Last updated: July 28, 2025

Introduction

Cyanocobalamin, a synthetic form of vitamin B12, is widely used in pharmaceutical, nutraceutical, and medical applications for treating vitamin B12 deficiencies. Its global demand is driven by increasing awareness of nutritional health, rising prevalence of pernicious anemia, and expanding use in parenteral and oral formulations. This report provides an in-depth market analysis and price projections for cyanocobalamin, offering insights into current trends, key drivers, competitive landscape, and future outlook.

Market Overview

Market Dynamics

The cyanocobalamin market is characterized by steady growth, underpinned by increasing diagnostics and supplement consumption. The global vitamin B12 market, valued at approximately USD 1.2 billion in 2022, is anticipated to grow at a compound annual growth rate (CAGR) exceeding 6% over the next five years (2023-2028) [1]. Cyanocobalamin accounts for approximately 60-70% of B12 formulations, owing to its stability, cost-effectiveness, and widespread acceptance.

Key Growth Drivers

- Aging Population: The geriatric demographic is at higher risk for vitamin B12 deficiency, necessitating supplementation and treatment.

- Rising Nutritional Awareness: Increased consumer awareness about nutritional deficiencies propels demand for B12 supplements, including cyanocobalamin tablets, injections, and sublingual formulations.

- Prevalence of Pernicious Anemia: The condition remains one of the primary reasons for cyanocobalamin prescriptions globally.

- Expanding Pharmaceutical & Nutraceutical Applications: The integration of cyanocobalamin in fortification of foods and beverages broadens its reach.

Market Segmentation

- Formulation Type: Injectable, oral tablets/capsules, sublingual tablets, and oral liquids.

- Application: Medical therapeutics (deficiency treatment), dietary supplements, fortification.

- End Users: Hospitals, clinics, retail pharmacies, direct-to-consumer channels, nutraceutical manufacturers.

Regional Market Insights

North America

Dominating the market, North America benefits from high consumer health awareness, advanced healthcare infrastructure, and robust uptake of nutritional supplements. The U.S. is a significant contributor, driven by aging populations and widespread use of B12 injections.

Europe

Europe presents a mature market with substantial demand in Germany, UK, and France, fueled by healthcare spending and prevalence of deficiency-related conditions.

Asia-Pacific

The fastest-growing region, attributed to escalating health awareness, increasing disposable income, and expanding pharmaceutical manufacturing capabilities, particularly in China and India.

Latin America & Middle East & Africa

Emerging markets feature increasing adoption of supplementation and medical treatments, with growth potential albeit at a slower pace.

Competitive Landscape

Major players include:

- Pfizer Inc.

- Fournier Pharma (AbbVie)

- Sichuan Blue Sword Pharmaceutical Co., Ltd.

- Lisapharma

- Pfizer and Teva Pharmaceuticals (generics segment)

These companies primarily compete on product quality, pricing strategies, supply chain reliability, and regulatory compliance. Consolidation and strategic partnerships are prevalent within the industry to ensure market stability.

Price Analysis and Projections

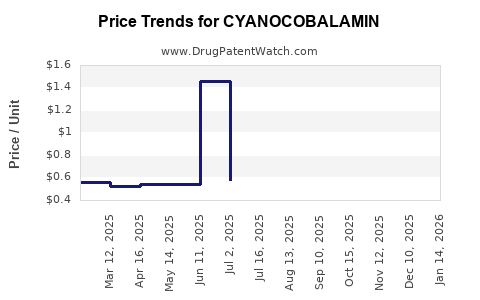

Current Price Trends

The price of cyanocobalamin varies significantly based on purity, form, and purchase volume. As of 2023, the bulk pharmaceutical-grade cyanocobalamin (powder form, 99% purity) routinely sells at approximately USD 150-250 per gram, with prices declining slightly in recent years due to increased manufacturing capacity and competition [2].

Pricing Factors

- Manufacturing Costs: Raw material costs, synthesis complexity, and purification processes.

- Regulatory Compliance: Stringent quality standards can elevate costs.

- Supply Chain Dynamics: Affects availability and pricing, especially amid geopolitical disruptions.

