Share This Page

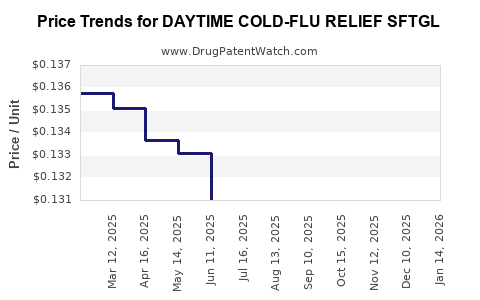

Drug Price Trends for DAYTIME COLD-FLU RELIEF SFTGL

✉ Email this page to a colleague

Average Pharmacy Cost for DAYTIME COLD-FLU RELIEF SFTGL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DAYTIME COLD-FLU RELIEF SFTGL | 00904-6995-44 | 0.13069 | EACH | 2025-12-17 |

| DAYTIME COLD-FLU RELIEF SFTGL | 00904-6995-44 | 0.13136 | EACH | 2025-11-19 |

| DAYTIME COLD-FLU RELIEF SFTGL | 00904-6995-44 | 0.13230 | EACH | 2025-10-22 |

| DAYTIME COLD-FLU RELIEF SFTGL | 00904-6995-44 | 0.13092 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DAYTIME COLD-FLU RELIEF SFTGL

Introduction

The landscape of over-the-counter (OTC) cold and flu medications remains highly competitive, driven by evolving consumer preferences, regulatory shifts, and innovations. “DAYTIME COLD-FLU RELIEF SFTGL” (hereafter referred to as SFTGL) emerges as a potential entrant within this segment, targeting symptom relief with a focus on daytime use. To inform strategic positioning and investment decisions, a comprehensive market analysis coupled with price projection insights are indispensable.

Market Overview of OTC Cold and Flu Medications

The global OTC cold and flu treatment market was valued at approximately $10 billion in 2022, with projections estimating a compound annual growth rate (CAGR) of 4.2% through 2027 [1]. In North America and Europe, the market extends across various segments, including multi-symptom relief, single-ingredient formulations, and natural remedies. The demand for safe, fast-acting, and non-drowsy formulations predominantly fuels innovation and market expansion.

Key Market Drivers

- Rising Incidence of Respiratory Infections: Increased prevalence of seasonal flu, colds, and COVID-19 variants elevates consumer demand for effective symptom management.

- Consumer Preference for OTC Alternatives: Growing inclination towards self-medication diminishes reliance on prescriptions, expanding OTC market share.

- Innovation in Formulations: Development of multi-symptom relief products with target-specific ingredients attracts a broader consumer base.

- Regulatory Environment: Stringent quality standards and transparent ingredient disclosures influence formulation and marketing strategies.

Market Challenges

- Regulatory Hurdles: FDA and EMA regulations requiring rigorous efficacy and safety data can delay market entry.

- Competitive Intensity: Numerous established brands, including NyQuil, DayQuil, and Tylenol Cold, dominate the landscape.

- Pricing Pressures: Consumer sensitivity to price compels manufacturers to optimize costs without compromising efficacy.

Product Positioning and Differentiation for SFTGL

To carve a niche, SFTGL must differentiate based on:

- Symptom Spectrum: Covering key symptoms with rapid relief (e.g., nasal congestion, cough, fever, minor sore throat).

- Daytime Efficacy: Emphasizing non-drowsy, stimulant-like ingredients, appealing to working professionals.

- Formulation Innovation: Potential incorporation of natural or herbal extracts aligned with current consumer trends.

- Brand Credibility: Establishing trust through clinical data, quality assurance, and effective marketing.

Market Entry Strategy

- Target Audience: Adults aged 25-55, health-conscious consumers, working professionals.

- Distribution Channels: Pharmacies, mass retail outlets, online platforms.

- Pricing Strategy: Competitive pricing aligned with market expectations, leveraging bundle offers or discounts during seasonal peaks.

- Regulatory Compliance: Ensuring formulations meet regional OTC standards, with clear labeling and safety profiles.

