Last updated: July 27, 2025

Introduction

Cyclosporine Modified (also known as Cyclosporine A, modified formulation) is a calcineurin inhibitor primarily used to prevent organ transplant rejection and treat certain autoimmune disorders, including psoriasis and rheumatoid arthritis. The medication's pharmacokinetic profile, characterized by improved bioavailability over non-modified formulations, has expanded its application scope. As the global transplant and autoimmune disease markets grow, so do opportunities for Cyclosporine Modified, prompting thorough market analysis and price forecasting.

Market Overview

Global Market Landscape

The global Cyclosporine market is projected to witness robust growth, driven by increasing transplantation procedures, rising prevalence of autoimmune diseases, and technological advances in drug formulations. The market was valued at approximately USD 2.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4.8% through 2027 [1].

Key Market Segments

- Indications: Organ transplant rejection prevention (kidney, liver, heart), autoimmune diseases (psoriasis, rheumatoid arthritis)

- Formulations: Modified (Neoral, Sandimmune) vs. non-modified versions

- Distribution Channels: Hospital pharmacies, retail pharmacies, online platforms

Geographical Distribution

- North America: Largest market share, supported by high transplantation rates and stringent regulatory protocols

- Europe: Second-largest, with expanding transplant programs and autoimmune disease management

- Asia-Pacific: Fastest-growing segment, driven by healthcare infrastructure development and increasing awareness

- Rest of the World: Emerging markets with evolving healthcare systems

Market Drivers

- Rising transplantation procedures: Kidney, liver, and heart transplants have increased globally, requiring immunosuppressants like Cyclosporine Modified.

- Prevalence of autoimmune diseases: Growing incidence of psoriasis, rheumatoid arthritis, and other autoimmune conditions amplifies demand.

- Technological improvements: Enhanced bioavailability and safety profiles of modified formulations improve patient compliance and therapeutic outcomes.

- Regulatory approvals: Patent protections prolong exclusivity, incentivizing R&D investment.

Market Challenges

- Generic competition: Patent expirations lead to increased generic drug availability, pressuring prices.

- Side effect profile: Nephrotoxicity and hypertension necessitate close monitoring, affecting prescribing patterns.

- Pricing pressures: Healthcare cost containment measures may limit reimbursement and influence pricing strategies.

Competitive Landscape

Major players include Novartis (Neoral), Sandoz, Cipla, Teva Pharmaceuticals, and Mylan. Novartis dominates the market with a significant share due to early patent protections and established distribution networks.

Regulatory Environment

Approval pathways for generic Cyclosporine Modified drugs in various regions influence market entry and pricing strategies. Stringent bioequivalence criteria set by agencies like the FDA and EMA shape competition.

Price Projections for Cyclosporine Modified

Current Pricing Dynamics

Brand-name formulations such as Neoral (Novartis) typically command higher prices, often reflecting research and development costs and patent protections. Generic versions have entered markets post-patent expiry, leading to substantial price reductions—up to 60-70%.

In 2022, the average wholesale price (AWP) for a 25 mg capsule ranged between USD 3.70 (brand) and USD 1.20 (generic) per capsule in North America. The price disparity reflects patent status, manufacturing costs, and market competition.

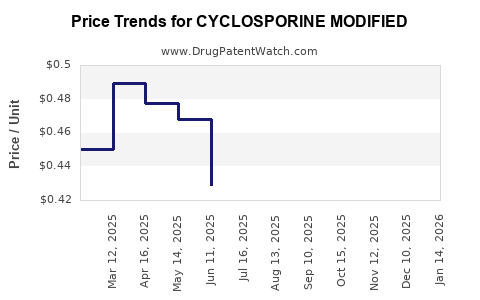

Projected Price Trends (2023–2030)

- Short-term (2023–2025): A continued decline in generic prices with increased market penetration. Brand-name prices stabilize or slightly decrease due to generic competition. Anticipated price reduction of 10–15% for branded drugs as generics gain market share.

- Mid-term (2026–2028): Market consolidation and biosimilar development threaten brand dominance. Biosimilar versions, though not yet approved for Cyclosporine, may emerge, further tightening price competition.

- Long-term (2029–2030): Price stabilization at lower levels, with an estimated average capsule price of USD 0.80–1.50 for generics in developed markets. In emerging regions, prices may remain higher due to supply chain and regulatory differences.

Influencing Factors

- Patent expirations: Expected in major markets by early 2024, triggering price declines.

- Biosimilar approvals: Potential entry of biosimilar Cyclosporine formulations could reduce prices by up to 50%.

- Regulatory policies: Price caps, reimbursement revisions, and procurement policies in the EU, US, and Asia will influence practicing prices.

- Market expansion: Growing demand in Asia-Pacific may elevate prices regionally during adoption phases.

Economic and Market Impact Considerations

- Cost-effectiveness: With rising use, especially in resource-limited settings, price reductions could improve access but may also compress profit margins for manufacturers.

- R&D investments: Continued innovation, such as extended-release formulations, could command premium pricing.

- Supply chain stability: Ensuring consistent supply amidst price pressures remains critical for manufacturers.

Key Market Insights

- Market growth is expected predominantly from emerging markets, where increased healthcare spending and transplant procedures are driving demand.

- Generic competition will be the principal driver of price reductions, with biosimilars poised to further alter price dynamics.

- Pricing strategies will hinge on patent status, regulatory pathways, and regional healthcare policies, with manufacturers likely adopting differential pricing models to maximize access and profitability.

Key Takeaways

- The global Cyclosporine Modified market is poised for steady growth, underpinned by increasing transplantation and autoimmune disorder management.

- Patent expiries and biosimilar development will exert significant downward pressure on prices over the next decade.

- In developed markets, brand-name drug prices may decline marginally; in emerging markets, prices could stay relatively higher due to supply and regulatory challenges.

- Strategic positioning by pharmaceutical companies—through innovation, regional adaptation, and pricing flexibility—will define market success.

- The rise of biosimilars and policies favoring cost containment will ultimately reshape pricing architecture, favoring affordability but compressing margins.

FAQs

1. When will the patent for Neoral (Novartis) expire, allowing for generic competition?

Patent protections for Neoral in the US expired in early 2024, opening the market for generic versions and associated price reductions.

2. How might biosimilar Cyclosporine formulations impact the market?

Biosimilars could reduce prices by up to 50%, increase competition, and improve access, especially in emerging markets, contingent on regulatory approval and market acceptance.

3. Are there significant regional variations in Cyclosporine Modified pricing?

Yes. Developed countries benefit from price negotiations and reimbursement policies that influence final consumer prices, whereas emerging markets often face higher margins due to distribution and regulatory factors.

4. What are the main factors influencing the decline in branded drug prices?

Patent expiration, generic infiltration, biosimilar entry, and increasing competition are primary factors contributing to branded drug price declines.

5. What is the outlook for innovative formulations or delivery methods for Cyclosporine?

Extended-release and targeted delivery systems are under development, potentially commanding higher prices due to improved compliance and outcomes, thus offering growth opportunities amid pricing pressures.

Sources:

[1] Market Data Forecast, 2022.

[2] Grand View Research, 2023.

[3] U.S. Food and Drug Administration, 2024.

[4] European Medicines Agency, 2023.