Last updated: July 27, 2025

Introduction

Cyclophosphamide is a well-established alkylating agent primarily used in chemotherapy for various cancers such as lymphomas, breast cancer, and leukemias, as well as in autoimmune disorders like lupus and vasculitis. Its long-standing clinical utility, combined with a complex patent landscape and manufacturing considerations, influences its market dynamics and pricing strategies. This analysis examines the current market status, competitive landscape, regulatory environment, and future price projections for cyclophosphamide, offering insights for pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Global Market Size and Growth

The global chemotherapy drugs market, inclusive of cyclophosphamide, was valued at approximately USD 13 billion in 2022, with an expected compound annual growth rate (CAGR) of 4-5% through 2030, driven by increasing cancer prevalence and expanded treatment indications. Cyclophosphamide remains a core component in treatment regimens owing to its established efficacy and relatively low cost compared to newer agents.

Key Market Segments

- Oncology: Supplies for lymphomas, breast cancer, and leukemia constitute the largest segment, accounting for over 60% of cyclophosphamide usage.

- Autoimmune Disorders: An expanding segment, especially with recent approvals for indications such as severe glomerulonephritis and systemic sclerosis.

- Geographic Distribution: North America holds the leading share (~40%), followed by Europe (~30%) and Asia-Pacific (~20%). Emerging markets in Asia and Latin America are witnessing accelerated adoption due to increasing healthcare infrastructure and rising cancer burden.

Market Drivers

- Established Efficacy and Cost-Effectiveness: Despite newer therapies, cyclophosphamide remains favored for its proven track record and affordability.

- Expanding Indications: Advances in clinical practice and broader licensing for autoimmune disorders increase demand.

- Patent Expiry and Generic Competition: The patent for original formulations expired decades ago, leading to widespread generic availability, which suppresses the drug’s price trajectory but sustains volume sales.

Regulatory and Manufacturing Landscape

Patent and Regulatory Status

As a generic drug with no active patents, cyclophosphamide’s market price is subject to intense competition from multiple global manufacturers. Regulatory approval is straightforward in most regions, given its long-standing clinical use, but manufacturing standards are stringently required to ensure purity and safety.

Manufacturing Considerations

Generic manufacturers benefit from scalable production processes. However, raw material costs and quality control remain critical factors influencing margins and, by extension, pricing.

Competitive Landscape

Major Producers and Market Share

- Pfizer and MGI Pharma: Historically dominant, although production has diversified.

- Sandoz, Hikma, and Teva: Leading generic players with extensive distribution channels.

- Emerging Market Manufacturers: India’s Cipla and Dr. Reddy’s Laboratories are significant suppliers to developing markets.

Pricing Strategies

Price competition is fierce, with variations depending on formulation (oral vs. IV), regional regulations, and procurement channels (hospital vs. retail). Price erosion has been steady owing to multiple generic options, but stable demand sustains unit sales volume.

Pricing Trends and Future Projections

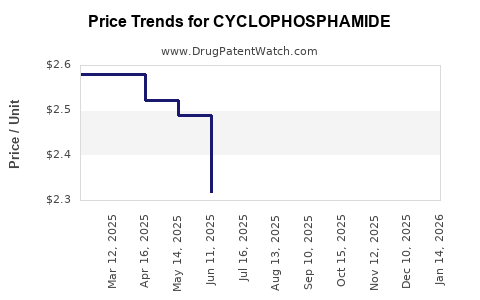

Historical Price Trends

Prices for cyclophosphamide have declined sharply over the past decade — often by 50% or more — driven by generic competition and healthcare cost containment policies. In North America and Europe, the average wholesale price (AWP) for a standard 25 mg capsule has diminished from approximately USD 0.50-0.80 in 2012 to USD 0.10-0.20 in 2022.

Factors Influencing Future Prices

- Market Saturation: Near-complete generic saturation limits significant new price increases.

- Manufacturing Cost Fluctuations: Raw material costs, particularly for cyclophosphamide’s intermediates, influence pricing but are stabilized due to global supply chains.

- Healthcare Policy and Pricing Regulations: Cost-control policies in rising markets could suppress prices further, whereas some regulatory environments may allow premium pricing for novel formulations or proprietary delivery systems.

Price Projection (2023–2030)

Given current trends, expected price declines will plateau, with marginal fluctuations:

- Short-term (2023–2025): Continued slight price erosion (~-2% annually), especially in Western markets.

- Medium-term (2026–2030): Stabilization expected, with prices hovering around USD 0.08-0.12 per capsule or equivalent unit, maintaining a low-cost position for dominant generics.

Emerging markets may observe slight increases in prices due to quality or regulatory factors, but overall, the trend favors affordability and volume-driven sales.

Market Opportunities and Risks

Opportunities

- Development of fixed-dose combinations or novel formulations targeting autoimmune diseases or reducing side effects could command premium pricing.

- Expansion into emerging markets with high disease burden and limited access to newer, costlier therapies.

Risks

- Introduction of biosimilars or non-chemotherapy alternatives could threaten market share.

- Regulatory shifts aimed at price controls could depress prices further.

- The advent of targeted therapies or immunotherapies with superior efficacy could diminish cyclophosphamide’s clinical relevance, impacting sales volumes and pricing.

Strategic Implications

- For Manufacturers: Focus on cost-efficient production and quality assurance to remain competitive in a heavily commoditized market. Innovate in formulations for niche indications that could command higher prices.

- For Investors: Monitor regulatory developments and emerging markets for growth opportunities, particularly where expanding disease prevalence meets unmet healthcare needs.

- For Healthcare Providers: Balance cost-efficiency with therapeutic efficacy, considering generic availability and local pricing policies.

Key Takeaways

- Market Size and Demand: Cyclophosphamide remains a critical chemotherapeutic and immunosuppressive agent with steady global demand, especially driven by its affordability.

- Price Trends: The drug’s prices have declined significantly over the past decade due to patent expiry and fierce generic competition, with future prices stabilizing at low levels.

- Regulatory and Manufacturing Dynamics: Intact regulatory pathways and streamlined manufacturing in emerging markets sustain supply and low prices.

- Strategic Focus: Differentiation through innovative delivery systems and targeting niche indications can offer new revenue streams amid declining base prices.

- Market Risks: Competition from newer therapies, biosimilars, and policy pressures pose ongoing threats to pricing and market share.

FAQs

-

What is the typical price range for cyclophosphamide in 2023?

In 2023, the average wholesale price for a 25 mg capsule is approximately USD 0.10 to 0.20, reflecting steady low-cost competition from generics.

-

Are there patent protections that could influence cyclophosphamide's price?

No. Cyclophosphamide is a generic drug with no active patents, leading to intense price competition worldwide.

-

Which regions offer the highest growth potential for cyclophosphamide?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa hold significant growth potential due to rising cancer incidences and increasing healthcare access.

-

What are the key factors influencing future price stability?

Market saturation with generics, manufacturing costs, healthcare policies on drug pricing, and the emergence of alternative therapies are primary determinants.

-

How might evolving treatment options affect cyclophosphamide’s market?

The rise of targeted therapies and immunotherapies could limit cyclophosphamide's use in certain cancer types, affecting volume but unlikely impacting its low-cost position significantly.

References

[1] MarketWatch, "Global Oncology Drugs Market Size & Trends," 2022.

[2] IQVIA Institute, "The Global Use of Medicines in 2022," 2022.

[3] Reports and data on generic drug pricing trends, 2022.

[4] Pharmaceutical regulatory bodies and WHO guidelines, 2022.

[5] Industry analyst reports on emerging markets and biosimilar developments, 2022.