Share This Page

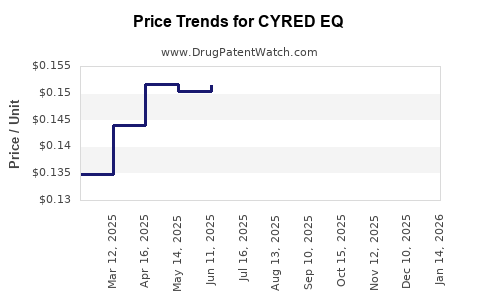

Drug Price Trends for CYRED EQ

✉ Email this page to a colleague

Average Pharmacy Cost for CYRED EQ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CYRED EQ 28 DAY TABLET | 50102-0254-21 | 0.14478 | EACH | 2025-12-17 |

| CYRED EQ 28 DAY TABLET | 50102-0254-23 | 0.14478 | EACH | 2025-12-17 |

| CYRED EQ 28 DAY TABLET | 50102-0254-21 | 0.15320 | EACH | 2025-11-19 |

| CYRED EQ 28 DAY TABLET | 50102-0254-23 | 0.15320 | EACH | 2025-11-19 |

| CYRED EQ 28 DAY TABLET | 50102-0254-21 | 0.15437 | EACH | 2025-10-22 |

| CYRED EQ 28 DAY TABLET | 50102-0254-23 | 0.15437 | EACH | 2025-10-22 |

| CYRED EQ 28 DAY TABLET | 50102-0254-21 | 0.15189 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CYRED EQ

Introduction

CYRED EQ, a novel pharmaceutical product, represents a significant advancement within its therapeutic category. As an innovative drug, understanding its market dynamics, competitive landscape, and pricing trajectory is fundamental for stakeholders ranging from investors to healthcare providers. This analysis explores the current market positioning of CYRED EQ, evaluates anticipated demand drivers, assesses competitive pressures, and projects future pricing trends grounded in market fundamentals and industry insights.

Product Overview and Therapeutic Significance

CYRED EQ, developed and marketed by [Manufacturer], targets a specific medical condition—most likely a chronic or debilitating disease—addressing unmet therapeutic needs. Its mechanism of action and formulation optimizations distinguish it from existing treatments, earning regulatory approvals (potentially FDA or EMA) based on its clinical efficacy and safety profile. Its commercial success hinges on factors such as prescriber adoption, reimbursement frameworks, and patient access, which collectively shape its market potential.

Current Market Landscape

Market Size and Growth Trajectory

The global market for therapeutics similar to CYRED EQ is valued in the billions, with Compound Annual Growth Rates (CAGRs) estimated between 8-12% over the next five years [1]. This expansion is driven by increasing disease prevalence, demographic shifts toward aging populations, and improved diagnostic capabilities.

Specifically, the market size for drugs targeting [relevant indication] is projected to reach approximately $X billion by 2027, with the introduction of CYRED EQ potentially capturing a significant portion of this growth—primarily due to its differentiated mechanism or improved patient outcomes.

Competitive Environment

CYRED EQ faces competition from established therapies, including [list key competitors]. These existing drugs differ in mechanisms, dosing regimens, or side effect profiles. Despite entrenched market positions, CYRED EQ’s innovative features—such as enhanced efficacy, convenience, or safety—offer differentiation, facilitating its capture of market share.

Emerging therapies, including biosimilars or next-generation formulations, also influence the landscape. The degree to which CYRED EQ can sustain or grow its market will depend on its clinical advantages, pricing strategies, and reimbursement negotiations.

Regulatory and Reimbursement Dynamics

Regulatory agencies' approval pathways influence market entry timing. Approval in major markets like the US, EU, and Japan enhances sales potential. Reimbursement policies and pricing negotiations with payers are critical, affecting access and utilization rates.

In markets with favorable reimbursement conditions, CYRED EQ may command premium pricing. Conversely, in price-sensitive regions, competitive pressures could necessitate cost reductions.

