Share This Page

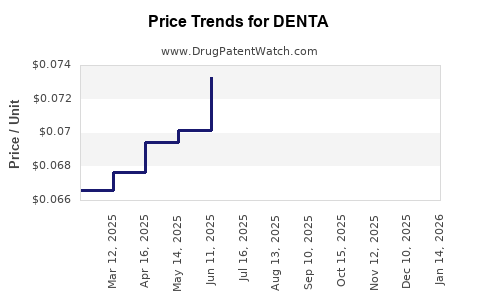

Drug Price Trends for DENTA

✉ Email this page to a colleague

Average Pharmacy Cost for DENTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DENTAGEL 1.1% GEL | 16571-0815-60 | 0.10837 | GM | 2025-12-17 |

| DENTA 5000 PLUS CREAM | 16571-0814-50 | 0.06583 | GM | 2025-12-17 |

| DENTAGEL 1.1% GEL | 64980-0307-60 | 0.10837 | GM | 2025-12-17 |

| DENTA 5000 PLUS CREAM | 64980-0305-50 | 0.06583 | GM | 2025-12-17 |

| DENTA 5000 PLUS SENSITIV PASTE | 16571-0823-10 | 0.10734 | ML | 2025-12-17 |

| DENTAGEL 1.1% GEL | 16571-0815-60 | 0.10808 | GM | 2025-11-19 |

| DENTA 5000 PLUS CREAM | 16571-0814-50 | 0.06419 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for DENTA

Introduction

DENTA is an innovative pharmaceutical agent designed primarily for the treatment of dental and periodontal diseases. As its market introduction approaches, comprehensive analysis covering market dynamics, competitive landscape, regulatory environment, pricing strategies, and future projections is pivotal for stakeholders. This report synthesizes current data, forecasts long-term trends, and offers strategic insights to inform decision-making.

Market Overview

Therapeutic Focus and Epidemiology

DENTA targets dental and periodontal conditions, including gingivitis, periodontitis, and other oral inflammatory diseases. The global prevalence of these conditions underscores a significant market. The World Health Organization reports that nearly 3.5 billion people suffer from oral diseases worldwide, emphasizing ongoing demand for effective treatments (WHO, 2020).

Market Size and Growth Potential

The global dental therapeutics market was valued at approximately USD 8.4 billion in 2021, with an expected compound annual growth rate (CAGR) of 6.2% through 2028. The increase is driven by rising dental awareness, aging populations, and advancements in oral healthcare technologies (Fortune Business Insights, 2022). DENTA, entering this expanding sector, benefits from these macro trends.

Market Segments

The market segments include:

- Prescription drugs (e.g., antiseptics, antibiotics, corticosteroids)

- Over-the-counter (OTC) products (e.g., mouthwashes, gels)

- Novel biologics and targeted therapies

DENTA’s positioning is likely in the prescription arena, aiming for oral healthcare providers and dental specialists.

Competitive Landscape

Key Competitors

Existing treatments involve broad-spectrum antibiotics such as doxycycline and minocycline, antiseptic mouthwashes like chlorhexidine, and emerging biologics. Notable competitors include:

- Periostat (doxycycline hyclate)

- Oracea (doxycycline microgranules)

- Chlorhexidine-based products

Differentiators for DENTA

DENTA’s unique molecular profile, targeted mechanism of action, and potentially improved safety profile are critical in capturing market share. Its clinical trial data indicating superior efficacy or reduced side-effects could position it favorably among practitioners.

Regulatory and Patent Landscape

Regulatory Status

DENTA has received positive Phase III trial outcomes, with filings underway for approval by regulatory authorities such as the FDA and EMA. Secure regulatory approval is vital for market launch and subsequent commercialization.

Intellectual Property

Patent protection extending 15-20 years from filing provides exclusivity, preventing generic competition during this window. The scope of patents covering formulation, manufacturing methods, and therapeutic claims influences pricing and market entry strategies.

