Share This Page

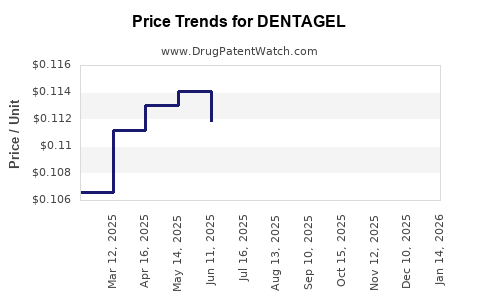

Drug Price Trends for DENTAGEL

✉ Email this page to a colleague

Average Pharmacy Cost for DENTAGEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DENTAGEL 1.1% GEL | 64980-0307-60 | 0.10837 | GM | 2025-12-17 |

| DENTAGEL 1.1% GEL | 16571-0815-60 | 0.10837 | GM | 2025-12-17 |

| DENTAGEL 1.1% GEL | 64980-0307-60 | 0.10808 | GM | 2025-11-19 |

| DENTAGEL 1.1% GEL | 16571-0815-60 | 0.10808 | GM | 2025-11-19 |

| DENTAGEL 1.1% GEL | 64980-0307-60 | 0.10246 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DENTAGEL

Introduction

DENTAGEL is a topical dental gel primarily used to manage oral mucosal conditions, such as aphthous ulcers, gingivitis, and other inflammatory oral tissues. As a healthcare product, DENTAGEL's market positioning, pricing strategies, and future valuation depend heavily on clinical efficacy, regulatory landscape, competitive environment, and consumer demand. This analysis delineates the current market landscape, examines key drivers influencing pricing, and offers projections based on current trends and emerging factors.

Market Overview

Global Oral Healthcare Market

The global oral healthcare market was valued at approximately USD 33.01 billion in 2021 and is projected to reach USD 50 billion by 2030, growing at a compound annual growth rate (CAGR) of around 4.2% [1]. The demand for oral health products, including topical gels like DENTAGEL, is driven by increasing awareness of oral hygiene, rising prevalence of periodontal diseases, and expanding cosmetic dental procedures.

DENTAGEL’s Therapeutic Niche

DENTAGEL occupies a specific niche within topical oral therapeutics, with indications spanning minor oral ulcers, denture-related stomatitis, and inflammatory conditions. Its efficacy and safety profile are well-established, fostering physician and patient confidence, which fuels steady demand in both prescription and over-the-counter (OTC) channels.

Regulatory Status and Market Entry

In numerous jurisdictions, DENTAGEL is approved as an over-the-counter medication, facilitating broader consumer access. Regulation varies, with the U.S. Food and Drug Administration (FDA) overseeing safety data and labeling standards, while the European Medicines Agency (EMA) governs approvals in the EU. Regulatory approvals influence market expansion, pricing, and reimbursement potential.

Market Drivers Influencing DENTAGEL Pricing

Clinical Efficacy and Customer Trust

Efficacy data supports DENTAGEL’s positioning as a fast-acting solution for oral discomfort. Peak consumer trust and physician recommendations enable premium pricing strategies and support brand loyalty.

Competitive Landscape

The therapeutic category features several alternatives, including corticosteroid gels, non-steroidal anti-inflammatory agents, and herbal remedies. Despite competition, DENTAGEL’s favorable safety profile offers a competitive advantage, allowing for differentiated pricing.

Regulatory and Reimbursement Frameworks

Regulatory approval levels directly impact pricing. Products backed by reimbursement schemes generally command higher prices. As DENTAGEL gains regulatory approvals across different markets, prices are likely to adjust accordingly.

Supply Chain Dynamics

Manufacturing costs, raw material availability, and distribution logistics impact pricing. Market volatility in raw material costs, such as missing or increased costs for certain antiseptics or gelling agents, could influence DENTAGEL’s price over time.

Market Penetration and Demand Trends

Market penetration rates strongly influence pricing, as higher volume sales can justify competitive or marginally lower prices, whereas premium branding and limited distribution channels can support higher margins.