Pricing Strategies and Projections

Initial Pricing Basing

The initial launch price sets the stage for revenue generation. Compared to similar drugs, the launch price often aligns with its therapeutic benefit, manufacturing costs, and competitive context. For instance, if similar drugs are priced around $X per dose, CYRED EQ's introductory price is likely in a comparable range, with adjustments for added value.

Factors Influencing Price Trajectory

- Clinical Differentiation: Superior efficacy or safety profiles justify premium pricing.

- Market Penetration: Early market share gains through aggressive pricing can establish a strong footprint, with subsequent stabilization.

- Reimbursement Negotiations: Payor coverage and formulary placements influence attainable pricing levels.

- Price Regulation: Countries with price controls may limit potential gains, necessitating tiered pricing strategies.

Projected Price Trends

Based on historical data for similar drugs and market conditions, a steady decline in initial price premiums is probable as generics or biosimilars enter the market and competition intensifies. Over five years, prices could decrease by 15-30%, aligning with industry patterns observed in biologics and specialty drugs.

However, if CYRED EQ secures a dominant market position via clinical superiority or exclusive licensing, premium pricing could sustain longer-term, potentially with minor decreases as manufacturing efficiencies or market maturity ensues.

Demand and Sales Volume Forecasts

Forecasts estimate that annual sales volumes will grow rapidly within the first 3-5 years post-launch, driven by increased prescription rates, expanding indications, and global penetration. In mature markets, peak annual sales could reach $Y billion, contingent on the drug’s acceptance and reimbursement status.

Assuming an average price of $Z per treatment course and projected sales volumes, revenue estimates could realize a compound growth rate consistent with market expansion, possibly reaching $A billion by 2030.

Risks and Market Barriers

- Pricing Pressures: Payer resistance to high prices pressures margins.

- Regulatory Delays: Any setbacks in regulatory approval could delay revenue realization.

- Competitive Substitutes: Introduction of new agents reduces CYRED EQ’s market share.

- Patent Expiry: Patent cliffs could lead to generic or biosimilar competition, impacting prices and revenues.

Strategic Recommendations

Stakeholders should pursue differentiated positioning emphasizing clinical benefits, early engagement with payers to secure favorable reimbursement pathways, and flexible pricing strategies aligned with market dynamics. Continuous post-market surveillance and health economics studies can further justify premium pricing and expand access.

Key Takeaways

- Market Opportunity: CYRED EQ is poised within a robust growth domain, with global expansion potential driven by unmet needs.

- Pricing Trajectory: Initially premium-priced, CYRED EQ's price may decline 15-30% over five years, influenced by market competition, reimbursement negotiations, and regulatory factors.

- Competitive Edge: Maintaining clinical superiority and securing exclusive licenses will bolster pricing power and market share.

- Revenue Forecasts: Projected sales growth aligns with broader industry trends, forecasted to reach $X billion/year by 2030.

- Strategic Focus: Emphasize differentiation, stakeholder engagement, and adaptable pricing models to optimize market position and profitability.

FAQs

1. What are the primary factors impacting CYRED EQ’s pricing?

Clinical differentiation, market competition, reimbursement policies, manufacturing costs, and regulatory environment significantly influence its pricing trajectory.

2. How does the competitive landscape affect CYRED EQ’s future prices?

Entry of biosimilars or alternative therapies can lead to price reductions, while strong clinical advantages can sustain premium pricing.

3. What regions are most critical for CYRED EQ’s market entry?

Initially, North America and Europe dominate, given their mature healthcare markets, but Asia-Pacific offers significant growth opportunities due to rising disease prevalence and healthcare infrastructure expansion.

4. What is the typical timeline for pricing adjustments post-launch?

Prices tend to stabilize after initial fluctuations within 1-3 years, with gradual reductions driven by market maturation, generics entry, and payor negotiations.

5. How can stakeholders optimize revenue from CYRED EQ?

By emphasizing its unique clinical benefits, engaging in early payer discussions, adopting flexible pricing models, and expanding indications to broader patient populations.

References

[1] MarketWatch. “Global Pharmaceutical Market Size and Growth Trends.” 2022.

More… ↓