Competitive Landscape Analysis

Leading competitors include brands like Tylenol Cold, Advil Cold & Sinus, and natural supplements such as Zicam. These brands leverage extensive distribution networks and brand loyalty. To compete effectively, SFTGL should focus on emphasizing unique value propositions, such as faster symptom relief, fewer side effects, or natural ingredients.

Price Projection Dynamics

Current Market Pricing Benchmarks

- Typical Price Range: OTC cold/flu relief products are priced between $6 to $12 for a standard 10- to 20-tablet pack.

- Premium Brands: Some formulations with claimed natural or dual-action benefits command premiums of $15 to $20.

Projected Pricing Trends (Next 3-5 Years)

Factors influencing future pricing include ingredient costs, manufacturing efficiencies, regulatory requirements, and competitive positioning:

- Ingredient Costs: Fluctuations due to supply chain disruptions—especially for herbal extracts or specialty compounds—may pressure margins.

- Market Penetration Strategy: Entry at a price point close to established competitors (~$8-$10), with potential premium positioning based on unique benefits.

- Inflation and Regulatory Costs: Anticipated to incrementally increase consumer prices by 3-5% annually.

Estimated Price Range For SFTGL

Given current market dynamics and product positioning, SFTGL could target:

- Introductory Price: $8.50 to $9.50 per 12- to 14-tablet pack to attract trial.

- Premium Positioning: If employing innovative natural ingredients or clinical backing, prices could range from $10 to $13.

Market Penetration and Price Differentiation

- Budget-Friendly Tier: $6.99 - $8.49 for basic formulations, capturing cost-sensitive consumers.

- Mid-Range Tier: $8.50 - $10.99, balancing affordability and perceived efficacy.

- Premium Tier: $11 - $13, targeting consumers seeking natural or advanced formulations.

Regulatory Impact on Pricing

Strict approval processes and compliance costs could marginally increase retail prices by approximately 10% over the baseline, notably in markets with rigorous regulations like the U.S. and EU [2].

Distribution and Market Penetration Implications

Effective distribution through pharmacies and online channels can reduce costs and support domestic and international expansion. Direct-to-consumer marketing and targeted advertising could justify premium pricing and foster brand loyalty.

Conclusion

SFTGL's success hinges on its ability to differentiate through targeted symptom relief, formulation innovation, and strategic pricing aligned with consumer preferences. Entry in the $8.50 to $9.50 range provides competitiveness, with scope for premium positioning based on product attributes. Dynamic market forces necessitate agile pricing models that adapt to resource costs, regulatory changes, and market reactions.

Key Takeaways

- The OTC cold and flu relief market remains robust, with sustained growth opportunities driven by consumer preference for self-medication and innovation.

- Price positioning for SFTGL should be tiered, starting around $8.50 to $9.50 per pack, with potential premium tiers for differentiated formulations.

- Competitive differentiation through natural ingredients, rapid symptom relief, and non-drowsy formulations can justify higher price points.

- Regulatory compliance costs are likely to influence pricing marginally, emphasizing the need for efficient regulatory strategies.

- Distribution channels and marketing will play a crucial role in achieving market penetration and shaping consumer perception.

FAQs

1. What factors influence OTC cold and flu medication pricing?

Pricing is affected by ingredient costs, manufacturing expenses, regulatory compliance fees, competitive positioning, distribution costs, and consumer willingness to pay for perceived efficacy or natural formulations.

2. How does SFTGL compete in a saturated market?

By emphasizing unique attributes such as rapid symptom relief during daytime, natural ingredients, non-drowsy formulations, and targeted marketing aimed at working adults.

3. What regulatory hurdles might impact the pricing strategy?

Regulatory requirements for efficacy data, ingredient safety, and labeling can increase development and compliance costs, marginally pushing retail prices upward.

4. What are the most effective distribution channels for SFTGL?

Pharmacies, big-box retailers, online marketplaces, and direct-to-consumer platforms offer broad reach and control over branding and pricing.

5. When should SFTGL consider premium pricing?

Once establishing market trust through clinical testing, unique formulations, or natural ingredients, premium pricing of $11-$13 per pack can attract health-conscious segments.

Sources:

[1] Grand View Research, "Over-the-counter (OTC) Drugs Market Size & Trends," 2022.

[2] U.S. Food and Drug Administration, "OTC Drug Review."

More… ↓