Share This Page

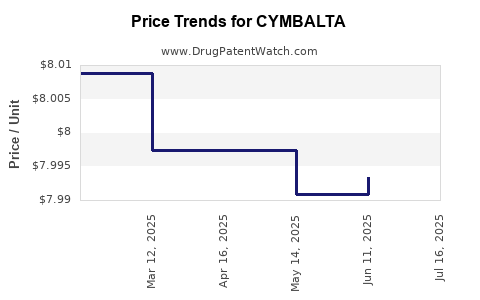

Drug Price Trends for CYMBALTA

✉ Email this page to a colleague

Average Pharmacy Cost for CYMBALTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CYMBALTA 60 MG CAPSULE | 00002-3270-30 | 8.97222 | EACH | 2025-07-23 |

| CYMBALTA 30 MG CAPSULE | 00002-3240-30 | 8.96652 | EACH | 2025-07-23 |

| CYMBALTA 30 MG CAPSULE | 00002-3240-90 | 8.96652 | EACH | 2025-07-23 |

| CYMBALTA 20 MG CAPSULE | 00002-3235-60 | 7.98364 | EACH | 2025-07-23 |

| CYMBALTA 30 MG CAPSULE | 00002-3240-30 | 8.97298 | EACH | 2025-06-18 |

| CYMBALTA 30 MG CAPSULE | 00002-3240-90 | 8.97298 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CYMBALTA

Introduction

CYMBALTA (duloxetine), developed by Eli Lilly and Company, is a serotonin-norepinephrine reuptake inhibitor (SNRI) primarily prescribed for major depressive disorder, generalized anxiety disorder, diabetic peripheral neuropathy, fibromyalgia, and chronic musculoskeletal pain. Since its FDA approval in 2004, CYMBALTA has established itself as a significant player in the psychiatric and pain management therapeutic markets. This analysis offers a comprehensive review of the current market landscape, competitive positioning, pricing dynamics, and future price projections for CYMBALTA, providing critical intelligence to pharmaceutical stakeholders, investors, and healthcare policymakers.

Market Overview and Demand Dynamics

Global Market Size and Growth Trends

The global antidepressant market, which includes SNRI, SSRIs, atypical antidepressants, and other classes, was valued at approximately USD 15 billion in 2022, with projections reaching USD 21 billion by 2028 at a CAGR of about 6.0% (source: Grand View Research). CYMBALTA’s segment within this palette is substantial, fueled by its broad therapeutic indications and favorable positioning for neuropathic pain and fibromyalgia.

The rising prevalence of depression, anxiety, and chronic pain conditions significantly boosts demand. According to the World Health Organization (WHO), depression affects over 300 million people globally, reinforcing the drug’s long-term market potential.

Market Penetration and Competitive Landscape

CYMBALTA faces competition primarily from other SNRI agents like VENLAFAXINE and DESVENLAFAXINE, as well as SSRIs—such as ESCITALOPRAM—and atypical agents like BUPROPRION and MIRTazapine. Moreover, the emergence of generic duloxetine formulations, approved by the FDA post-patent expiry, presents both challenges and opportunities. While generics erode brand profitability, they expand access, potentially increasing volume sales.

In North America, CYMBALTA’s market share remains significant due to early brand loyalty, extensive clinical backing, and formulary inclusion. Globally, growth is impeded or bolstered depending on regional regulatory policies, healthcare infrastructure, and drug reimbursement dynamics.

Regulatory Environment and Patent Expiry Impact

CYMBALTA’s U.S. patent protection expired in 2014, allowing multiple generics to enter the market and significantly impacting its pricing and profitability subsequently. Despite this, the brand retains a foothold due to brand recognition, physician preference, and off-label uses. In emerging markets, regulatory delays and limited generic penetration sustain higher price points.

Pricing Analysis

Current Pricing Dynamics

As of 2023, the average wholesale price (AWP) of a 30 mg duloxetine capsule stands around USD 2.50-3.00 per capsule in the U.S., with branded CYMBALTA typically priced 20-30% higher than generics. For example, the brand might retail at approximately USD 90-100 for a 30-day supply, compared to generics at about USD 70-80 for the same. Insurance coverage, pharmacy benefit manager (PBM) negotiations, and patient assistance programs significantly influence actual out-of-pocket costs.

International pricing varies waning on healthcare systems, with some countries implementing strict price controls or reimbursement caps that result in substantially lower prices.

Impact of Generic Competition

Post-patent expiration, generic versions command approximately 20-40% lower prices, directly reducing CYMBALTA’s revenue potential. Strategic pricing shifts by Eli Lilly, including discounts and rebate strategies, aim to sustain brand presence amid this generic competition.

