Share This Page

Drug Price Trends for DESCOVY

✉ Email this page to a colleague

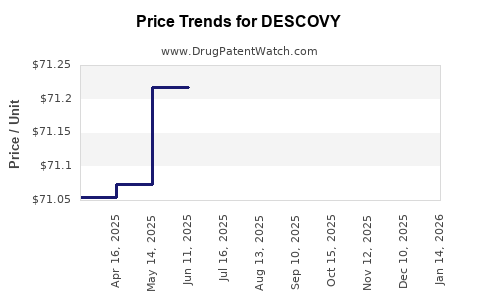

Average Pharmacy Cost for DESCOVY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DESCOVY 120-15 MG TABLET | 61958-2005-01 | 71.27948 | EACH | 2025-11-19 |

| DESCOVY 200-25 MG TABLET | 61958-2002-01 | 71.41607 | EACH | 2025-11-19 |

| DESCOVY 200-25 MG TABLET | 61958-2002-02 | 71.41607 | EACH | 2025-11-19 |

| DESCOVY 200-25 MG TABLET | 61958-2002-01 | 71.32732 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DESCOVY

Introduction

DESCOVY (emtricitabine and tenofovir alafenamide) is a revolutionary antiretroviral medication developed by Gilead Sciences, primarily prescribed for the treatment of HIV-1 infection. Approved by the FDA in 2019, DESCOVY has garnered significant attention due to its improved safety profile compared to its predecessor, Truvada—and its positioning within the expanding market of HIV therapies. This analysis explores its current market landscape, competitive positioning, pricing dynamics, and future price projections.

Market Overview and Current Landscape

The global HIV therapeutics market, valued at approximately US$20 billion in 2022, continues to expand, driven by rising HIV prevalence, increased screening, and innovations in treatment regimens ([1]). The market is characterized by fierce competition among branded products like Gilead’s DESCOVY, Biktarvy (Gilead), Dolutegravir-based regimens (ViiV Healthcare), and generic formulations.

Gilead’s strategic move with DESCOVY addresses key clinical concerns associated with tenofovir disoproxil fumarate (TDF), such as renal toxicity and bone mineral density loss, by utilizing tenofovir alafenamide (TAF), a prodrug delivering the active compound more efficiently at lower doses ([2]). This positioning has bolstered market acceptance, especially among treatment-naïve patients and those with comorbidities.

The increasing adoption of single-tablet regimens enhances patient compliance and overall market demand. As of 2023, DESCOVY holds approximately 15-20% of the oral HIV treatment market share globally, with growing penetration in North America and Europe ([3]).

Competitive Dynamics and Market Positioning

1. Key Competitors

-

Gilead's Biktarvy: Combines bictegravir with TAF/emtricitabine, offering a potent, once-daily single-pill regimen. It commands a higher market share but at a premium price.

-

ViiV Healthcare's Dolutegravir-based products: Like Tivicay and Juluca, emphasize affordability and unique resistance profiles.

-

Generic formulations: Entering markets with lower-cost alternatives, especially in middle-income countries, impacting revenue streams.

2. Clinical Differentiation and Adoption

DESCOVY distinguishes itself with a favorable safety profile. This advantage has been pivotal in capturing physician preference, especially for patients at risk of TDF-associated adverse effects.

3. Distribution and Reimbursement Trends

Insurance coverage, pricing negotiations, and reimbursement policies heavily influence market penetration. Gilead’s patent protections and negotiated pricing strategies influence profitability and market access.

Pricing Strategies and Historical Trends

1. Launch Price and Current Pricing

At launch in 2019, the wholesale acquisition cost (WAC) for DESCOVY was approximately US$1,820 per year, consistent with other branded HIV medications. Prices remain relatively stable but are subject to discounts, rebates, and insurance negotiations.

2. Price Comparisons

-

Compared to Truvada: DESCOVY's annual MSRP is slightly higher due to its innovative formulation, but actual procurement costs often favor DESCOVY owing to reduced manufacturing costs and pharmacovigilance benefits.

