Last updated: July 27, 2025

Introduction

Desipramine, a tricyclic antidepressant (TCA), has been a staple in psychiatric treatment since its development in the 1960s. Primarily prescribed for major depressive disorder, off-label uses extend to neuropathic pain and other off-label indications. Despite the advent of newer antidepressants and complex competition dynamics, Desipramine maintains a niche market, driven by certain clinical advantages, cost factors, and patient populations. This analysis examines current market conditions, competitive landscape, regulatory factors, and projects future pricing trends for Desipramine.

Market Overview

Historical Context

Initially introduced by ICI (now AstraZeneca) in 1963, Desipramine's patent expired in the late 20th century, transitioning it to generic status. The drug's longstanding clinical use has solidified its position in treatment regimens, especially in regions with limited healthcare budgets where cost-effective therapies are prioritized.

Current Market Dynamics

The global antidepressant market, valued at approximately USD 17 billion in 2022, is increasingly dominated by selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs). However, Tricyclic antidepressants (TCAs), including Desipramine, account for a smaller segment, roughly 5-7%, due to side effect profiles and newer options.

Key factors influencing Desipramine’s market share include:

- Cost-effectiveness: As a generic drug, Desipramine remains among the most affordable options, especially in low- and middle-income countries.

- Clinical preference: some psychiatrists favor TCAs like Desipramine for treatment-resistant cases owing to efficacy.

- Safety concerns: The side effect profile, including cardiotoxicity, limits its widespread use.

- Regulatory trends: Orphan drug status or restrictions are not prevalent, but some regions impose strict controls due to misuse potential.

Geographical Market Distribution

- North America: A declining but steady demand; prescriber preference favors newer agents.

- Europe: Similar trends with continued usage in specific cases.

- Asia-Pacific: Growing demand due to cost constraints and established prescribing habits.

- Emerging Markets: Increasing utilization driven by affordability and high patient volume.

Competitive Landscape

The competitive landscape for Desipramine is characterized primarily by generics, with a handful of branded and unbranded formulations. The intensity of competition and market pricing is shaped by:

- Generics producers: Multiple manufacturers globally, fostering price competition.

- Alternative therapies: SSRIs (e.g., Fluoxetine, Sertraline), SNRIs (e.g., Venlafaxine), and newer agents diminish market share.

- Off-label use: Limited in number, mostly for neuropathy, affecting demand volume.

Brand vs. generic: Well-established generics dominate due to low prices and extensive supply networks. Limited branded versions exist, primarily for institutional or specialized use.

Pricing Analysis

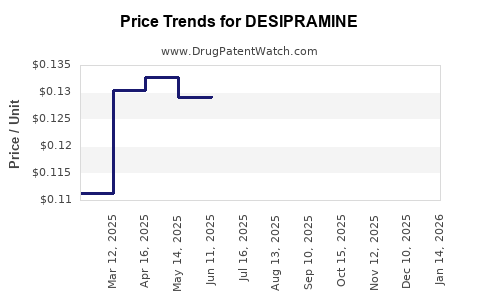

Historical Pricing Trends

- Average wholesale prices (AWP): Historically, the AWP for Desipramine 25 mg per tablet in the U.S. ranged around USD 0.20 to 0.40.

- Market discounts: Actual transaction prices tend to be significantly lower due to negotiations and insurance discounts.

- Comparative pricing: In low-income countries, prices can be as low as USD 0.05 per tablet, whereas high-income markets see prices near USD 0.50-0.70 per tablet wholesale.

Current Price Points

- United States: USD 0.10 - 0.30 per tablet (generics)

- Europe: EUR 0.08 - 0.25 per tablet

- Asia-Pacific: USD 0.05 - 0.15 per tablet

- Emerging markets: USD 0.05 or less per tablet

Future Price Projections

Considering market maturation, manufacturing costs, regulatory influences, and competitive pressures, the following projections are made:

-

Short-term (1-3 years):

Marginal price stability or slight decrease (~5%). Generic manufacturers will leverage economies of scale, and competitive discounting will sustain low prices. No significant premium expected unless supply disruptions occur.

