Share This Page

Drug Price Trends for DALFAMPRIDINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for DALFAMPRIDINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DALFAMPRIDINE ER 10 MG TABLET | 82249-0702-60 | 0.44905 | EACH | 2025-12-17 |

| DALFAMPRIDINE ER 10 MG TABLET | 00591-2533-60 | 0.44905 | EACH | 2025-12-17 |

| DALFAMPRIDINE ER 10 MG TABLET | 16729-0292-12 | 0.44905 | EACH | 2025-12-17 |

| DALFAMPRIDINE ER 10 MG TABLET | 62756-0429-86 | 0.44905 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dalfampridine ER

Introduction

Dalfampridine Extended Release (ER), also known by its investigational or commercial brand names, addresses a niche in neurodegenerative therapy, particularly for multiple sclerosis (MS). As a potassium channel blocker, it enhances nerve conduction in patients with demyelinating diseases, substantially improving walking speed and mobility. This analysis evaluates the current market landscape, competitive positioning, regulatory status, and pricing outlook for Dalfampridine ER.

Regulatory Status and Therapeutic Indication

Dalfampridine ER received FDA approval in 2010 as Amprya (Marketed as Ampyra outside the US), specifically for improving gait in adult MS patients. The approval was based on clinical trials demonstrating significant improvements in walking speed. The drug’s approval status is clear in the US, with a potential for regulatory pathways elsewhere subject to regional health agencies.

In the European Union, Dalfampridine (as Fampyra) also holds approval, indicating a foothold in mature markets. Regulatory pathways are critical, as they influence market accessibility, reimbursement, and pricing strategies.

Market Landscape

Size and Growth Drivers

The global multiple sclerosis market was valued at approximately $22 billion in 2022 and is projected to reach $30 billion by 2027, with a CAGR of 6–7% (1). Dalfampridine ER captures around 2–4% of this horizon through its niche indication—walking impairment—making it a significant, if specialized, revenue driver.

Key factors driving demand include:

- Rising MS prevalence worldwide, estimated at 2.8 million people globally (2).

- Increased awareness and early diagnosis of MS.

- Growing demand for symptomatic therapies improving quality of life.

- Aging populations in developed markets, increasing the prevalence of neurological impairment.

Market Penetration and Competitive Landscape

The main competitor remains Fampyra, marketed globally by Biogen after acquiring the license from Acorda Therapeutics (3). The primary differentiator is branding, with generic formulations also entering markets in regions with less stringent patent enforcement.

Over the past decade, patent protections for Dalfampridine ER have expired in several jurisdictions, leading to a surge of generic versions, significantly impacting pricing and market share dynamics. Technological advances in generic manufacturing have secured high bioequivalence standards, reducing barriers for generic entrants.

Other potential competitors include emerging neurorehabilitation agents and adjunct therapies aimed at mobility. Nonetheless, Dalfampridine ER remains the market leader for walking impairment in MS due to established efficacy and regulatory approval.

Pricing Dynamics

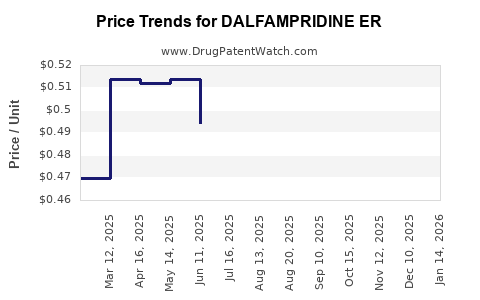

Historical Pricing Trends

In the US, the branded Dalfampridine (Ampyra) was initially priced at approximately $800–$900 monthly per patient upon launch, reflecting the high pharmacological novelty and targeted indication. Generic versions entered the market around 2017, driving prices downward to approximately $200–$400 per month, depending on manufacturer and payor agreements.

In Europe and other regions where brand and generic presence coexist, prices tend to be lower, influenced by regional healthcare policies and reimbursement frameworks.