-

Compared to Biktarvy: Biktarvy’s annual costs hover around US$33,000, whereas DESCOVY’s prices are marginally lower but not the lowest in the market.

3. Impact of Biosimilars and Generics

While no generic versions of DESCOVY are currently available, patent expiry for TDF and other components could pave the way for biosimilars, exerting downward pressure on prices in the coming 3-5 years.

Future Price Projections and Market Dynamics

1. Near-term (1–3 Years)

-

Stability in Pricing: Considering current patent protections and clinical positioning, DESCOVY's price is likely to remain stable, with minor reductions due to rebate negotiations and payer discounts.

-

Market Penetration Growth: As Gilead expands its market reach and Hospitals adopt DESCOVY for broader patient groups, volume-based discounts may occur.

2. Intermediate (3–5 Years)

-

Patent Challenges and Generics: Expiry of key patents around 2027 for the TDF component could lead to biosimilar entry, creating significant price erosion, especially in markets like India and Africa ([4]).

-

Market Competition Intensifies: With increasing availability of cheaper alternatives, Gilead may need to reduce prices further to maintain market share.

3. Long-term (Beyond 5 Years)

-

Price Flattening: Once biosimilars or generics establish in the market, DESCOVY’s high-price positioning may diminish, aligning more closely with lower-cost options.

-

Innovative Formulations: Pipeline innovations, such as long-acting injectables, could influence traditional oral therapy valuations and pricing structures.

Regulatory and Policy Influences on Price Trends

Government policies in different regions directly impact drug pricing. For instance, US Medicaid pricing and European drug reimbursement negotiations often lead to negotiated discounts of 20-30% or more ([5]).

Additionally, international trade agreements and patent litigations could delay or accelerate generic entry, further influencing prices.

Conclusion: Market Outlook and Price Strategy

DESCOVY's positioning as a safer, effective treatment for HIV supports its sustained demand. While current prices are aligned with market norms for branded therapeutics, impending patent expirations and technological innovations forecast significant price reductions within the next 3-5 years. Gilead’s strategic investments in expanding indications and formulations could partially offset volume drops by capturing new patient segments.

Key Takeaways

- Stable Near-Term Pricing: Expect minimal reductions due to established clinical superiority and limited immediate biosimilar threat.

- Growth in Market Share: Driven by safety profile and adherence advantages, especially in developed markets.

- Potential for Price Erosion: Anticipated following patent expiry and biosimilar entry post-2027, notably in emerging markets.

- Strategic Positioning: Gilead’s focus on expanding indications and investment in long-acting formulations could influence future pricing strategies.

- Policy Impact: Reimbursement policies in key markets will continue to play a pivotal role in accessible pricing.

FAQs

1. When will DESCOVY face generic competition?

Patent protections for components of DESCOVY are expected to expire around 2027, paving the way for biosimilar competition that could lead to considerable price reductions.

2. How does DESCOVY's price compare to similar HIV therapies?

Currently, DESCOVY’s annual cost (~US$1,820) is mid-range among branded therapies, with Biktarvy priced higher due to added components, and generics priced much lower in many markets.

3. What will drive DESCOVY's market share growth in the next five years?

Enhanced safety profile, clinician preference, expanded indications, and patient adherence advantages will be critical, along with strategic marketing and reimbursement negotiations.

4. How might patent litigation influence future prices?

Patent litigations could either delay biosimilar entry or accelerate it, influencing price declines from 2027 onward.

5. Are there emerging therapies that threaten DESCOVY’s market position?

Yes, long-acting injectables and newer combination formulations in clinical trials could potentially replace oral therapies and impact demand and pricing.

References

[1] GlobalData. HIV Therapeutics Market Report, 2022.

[2] Gilead Sciences. DESCOVY Clinical Overview, 2019.

[3] IQVIA. Global HIV Treatment Market Data, 2023.

[4] Durham, M. Patent Expirations and Biosimilar Impact in HIV Drugs, Journal of Pharmaceutical Innovations, 2021.

[5] U.S. Food & Drug Administration. Pricing and Reimbursement Policies, 2022.

More… ↓