-

Medium-term (3-5 years):

Prices may decline modestly, reaching USD 0.05 - 0.10 per tablet globally, driven by increased competition, especially in emerging economies. The increasing prevalence of generic production will pressure prices downward.

-

Long-term (5+ years):

Potential stabilizations at low levels, unless new formulations or indications emerge that could command premium pricing. Producing countries with low manufacturing costs will sustain minimal prices, whereas developed markets may maintain slightly higher prices due to supply chain costs.

Regulatory and Patent Impacts

Although Desipramine is off-patent, regulatory factors can influence market dynamics:

- Quality standards: Stringent Good Manufacturing Practice (GMP) requirements could temporarily inflate costs.

- Drug shortages: Supply chain disruptions might temporarily elevate prices, especially if generic manufacturers exit the market.

- New indications: Discovery of additional therapeutic uses could introduce patent protections or exclusivities, increasing prices temporarily.

Market Opportunities & Risks

Opportunities

- Growing demand in regions with limited healthcare resources.

- Potential for repurposing in off-label indications.

- Cost advantages for emerging markets.

Risks

- Competition from newer, safer, and more tolerable antidepressants.

- Mandatory safety monitoring may impose additional costs.

- Policy shifts favoring newer agents could further diminish demand.

Key Takeaways

- Limited growth prospects: The market for Desipramine remains primarily in established, cost-sensitive environments, with limited upside due to competition and safety concerns.

- Stable low pricing trend: Expect prices to hover near current generic levels, with minor declines driven by manufacturing efficiencies and market saturation.

- Emerging markets premium: In regions with less regulatory oversight, prices could temporarily remain slightly higher, but overall, the trend favors further declines.

- Potential for niche resurgence: Off-label uses or combination therapies might sustain niche demand but probably won't affect pricing significantly.

- Market consolidation: Increased competition among generic manufacturers could lower prices further, maintaining Desipramine's position as an ultra-low-cost antidepressant.

Conclusion

Desipramine's market remains largely stable in terms of pricing, with a clear trajectory towards further price reductions driven by generics and market saturation. Its niche status in specific regions, combined with its cost advantages, ensures continued relevance, albeit in a declining share of the global antidepressant market. Market players and stakeholders should monitor regulatory changes, emerging indications, and regional demand shifts to refine strategic positioning.

FAQs

1. What factors influence the price of Desipramine in global markets?

Primarily, manufacturing costs, competition among generic producers, regulatory standards, regional demand, and healthcare policies influence its pricing.

2. Will the price of Desipramine increase in the near future?

Unlikely. Market trends indicate stable or declining prices, especially with increasing generic competition and the availability of newer antidepressants.

3. How does Desipramine compare pricing-wise to other antidepressants?

It remains one of the most affordable options, particularly in low-income regions, due to its generic status. Brand-name or specialty formulations are generally more expensive.

4. Are there emerging indications that could affect Desipramine market prices?

Potential off-label uses in neuropathic pain or other conditions could extend demand but are unlikely to impact pricing significantly unless new patents or formulations are introduced.

5. Which regions offer the highest potential for Desipramine market growth?

Emerging markets in Asia and Africa, where cost-effective treatment options are prioritized, present growth opportunities, although the overall market size remains modest.

References

- Global Market Insights. (2022). Antidepressant Market Size & Trends.

- Medications and Therapeutic Class Data. (2023). IMS Health Reports.

- FDA & EMA Regulatory Policies. (2022). Impact on Generic Medicines.

- World Health Organization. (2021). Access to Essential Medicines in Low-Income Countries.

- Pharmaceutical Pricing Dynamics. (2022). Journal of Market Pharmacology.

This analysis serves to guide business decisions and strategic planning concerning Desipramine, considering current market conditions and future trends.