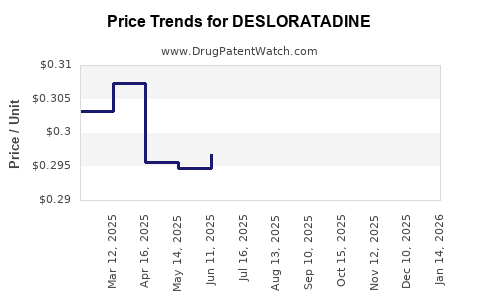

Historical Pricing Trends

In the United States, the average retail price for brand-name desloratadine (e.g., Clarinex) has historically ranged from USD 150–200 for a 30-tablet bottle, whereas generics are priced around USD 80–110 [2]. OTC formulations are significantly cheaper, with prices around USD 10–15 per month’s supply.

In Europe, the London Drug Tariff indicates similar trends, with branded prices notably higher than generics.

Pricing Influences

- Patent Status: Patent expiration in many markets has precipitated a sharp decline in prices for generics, closely aligned with manufacturing costs.

- Regulatory Policies: Price controls in countries like the UK, Canada, and Australia influence retail prices.

- Market Penetration of Generics: Increased production and competition have driven down prices substantially over the past decade.

- Demand Dynamics: Rising demand supports stable or slightly increasing prices for niche formulations or combination therapies.

Future Price Projections (2023–2030)

Based on market trends, regulatory environments, and competitive landscape, the following price projections are outlined:

Branded Desloratadine (Originator)

- 2023–2025: Prices expected to decline by approximately 10–15% annually due to patent expiries and generic competition.

- 2026–2030: Stabilization at 30–40% below peak brand prices; potential niche premium for specialized formulations.

Generic Desloratadine

- 2023: Entry prices around USD 50–70 for a 30-day supply.

- 2024–2026: Prices anticipated to decrease further, reaching USD 30–50.

- 2027–2030: Prices may stabilize around USD 20–30, driven by manufacturing efficiencies and high-volume sales.

OTC Formulations

- Stable or marginally declining prices, with potential for further cost reductions in emerging markets due to local manufacturing.

Premium and Combination Products

- Limited growth; prices may range higher depending on added value, such as extended-release formulations or combination with other antihistamines.

Note: These projections assume no disruptive technological breakthroughs or regulatory changes and reflect current national pricing mechanisms.

Implications for Stakeholders

- Pharmaceutical Companies: Invest in differentiating formulations, especially combination therapies, to sustain premium pricing.

- Investors: Reduced premiums on originator brands warrant cautious positioning; opportunities exist in high-volume generics and OTC segments.

- Healthcare Providers and Policymakers: Trends towards OTC availability and lower prices suggest increased access but necessitate monitoring for overuse or misuse.

Key Takeaways

- The desloratadine market is mature in developed regions but expanding rapidly in Asia-Pacific and emerging markets.

- Patent expiries have driven significant price decreases for generics, challenging brand-name dominance.

- Demand growth projections remain positive, primarily due to rising allergy prevalence and regulatory shifts toward OTC sales.

- Price projections indicate further declines for generics, with stable or marginally reduced costs for OTC products through the 2020s.

- Strategic focus should be on innovation in formulations, combination therapies, and market expansion to sustain profitability.

Conclusion

Desloratadine's market trajectory reflects a typical post-patent landscape characterized by intense generic competition and declining prices. Yet, its essential role in allergy management ensures enduring demand. Stakeholders should adapt by emphasizing differentiated formulations and expanding access through OTC channels, aligning with evolving healthcare trends.

FAQs

1. How will patent expirations influence desloratadine prices globally?

Patent expirations lead to increased generic competition, exerting downward pressure on prices. In markets like the US and Europe, generics now comprise a significant market share, reducing revenue streams for originator brands and driving retail prices lower.

2. What are the key drivers for future demand of desloratadine?

Rising global prevalence of allergic conditions, growing awareness, expansion of OTC formulations, and demographic shifts toward aging populations are central demand drivers.

3. Are there any upcoming innovations in desloratadine formulations?

Research focuses on sustained-release formulations, combination therapies with other antihistamines or decongestants, and novel delivery systems (e.g., nasal sprays). These innovations aim to improve patient adherence and expand therapeutic options.

4. How do regional pricing policies affect desloratadine prices?

Price controls in regions like Europe and certain Asian countries cap retail prices, leading to lower consumer costs. Conversely, markets with free pricing tend to have higher retail prices, especially for branded products.

5. What potential risks could impact desloratadine market stability?

Emergence of new allergy treatments, shifts in regulatory policies, supply chain disruptions, or adverse safety reports could alter market dynamics and pricing strategies.

Sources

[1] Transparency Market Research, “Antihistamines Market,” 2022.

[2] GoodRx, “Desloratadine Prices and Trends,” 2023.