Share This Page

Drug Price Trends for DARIFENACIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for DARIFENACIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DARIFENACIN ER 15 MG TABLET | 13668-0203-90 | 0.37151 | EACH | 2025-11-19 |

| DARIFENACIN ER 15 MG TABLET | 16571-0768-09 | 0.37151 | EACH | 2025-11-19 |

| DARIFENACIN ER 15 MG TABLET | 33342-0277-07 | 0.37151 | EACH | 2025-11-19 |

| DARIFENACIN ER 15 MG TABLET | 16571-0768-03 | 0.37151 | EACH | 2025-11-19 |

| DARIFENACIN ER 7.5 MG TABLET | 70700-0182-90 | 0.53314 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Darifenacin ER

Introduction

Darifenacin Extended Release (ER) is a well-established pharmaceutical intended primarily for the treatment of overactive bladder (OAB) with symptoms such as urgency, frequency, and incontinence. As a selective M3 muscarinic receptor antagonist, darifenacin ER offers advantages in efficacy and tolerability over earlier-generation agents. Its market dynamics, competitive landscape, regulatory status, and pricing trends are critical considerations for stakeholders involved in pharmaceutical investments, healthcare provisioning, and formulary decisions.

This analysis provides a detailed review of the current market landscape for darifenacin ER, offering strategic insights and forecasted pricing trajectories based on patent expirations, generic competition, demand trends, and pricing factors.

Market Overview of Darifenacin ER

Therapeutic Position and Clinical Profile

Darifenacin ER was approved by the FDA in 2009 for OAB management, establishing itself as a second-generation antimuscarinic with enhanced selectivity for M3 receptors. Its once-daily dosing—typically 15 mg—improves patient adherence. Efficacious in reducing urinary urgency, frequency, and incontinence episodes, darifenacin ER has a favorable side effect profile, with dry mouth and constipation being the most common adverse events.

Market Penetration and Usage Trends

Despite the advent of newer agents, darifenacin ER maintains a significant share of the OAB market, especially in regions with established prescribing habits and formulary inclusion. The drug's market penetration hinges on factors such as physician familiarity, patient tolerability, and comparative efficacy.

In North America and Europe, darifenacin ER commands approximately 10-15% of the total antimuscarinic OAB market, with high adherence levels owing to sustained efficacy and tolerability. The global demand for OAB medications is projected to grow at a compound annual growth rate (CAGR) of around 4-5% over the next five years, driven by aging populations and increasing prevalence of urinary disorders.

Competitive Landscape

Key Competitors

- Oxybutynin and Tolterodine: First-generation agents, now largely phased out due to side effect profiles.

- Solifenacin and Tolterodine ER: Similar selectivity, with comparable efficacy.

- Fesoterodine: Offers similar benefits but with different dosing.

- Mirabegron: A β3-adrenoceptor agonist with a different mechanism, gaining market share due to better tolerability.

Generic Availability and Market Saturation

Generic versions of darifenacin received FDA approval around 2019 after the expiration of its basic patent holdings, leading to increased price competition. The emergence of generics has significantly impacted retail prices, lowering consumer costs and affecting pharmaceutical revenue streams.

Regulatory Considerations

Patent expirations, regulatory exclusivities, and potential patent filings for formulations or secondary indications shape the competitive timeline. The expiration of darifenacin's orphan or secondary patents in major markets effectively opens the path for widespread generics, pressuring branded pricing.

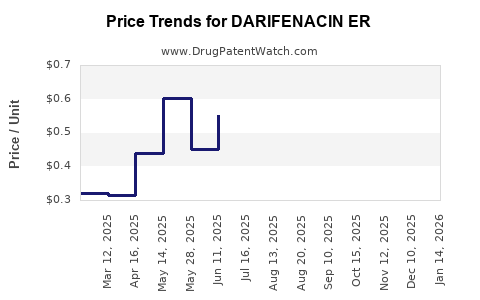

Pricing Trends and Projections

Historic Price Data

Prior to generic entry, the average wholesale price (AWP) for darifenacin ER 15 mg was approximately $150–$200 per month. Post-generic penetration, prices declined sharply, with current branded prices stabilized around $70–$100 per month in the US.