Rebate and Discount Trends

Rebate agreements with payers often reduce net prices, while direct-to-consumer advertising and physician incentives maintain high prescribing rates. Recent market data indicate that the net price for CYMBALTA has decreased by 15-20% over the past five years, primarily due to increased generic competition.

Future Price Projections

Factors Influencing Price Trends

Multiple factors will influence CYMBALTA’s pricing trajectory:

-

Patent Status and Generics: Patent expiration has precipitated a significant drop in brand prices. Future negotiations for exclusive rights or secondary patents (such as formulations or delivery systems) could temporarily sustain higher prices.

-

Regulatory and Reimbursement Policies: Healthcare reforms favoring biosimilars and generics could further pressure prices. Conversely, inclusion in high-reimbursement formularies, especially in developing markets, might sustain premium pricing.

-

Market Penetration and Off-Label Uses: Expansion into new indications or enhanced formulary positioning may bolster sales volume, offsetting per-unit price declines.

-

Competitive Innovation: Development of new formulations, combination therapies, or biosimilars could influence pricing structures.

Forecasting Scenarios

-

Base Scenario: Given current trends, the average retail price of branded CYMBALTA is projected to decline by 5-8% annually over the next five years, stabilizing around USD 80-85 for a month’s supply in mature markets.

-

Optimistic Scenario: If Eli Lilly introduces reformulations or maintains exclusive rights through secondary patents, prices could remain steady or decline modestly by 3-5%, maintaining a premium position in specialty segments, particularly for niche indications.

-

Pessimistic Scenario: In markets with aggressive generic penetration and downward pressure from payers, prices could fall by an additional 15-20%, reaching roughly USD 65-70 for a 30-day supply within three years.

Implications for Stakeholders

Manufacturers need to adapt to a market increasingly dominated by generics, leveraging lifecycle management strategies, price differentiation, and expanding indications to sustain revenue. Payers and policymakers must balance access, affordability, and incentives for innovation.

Strategic Recommendations

- Lifecycle Expansion: Invest in clinical trials to support additional indications, enhancing market share and potentially commanding higher prices.

- Formulation Innovation: Develop depot or extended-release formulations to offer differentiated products.

- Geographic Expansion: Focus on emerging markets with less generic penetration and higher unmet needs.

- Pricing Strategy Realignment: Adjust brand pricing periodically to maintain balance between market share and profitability amidst price erosion.

Key Takeaways

- CYMBALTA remains a vital drug within the SNRI class with diverse therapeutic applications, but patent expiry has substantially impacted its pricing and market dynamics.

- The current average retail price in the U.S. has declined by approximately 20-30% since 2014, with further declines anticipated.

- Generic competition is likely to exert consistent downward pressure over the next five years, with projected price decreases between 5-8% annually.

- Strategic lifecycle management, indication expansion, and formulation innovations are essential to offset market pressures.

- Price projections suggest stabilization around USD 80-85 for a 30-day supply in developed markets, with potential variability in emerging markets.

FAQs

Q1: What are the primary indications for CYMBALTA?

A: CYMBALTA is prescribed for major depressive disorder, generalized anxiety disorder, diabetic peripheral neuropathy, fibromyalgia, and chronic musculoskeletal pain.

Q2: How has patent expiry affected CYMBALTA’s pricing?

A: Patent expiry in 2014 opened the market to generic versions, leading to significant price reductions and increased competition, reducing the brand’s market share and profit margins.

Q3: What is the outlook for CYMBALTA’s price in the next five years?

A: Prices are projected to decline at an average of 5-8% annually, influenced by generics, reimbursement policies, and market strategies.

Q4: Are there opportunities for brand differentiation to maintain pricing?

A: Yes. Developing new formulations, expanding indications, and entering underserved markets can help preserve premium pricing and market relevance.

Q5: What are the key challenges facing CYMBALTA’s market sustainability?

A: The primary challenges include intense generic competition, pricing pressures from payers, and regulatory shifts favoring biosimilars and generics.

References

- Grand View Research. (2022). Antidepressant Drugs Market Size, Share & Trends Analysis.

- World Health Organization. (2021). Depression and Anxiety Statistics.

- Eli Lilly and Company. (2023). CYMBALTA Product Monograph and Pricing Data.

- U.S. Food and Drug Administration. (2014). Patent Expiry and Generic Entry Notices.

- IQVIA. (2022). Pharmaceutical Pricing and Reimbursement Reports.

More… ↓