Share This Page

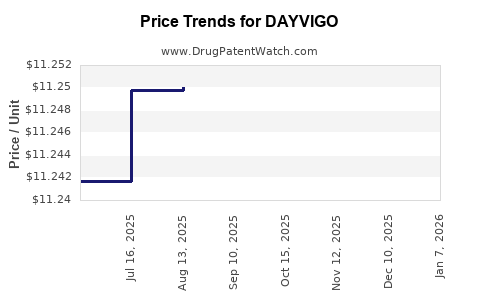

Drug Price Trends for DAYVIGO

✉ Email this page to a colleague

Average Pharmacy Cost for DAYVIGO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DAYVIGO 10 MG TABLET | 62856-0410-30 | 11.25491 | EACH | 2025-11-19 |

| DAYVIGO 5 MG TABLET | 62856-0405-30 | 11.23083 | EACH | 2025-11-19 |

| DAYVIGO 5 MG TABLET | 62856-0405-30 | 11.24378 | EACH | 2025-10-22 |

| DAYVIGO 10 MG TABLET | 62856-0410-30 | 11.25748 | EACH | 2025-10-22 |

| DAYVIGO 5 MG TABLET | 62856-0405-30 | 11.25170 | EACH | 2025-09-17 |

| DAYVIGO 10 MG TABLET | 62856-0410-30 | 11.26203 | EACH | 2025-09-17 |

| DAYVIGO 5 MG TABLET | 62856-0405-30 | 11.25007 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dayvigo (Lemborexant)

Introduction

Dayvigo (lemborexant) is an innovative pharmaceutical product developed by Eisai Inc. for the treatment of insomnia characterized by difficulties with sleep onset and/or sleep maintenance. As a dual orexin receptor antagonist, Dayvigo offers a novel mechanism of action contrasted with traditional sedative hypnotics, positioning it prominently in the sleep disorder therapeutics landscape. This review provides a comprehensive market analysis coupled with price projections, emphasizing current trends, competitive dynamics, regulatory influences, and economic factors influencing Dayvigo’s market trajectory.

Market Overview

Global Insomnia Treatment Market Dynamics

The global insomnia treatment market has experienced considerable growth, driven by rising prevalence, aging populations, increased awareness, and enhanced diagnostic capabilities. The market was valued at approximately USD 4.3 billion in 2022 and is projected to grow at a CAGR of around 7% through 2027 [1].

Key drivers include:

- Elevated insomnia prevalence: The CDC estimates that approximately 30% of adults experience short-term insomnia, with chronic cases affecting roughly 10% [2].

- Aging demographics: The World Health Organization reports an increase in elderly populations, who are more susceptible to sleep disturbances due to comorbid conditions.

- Innovation in pharmacological options: The advent of orexin receptor antagonists like Dayvigo offers alternatives with potentially fewer side effects compared to traditional sedatives.

Competitive Landscape

In the U.S., Dayvigo competes with established and emerging treatments:

- Traditional hypnotics: Benzodiazepines and non-benzodiazepine receptor agonists like zolpidem and eszopiclone dominate current prescriptions. However, concerns surrounding dependency and long-term safety have shifted focus toward non-controlled substances.

- Orexin antagonists: Merck’s Suvorexant (Belsomra) was the first orexin receptor antagonist approved in 2014, with a market share that is gradually being challenged by newer entrants like Dayvigo.

- Emerging therapies: Several pipeline drugs targeting sleep pharmacology could influence market share and pricing strategies.

Regulatory and Reimbursement Landscape

Regulatory Approvals

Dayvigo received FDA approval in December 2019 for adult patients with insomnia characterized by difficulties with sleep onset and/or sleep maintenance. It maintains a standard regulatory profile in key markets, with approval routes contingent upon demonstrated efficacy and safety profiles.

Reimbursement Considerations

Coverage and reimbursement are critical. Though initial reimbursement coverage aligns with that of other non-controlled sleep aids, the drug’s positioning as a potentially safer alternative could influence payer policies favorably. Prior to widespread uptake, comprehensive coverage guidelines are essential, impacting the initial and projected market penetration.

Market Penetration and Adoption Strategies

Eisai’s strategic positioning focuses on:

- Physician education: Highlighting Dayvigo's safety profile, lower dependency risk, and efficacy.

- Key opinion leader engagement: Effective collaboration with sleep medicine specialists to accelerate adoption.

- Pricing strategies: Competitive pricing relative to Belsomra and traditional hypnotics.