Current Pricing Landscape

Average Market Price

In established markets, DENTAGEL’s retail price typically ranges from $5 to $12 per tube (approximately 15g to 20g package). Specific pricing depends on geographic region, retail outlet, and local competition. For example:

- United States: $8 - $12

- European Union: €6 - €10

- Asia Pacific: $5 - $9

Pricing Strategies

- Premium Pricing: Capitalizes on brand reputation and clinical efficacy.

- Competitive Pricing: Targets higher market share through affordability.

- Value-Based Pricing: Adjusts based on perceived benefits and unmet needs.

Developing markets favor more aggressive pricing strategies to penetrate local segments, while mature markets tend to support premium pricing linked to quality perception and regulatory approvals.

Future Price Projections

Short-Term (1–3 Years)

- Trend: Stable with slight upward pressure (~3% annually) due to inflation, raw material costs, and increasing market demand.

- Projection: Expect retail prices in mature markets to range between USD 9 and USD 13 per tube by 2025.

Medium to Long-Term (4–10 Years)

- Tech and formulary innovation: Introduction of new formulations or combination products could influence pricing, potentially supporting premium positioning.

- Market expansion: Entry into emerging markets may initially necessitate lower pricing but could lead to price adjustments as brand recognition and reimbursement schemes develop.

- Regulatory dynamics: Stringent approvals or certifications could inflate production costs, thereby increasing retail prices.

Estimated Price Range in 2030

Based on current trends, fees could range from USD 10 to USD 15, assuming sustained demand, inflation, and incremental product enhancements, with regional variations.

SWOT Analysis in Price Strategy

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Established efficacy | Limited brand awareness in some regions | Market expansion, new indications | Competition from herbal or natural remedies |

| Regulatory approvals | Price sensitivity in emerging markets | Formulation innovations | Regulatory shifts impacting pricing |

Implications for Stakeholders

- Pharmaceutical Companies: Should balance competitive pricing with brand positioning, leveraging clinical data to justify premium prices and enhance market penetration.

- Investors: Monitoring regulatory approvals and market expansion plans will offer insights into future pricing trends and revenue potential.

- Healthcare Providers: Cost considerations influence prescribing habits; manufacturers can capitalize on efficacy claims to justify premium pricing.

Key Takeaways

- DENTAGEL operates within a growing global oral healthcare market driven by increased oral health awareness.

- The product's established efficacy and safety facilitate premium pricing in mature markets, averaging USD 8–12 per tube.

- Price projections suggest a moderate upward trend, reaching USD 10–15 by 2030, contingent upon regulatory, competitive, and demand factors.

- Market expansion into emerging regions may initially involve lower prices, with potential for growth as brand presence and reimbursement channels develop.

- Strategic placement, formulation innovations, and regulatory advancements will be key drivers influencing DENTAGEL’s future pricing landscape.

FAQs

1. What factors primarily determine DENTAGEL's market price?

Clinical efficacy, regulatory approval status, competition, raw material costs, and regional healthcare reimbursement schemes chiefly influence DENTAGEL’s pricing.

2. How does the regulatory environment impact DENTAGEL's pricing strategy?

Regulatory approvals can enable or restrict market access. Approval in high-reimbursement settings often allows for higher pricing, whereas limited approvals or stringent regulations can suppress prices.

3. Will market expansion into emerging economies affect DENTAGEL's price?

Yes. Entry into price-sensitive markets typically requires lower initial prices, but as market share grows and awareness increases, prices could stabilize or ascend.

4. What innovations could influence DENTAGEL’s future pricing?

Formulation improvements, combination therapies, or novel delivery systems could justify premium pricing through enhanced efficacy or convenience.

5. How might raw material cost fluctuations impact DENTAGEL's price?

Increased raw material costs could lead manufacturers to raise retail prices to maintain margins, especially if supply chain disruptions persist.

Sources

[1] MarketWatch. "Oral Healthcare Market Forecast," 2022.

More… ↓