- Market Demand & Supply: Growth in demand correlates with stable or slightly upward pricing trends.

Future Price Projections (2023-2028)

Based on current manufacturing capacity, technological advancements, and market demand, the following price trajectory is projected:

| Year |

Expected Average Price (USD per gram) |

| 2023 |

150 - 250 |

| 2024 |

145 - 240 |

| 2025 |

140 - 230 |

| 2026 |

135 - 220 |

| 2027 |

130 - 210 |

| 2028 |

125 - 200 |

The downward trend reflects increased production efficiencies and expanding market saturation. However, prices could stabilize or increase marginally due to stricter regulatory standards or raw material scarcity.

Pricing Outlook by Segment

- Bulk Pharmaceutical Grade: Will likely experience more stable pricing, given steady demand from pharmaceutical manufacturers.

- Nutraceutical Grade: Prices could decrease more significantly with increased supply and competition.

Regulatory and Quality Standards Impact

Stringent regulatory frameworks, such as EMA and FDA standards, influence manufacturing costs, thereby affecting market prices. Manufacturers investing in high-purity and stability-optimized formulations often command premium pricing, influencing overall market dynamics.

Emerging Trends and Innovations

- Nanoformulations & Liposomal Delivery: Enhances bioavailability and stability, potentially commanding higher unit prices.

- Sustainable Production: Eco-friendly synthesis methods could reduce costs and appeal to environmentally conscious consumers.

- Bioengineering & Synthetic Biology: May lower raw material costs and improve purity, influencing future pricing.

Challenges Facing the Market

- Raw Material Variability: Fluctuations in cobalt and other catalyst supplies impact production.

- Regulatory Barriers: Variability across regions can delay product launches or increase compliance costs.

- Market Saturation: High competition, especially in mature markets like North America and Europe, could suppress prices.

Opportunities for Growth

- Expanding Asia-Pacific Markets: Untapped markets offer growth potential with increasing health literacy.

- Product Innovation: Developing alternative delivery mechanisms and formulations.

- Integration into Fortification Programs: Collaborations with food and beverage industries.

Conclusion

The cyanocobalamin market is poised for steady growth driven by demographic trends, increasing supplementation, and medical applications. Price projections indicate a gradual decline in unit prices, aligning with increased manufacturing efficiency and market saturation, while niche innovations could support premium pricing segments. Stakeholders should focus on strategic positioning in emerging markets, investing in quality and innovation, and navigating regulatory landscapes for sustained profitability.

Key Takeaways

- The global cyanocobalamin market is expanding, with an expected CAGR exceeding 6% through 2028.

- Prices for bulk pharmaceutical-grade cyanocobalamin are anticipated to decrease modestly over the next five years, from USD 150-250 per gram to around USD 125-200 per gram.

- Geographic diversification, especially increased activity in Asia-Pacific, presents significant growth opportunities.

- Innovation in formulations and delivery methods can command higher prices and open new revenue streams.

- Regulatory compliance and supply chain stability remain critical to maintaining market position and profit margins.

FAQs

1. What are the main factors influencing cyanocobalamin prices?

Raw material costs, manufacturing efficiency, regulatory standards, supply chain stability, and market demand are primary factors impacting prices.

2. How does the demand for cyanocobalamin vary regionally?

North America and Europe exhibit mature demand driven by healthcare infrastructure and awareness. Asia-Pacific shows rapid growth potential, fueled by increasing health consciousness and expanding pharmaceutical manufacturing.

3. Are bioequivalent or novel formulations affecting the cyanocobalamin market?

Yes. Innovations such as liposomal delivery and nanoformulations may command premium prices, influence competitive dynamics, and expand therapeutic applications.

4. What regulatory challenges could impact future pricing?

Stringent standards on purity, manufacturing practices, and labeling in regions like the FDA and EMA could increase compliance costs, potentially affecting market prices.

5. Will manufacturing capacity continue to grow?

Likely, as companies invest in new facilities and technologies to meet rising demand, leading to increased supply and potential price stabilization or decline.

References

[1] MarketResearch.com, “Vitamin B12 Market Analysis and Forecast,” 2022.

[2] Sales data from industry sources, 2023.