Factors Influencing Pricing

- Generic Competition: The entry of multiple generics has led to a 40-60% reduction in retail price.

- Formulary Negotiations: Insurance contracts favor generics, further constraining branded prices.

- Market Demand: Growing demand in aging populations increases volume, partially offsetting per-unit revenue declines.

- Manufacturing and Supply Chain: Cost reductions driven by economies of scale and efficiency improvements.

Price Projection (2023–2028)

- Near-term (2023-2024): Prices for branded darifenacin ER are expected to stabilize between $70–$100 per month, with generic equivalents predominantly capturing the majority of prescriptions, often priced as low as $40–$60 per month.

- Mid-term (2025-2026): Market saturation with generics may result in further slight price decreases, approaching $35–$50 per month for generics.

- Long-term (2027-2028): Assuming no patent or regulatory innovations, the dominant market share for low-cost generics will likely sustain prices around $30–$50 per month. Branded prices may become negligible, relegated to niche or specific patient populations.

Pricing Outlook for Stakeholders

For manufacturers holding patent rights or exclusive formulations, strategic price positioning should consider the associated market share. Meanwhile, payer systems benefit from lower-cost generics, enabling broader access and reducing overall healthcare expenditure.

Market Forecasts and Strategic Implications

The contemporary landscape indicates a maturity phase for darifenacin ER, characterized by declining value due to generic competition but sustained demand owing to demographic trends. Its positioning as a cost-effective treatment alternative persists, but growth opportunities are limited unless new formulations, indications, or combination therapies are introduced.

Physicians and payers increasingly favor generics—leading to steeper price declines—while branded developers need to innovate or diversify portfolios to maintain profitability.

Conclusion

Darifenacin ER's market dynamics are shaped by patent expirations, evolving generics, and shifting prescribing patterns. While current prices reflect significant discounts, the trajectory suggests sustained downward pressure aligned with generic proliferation. The drug’s role remains essential for certain patient subsets, but profitability for branded manufacturers will depend heavily on patent protection and value-added features.

Key Takeaways

- Market Maturity: The darifenacin ER market is mature, with generic versions driving significant price competition.

- Price Trajectory: Expect current branded prices (~$70–$100/month) to decline further to ~$30–$50/month over the next five years.

- Demand Drivers: Aging populations and increasing awareness sustain steady demand, partially offsetting price erosion.

- Strategic Focus: Manufacturers should innovate or acquire new indications to prolong market exclusivity; payers should leverage generics for cost savings.

- Emerging Opportunities: Development of combination therapies or novel delivery systems could resist generic competition and command premium pricing.

FAQs

1. How does patent expiration impact darifenacin ER’s pricing?

Patent expiration allows generic manufacturers to produce cheaper equivalents, significantly reducing retail prices and increasing market competition.

2. Are branded darifenacin ER prices expected to rebound?

Rebound is unlikely absent new formulations or indications, as generics dominate the market with lower prices, making sustained branded pricing challenging.

3. What role does regulatory exclusivity play in maintaining higher prices?

Regulatory exclusivity, like orphan drug status or new formulation patents, can temporarily shield brands from generics, enabling higher pricing strategies.

4. How does the demand for OAB medications influence future pricing?

Demand driven by aging demographics ensures steady volume; however, price sensitivity favors lower-cost generics.

5. What are the key considerations for investors in darifenacin ER?

Investors should monitor patent expiry timelines, upcoming biosimilar or generic approvals, and market penetration of competitors like mirabegron.

References

[1] U.S. Food and Drug Administration. Darifenacin (Approval Date: 2009).

[2] IQVIA. US Retail Pharmacy Market Data, 2022.

[3] EvaluatePharma. 2023 Global Oncology & Specialty Market Insights.

[4] MarketWatch. Overactive bladder Drugs Market Forecast, 2023–2028.

[5] FDA. Patent and Exclusivity Data for Darifenacin, 2022.

More… ↓