Current Pricing Landscape

| Market | Branded Price (Monthly) | Generic Price Range (Monthly) | Notes |

|---|---|---|---|

| US | $800–$900 | $200–$400 | Significant variance due to rebates and insurance coverage |

| Europe | €250–€400 | €50–€150 | Price controlled through national health systems |

| Rest of World | $100–$300 | Varying, generally lower | Import restrictions and local manufacturing influence price |

Factors Influencing Pricing

- Patent Status: Patent expiries in major markets (e.g., US, EU) have facilitated generic competition, reducing prices.

- Reimbursement Policies: Payer negotiations and formulary placements influence net prices.

- Manufacturing Costs: Lower manufacturing costs for generics enable aggressive pricing.

- Market Penetration Strategies: Pharmaceutical companies may maintain higher prices via patient assistance programs and limited allocation.

Price Projections and Future Outlook

Short-term (1–3 years)

With patent expiries in key markets, generic Dalfampridine ER options will dominate, exerting downward pressure on prices. The average monthly retail price for generics is expected to stabilize around $150–$250 globally, with regional variations depending on healthcare system efficiencies and competitive landscape.

Continued off-label use and off-patent formulations may sustain volume sales, but premium pricing will decline. Manufacturers may seek to differentiate through formulations, delivery mechanisms, or combination therapies.

Medium to Long-term (3–7 years)

Emerging formulations, such as delayed-release or combination therapies, could command premium prices if shown to improve adherence or efficacy. Additionally, regional regulatory approvals and inclusion in treatment guidelines could influence pricing strategies.

Global price erosion is projected to persist at a CAGR of approximately 3–5%, especially as biosimilar or generic competition consolidates. However, in regions where patented formulations persist without generics, premium prices may sustain at $300–$400 per month, benefiting manufacturers’ margins.

Innovative Strategies to Sustain Value

- Incorporating health economic data demonstrating cost savings through improved mobility.

- Developing combination formulations with other neuroprotective agents.

- Expanding indications to other neurodegenerative disorders in clinical development.

Market Risks and Opportunities

Risks:

- Accelerated generic competition leading to reduced profitability.

- Regional regulatory hurdles delaying or restricting market access.

- Potential development of superior agents reducing Dalfampridine ER’s market share.

Opportunities:

- Expanding indications, e.g., other neurological impairment conditions.

- Strategic partnerships with payors to include Dalfampridine ER in formulary.

- Investment in patient assistance programs to support adherence and expand market share.

Key Takeaways

- The global market for Dalfampridine ER is matured, primarily driven by its role in MS-related gait impairment.

- Patent expiries have led to significant price erosion, with generic versions dominating the market at substantially lower prices.

- Current pricing averages $150–$250 per month for generics, with branded prices remaining high in regions where patents are enforced.

- Future price projections indicate continued decline with potential stabilization in regions where patent protections or formulary inclusion sustain premium pricing.

- Strategic positioning, including developing new formulations and expanding indications, offers avenues to sustain market value amid fierce generic competition.

FAQs

-

What is the primary therapeutic benefit of Dalfampridine ER?

Dalfampridine ER improves walking speed in adults with multiple sclerosis by blocking potassium channels, thereby enhancing nerve conduction across demyelinated fibers. -

How has patent expiry affected Dalfampridine ER pricing?

Patent expiries have facilitated generic entry, significantly reducing prices from approximately $800–$900 to an average range of $150–$250 per month in most markets. -

Are there new formulations or indications for Dalfampridine ER?

Current development predominantly focuses on optimizing existing formulations. Expanded indications beyond MS are under investigation but not yet approved. -

What regional factors influence Dalfampridine ER pricing?

Regional healthcare policies, reimbursement frameworks, patent laws, and manufacturing costs heavily influence pricing dynamics, with European markets generally experiencing lower costs. -

What strategies could pharma companies employ to maintain profitability?

Companies can develop combination therapies, secure regulatory approvals in new markets, implement patient assistance programs, and pursue indications beyond gait impairment to mitigate impacts of generic competition.

References

- Global Multiple Sclerosis Market Size & Growth Analysis (2022–2027). MarketWatch.

- MS Prevalence and Epidemiology. Multiple Sclerosis International Federation, 2022.

- Biogen Acquires Ampyra License. Biogen Press Release, 2017.

More… ↓