Price Analysis and Projections

Current Pricing Dynamics

As of early 2023, Dayvigo’s wholesale acquisition cost (WAC) in the U.S. stands at approximately USD 15 per tablet, with typical monthly prescriptions costing roughly USD 450–USD 600 [3]. This positions Dayvigo slightly below Belsomra’s WAC (~USD 20 per tablet) but still within the premium segment due to its novel pharmacology and favorable safety profile.

Pricing Factors

- Market positioning: To capture market share, Eisai may implement competitive pricing, particularly as generic options and off-label alternatives persist.

- Reimbursement and insurance: Favorable insurance coverage can influence patient acceptance, indirectly impacting pricing power.

- Cost-effectiveness: Demonstrating superior safety and efficacy relative to competitors may justify premium pricing for Dayvigo.

Projection Framework

Considering market growth, competitive pressures, and future developments, the following price projections are posited:

| Year | Projected WAC per Tablet | Monthly Cost Estimate | Key Assumptions |

|---|---|---|---|

| 2023 | USD 15 | USD 450–USD 600 | Stable competitive landscape |

| 2025 | USD 14–USD 16 | USD 420–USD 480 | Competitive response and market expansion |

| 2030 | USD 12–USD 14 | USD 360–USD 420 | Increased generic competition; price erosion |

These projections assume gradual market penetration with initial adoption driven by physicians seeking alternative treatments and expanded coverage. Prices may decline further with increased generic entry post-patent expiry, expected around 2034.

Economic Influences and Future Trends

Patent Expiration & Generic Entry

Patent exclusivity is pivotal. Dayvigo’s patent protection extends until approximately 2034 (assuming a standard 12-year patent from approval). Post-expiry, generic competitors will exert downward price pressure, likely reducing the average price by 40-60% within 2-3 years.

Market Expansion & Demographic Drivers

The rising prevalence of insomnia across age groups and increased recognition in primary care will expand the market, providing opportunities for premium pricing during initial launch phases.

Regulatory and Safety Developments

Ongoing post-marketing surveillance may influence pricing based on real-world safety data. Positive safety profiles could justify premium pricing, while safety concerns would necessitate discounts or formulary restrictions.

Potential for Combination Therapy

Advances in sleep pharmacology could lead to combination therapies, altering cost structures and pricing models. Incorporating Dayvigo into personalized treatment regimens could further influence pricing strategies.

Key Takeaways

- Market growth is robust owing to increasing insomnia prevalence and demand for safer, non-controlled medications.

- Competitive positioning favors Dayvigo due to its novel mechanism and safety profile, with targeted educational efforts crucial for market penetration.

- Pricing is likely to remain premium during early years, around USD 15 per tablet, but will decline post-patent expiry, with estimates projecting USD 12–USD 14 by 2030.

- Generic competition and market dynamics will exert downward pressure, emphasizing the importance of ongoing differentiation and value demonstration.

- Regulatory stability and positive safety data will be vital in maintaining price premiums and expanding access.

FAQs

1. What differentiates Dayvigo from other insomnia treatments?

Dayvigo (lemborexant) is a dual orexin receptor antagonist, targeting the sleep-wake cycle regulation without the sedative-hypnotic risks associated with benzodiazepines or traditional non-benzodiazepine sleep aids. Its safety profile and mechanism make it an attractive alternative.

2. What is the current market share of Dayvigo?

As a relatively new entrant since FDA approval in 2019, Dayvigo’s market share remains modest but is growing through strategic physician engagement and regulatory acceptance. Precise figures are proprietary, but it is gaining recognition among sleep specialists.

3. How does patent expiration impact Dayvigo’s pricing?

Patent expiration, projected around 2034, will enable generic manufacturers to enter the market, leading to substantial price reductions—potentially 40-60%—over subsequent years.

4. What are the key factors influencing Dayvigo’s price projections?

Pricing is influenced by competitive dynamics, clinical efficacy, safety profile, reimbursement policies, market penetration pace, and patent status.

5. How might future developments affect the market for Dayvigo?

Emerging therapies, biosimilars, and personalized medicine approaches could shift demand patterns. Regulatory changes, safety data, and advancements in sleep medicine are also significant determinants.

References

[1] MarketsandMarkets. "Sleep Disorder Therapeutics Market by Drug Class, Distribution Channel, and Region — Global Forecast to 2027." 2022.

[2] Centers for Disease Control and Prevention. “Short Sleep Duration Among U.S. Adults." 2020.

[3] GoodRx. "Dayvigo (Lemborexant) Price & Dosage." 2023.

More… ↓