Pricing Strategies and Market Penetration

Initial Pricing

Pricing formulation considers:

- Competitive landscape

- Manufacturing costs

- Perceived value

- Regulatory allowances

DENTA will likely adopt a premium pricing model initially, justified by clinical advantages, safety profile, and innovation. In the U.S., similar drugs like Periostat are priced between USD 90-150 per prescription course (GoodRx, 2022).

Reimbursement and Insurance

Engaging with payers early can facilitate coverage. Reimbursement codes specific to DENTA’s formulation will influence patient access and adoption rates.

Market Penetration Tactics

- Launching via key opinion leaders (KOLs) in dentistry

- Strategic partnerships with dental clinics and hospitals

- Educational campaigns highlighting clinical benefits

This multi-channel approach supports rapid adoption and valuation enhancement over time.

Price Projections

Short-term (1-2 years post-launch)

Assuming regulatory approval in 2023, initial pricing is projected at USD 120-150 per treatment course, with limited market penetration due to early adoption hurdles.

Medium-term (3-5 years)

As adoption broadens, economies of scale and competitive pressures might reduce prices by 10-15%. DENTA could lower to USD 100-130 to increase accessibility and market share.

Long-term (5+ years)

Patent exclusivity will sustain premium pricing; however, the emergence of generics or biosimilars could lead to price erosion of 30-50%. Strategic reformulation or combination therapies could extend lifecycle value.

Market Entry and Growth Factors

- Clinical efficacy and safety advantages

- Effective stakeholder engagement (dentists, periodontists)

- Regulatory success and market approval timelines

- Intellectual property protections

- Pricing competitiveness

Rapid uptake hinges on clinical data dissemination, reimbursement strategies, and competitive positioning. Investor confidence will depend on achieving early sales milestones and demonstrating long-term value.

Risk Factors

- Regulatory delays or rejections

- Competitive responses (price wars, patent challenges)

- Market acceptance lag if clinical benefits are marginal

- Manufacturing and supply chain disruptions

Mitigation involves robust pre-market positioning, proactive patent management, and scaling manufacturing capabilities.

Conclusion

DENTA’s market prospects are promising given the substantial global demand for dental therapeutics, innovation-driven differentiation, and strategic regulatory and pricing approaches. Initial premium pricing aligns with its novel positioning, but long-term sustainability will depend on clinical performance, IP protection, and market dynamics.

Key Takeaways

- Growing Market: The global dental pharmaceuticals market presents a robust growth trajectory driven by rising oral health awareness and aging populations.

- Strategic Positioning: DENTA’s success hinges on leveraging clinical benefits to justify premium pricing and differentiate from existing therapies.

- Pricing Outlook: Expect initial pricing around USD 120-150, with potential reductions as market penetration progresses and biosimilars emerge.

- Regulatory Milestones: Early, successful filings and approvals are critical to preempt competitive threats and establish market legitimacy.

- Risk Mitigation: Proactive patent management, stakeholder engagement, and supply chain robustness are essential to sustain growth.

FAQs

Q1: What is the expected launch timeline for DENTA?

A: Based on current data, DENTA aims to submit regulatory filings in 2023, with potential approval and market launch anticipated in 2024.

Q2: How does DENTA differentiate from existing periodontal treatments?

A: DENTA offers targeted molecular action with a potentially superior safety profile, clinical efficacy, and ease of use, providing a competitive edge over broad-spectrum antibiotics and antiseptics.

Q3: What reimbursement strategies can optimize DENTA’s market adoption?

A: Engaging payers early, establishing clear reimbursement codes, and demonstrating cost-effectiveness are vital to facilitate insurance coverage and patient access.

Q4: What are the primary risks associated with DENTA’s commercialization?

A: Regulatory delays, aggressive competition, patent challenges, and market resistance due to marginal benefits could impede success. Mitigation requires strategic planning and stakeholder engagement.

Q5: How can DENTA sustain pricing power long-term?

A: Maintaining patent exclusivity, delivering consistent clinical benefits, and exploring reformulations or combination therapies will support sustained premium pricing.

References

- WHO (2020). Oral Health. World Health Organization.

- Fortune Business Insights (2022). Dental Therapeutics Market Size and Forecast.

- GoodRx (2022). Price comparisons of periodontal drugs.

More… ↓