Share This Page

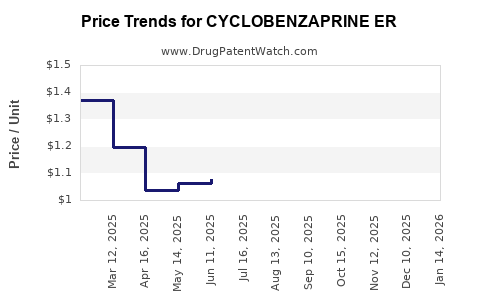

Drug Price Trends for CYCLOBENZAPRINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for CYCLOBENZAPRINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CYCLOBENZAPRINE ER 15 MG CAP | 00093-1920-06 | 1.23169 | EACH | 2025-12-17 |

| CYCLOBENZAPRINE ER 15 MG CAP | 00115-1436-13 | 1.23169 | EACH | 2025-12-17 |

| CYCLOBENZAPRINE ER 15 MG CAP | 24979-0035-04 | 1.23169 | EACH | 2025-12-17 |

| CYCLOBENZAPRINE ER 15 MG CAP | 00093-1920-06 | 1.15603 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CYCLOBENZAPRINE ER

Introduction

Cyclobenzaprine ER (Extended Release) is a muscle relaxant used primarily to alleviate acute muscle spasms associated with musculoskeletal conditions. Its extended-release formulation offers sustained therapeutic effects, reducing dosing frequency and potentially improving patient adherence. As the pharmaceutical landscape evolves, understanding the market dynamics and pricing projections for Cyclobenzaprine ER is critical for stakeholders ranging from manufacturers to investors.

Market Overview

Current Therapeutic Landscape

Cyclobenzaprine ER competes within the small but essential segment of muscle relaxants. Its primary competitors include immediate-release formulations of cyclobenzaprine, other muscle relaxants like baclofen, tizanidine, and newer agents with similar indications. The global muscle relaxant market was valued at approximately USD 900 million in 2022, with expected CAGR of around 4% until 2030 [1].

Key Market Drivers

- Growing Musculoskeletal Disorder Incidence: Aging populations and increased activity levels escalate the prevalence of back pain, neck pain, and other musculoskeletal issues—boosting demand for effective muscle relaxants [2].

- Patient Adherence Enhancement: The extended-release formulation simplifies dosing schedules, which correlates with higher compliance and favorable patient outcomes.

- Prescriber Preference Shift: Physicians tend to favor drugs with a better tolerability profile and sustained efficacy, favoring ER formulations for chronic management.

Regional Market Dynamics

- North America: Dominates the market, driven by high healthcare spending, robust drug approval pathways, and higher awareness.

- Europe: Significant growth driven by aging demographics and increased musculoskeletal disorder management.

- Asia-Pacific: Rapid expansion due to rising middle-class incomes, improved healthcare access, and increased prevalence rates.

Patent and Regulatory Landscape

Cyclobenzaprine ER's patent landscape remains crucial for market exclusivity. With original patents expiring, generic manufacturers are entering, intensifying price competition. However, specific formulations often maintain market share via brand recognition and differentiated drug delivery systems [3].

Regulatory agencies like the FDA approve formulations based on bioequivalence, which may expedite the entry of generics, impacting pricing strategies.

Market Challenges

- Generic Competition: As patents lapse, price erosion becomes inevitable.

- Adverse Effects & Safety Profile: Side effects such as dry mouth, dizziness, and sedation can limit prescribing in certain populations, constraining market growth.

- Pricing and Reimbursement Policies: Cost containment measures in healthcare systems influence pricing flexibility.

Price Projections

Historical Pricing Trends

Historically, brand-name Cyclobenzaprine ER cost approximately USD 150–200 per month, with significant reductions post-generic entry. Generics now range between USD 50–80 per month (retail), depending on supply chain factors.

Future Price Trends

- Post-Patent Expiry: Prices are projected to decline further, stabilizing around USD 40–60 per month for generics by 2025–2027 [4].

- Innovative Formulations: Newer delivery technologies or combination therapies could command premium pricing—potentially USD 100–150 per month—if proven superior.

- Market Penetration and Volume: With increasing prevalence and broader acceptance, unit sales are expected to rise, partially offsetting reduced per-unit prices.

Pricing Strategy Forecast

Manufacturers may adopt tiered pricing, balancing between maintaining brand value and competing effectively with generics. Limited patent extensions or formulation improvements could temporarily sustain higher prices, but the overall trend points towards downward pressure.

Competitive Landscape Analysis

Major players include:

- Pfizer: Originally marketed the branded formulation.

- Generic Manufacturers: Multiple entrants including Teva, Mylan, and Sandoz. Mass production of generics significantly impacts pricing.

- Emerging Biotech Firms: Investigate alternative formulations or combination therapies offering differentiated value.

The competitive environment will influence not only prices but also market share distribution.

Key Trends and Future Outlook

- Personalized Therapeutics: Growing interest in tailored muscle relaxant therapies may reshape market strategies.

- Regulatory Shifts: Potential policies favoring biosimilars or generics could hasten price declines.

- Digital Health Integration: Reminder apps and adherence tools can augment market expansion, especially in chronic use scenarios.

Conclusion

The Cyclobenzaprine ER market is positioned at the intersection of aging demographics, evolving regulatory frameworks, and increased generic competition. While the current market offers profitable opportunities for early adopters and innovators, long-term projections indicate decreasing prices driven by patent expirations and cost-containment policies. Stakeholders must adapt pricing strategies and investment plans to these dynamics, emphasizing differentiation, formulation innovation, and patient engagement.

Key Takeaways

- The global muscle relaxant market is steadily growing, with Cyclobenzaprine ER occupying a significant niche due to its extended-release benefits.

- Patent expirations and increased generic competition are expected to reduce prices, with mid- to long-term projections stabilizing around USD 40–60 per month for generics.

- Regional variations—especially in North America and Europe—present diverse pricing and marketing opportunities.

- Differentiation through formulation enhancements and digital health solutions may sustain premium pricing and market share.

- Strategic planning should focus on navigating competitive pressures, regulatory changes, and evolving prescriber preferences.

FAQs

1. How does the pricing of Cyclobenzaprine ER compare between brand-name and generic versions?

Brand-name Cyclobenzaprine ER typically costs USD 150–200 per month, whereas generic versions are priced around USD 50–80 monthly. Post-patent expiry, generic entry drives prices downward.

2. What factors influence the future pricing of Cyclobenzaprine ER?

Patent expirations, regulatory approval of generics, manufacturing costs, competition, and reimbursement policies are primary influences on future pricing.

3. Are there upcoming formulation innovations that could affect the Cyclobenzaprine ER market?

Yes, advancements such as combination therapies, transdermal patches, or novel delivery systems could command premium prices if they demonstrate superior efficacy or safety.

4. How significant is regional variation in the market and pricing of Cyclobenzaprine ER?

Market size, healthcare infrastructure, prescribing habits, and reimbursement policies cause significant regional differences, with North America leading in valuation and growth potential.

5. What strategies should manufacturers consider to remain competitive as prices decline?

Innovate with differentiated formulations, focus on clinical outcomes and adherence improvements, expand into emerging markets, and negotiate favorable reimbursement terms.

References

- MarketWatch. "Muscle Relaxants Market Size, Share & Trends Report." 2022.

- World Health Organization. "Musculoskeletal conditions: prevalence and impact." 2021.

- U.S. Food & Drug Administration. "ANDA Approvals and Patent Status." 2023.

- IQVIA. "Pharmaceutical Pricing Trends Report." 2022.

More… ↓