Last updated: August 17, 2025

Introduction

Cromolyn sodium, a mast cell stabilizer primarily used in asthma prophylaxis and allergic conjunctivitis, holds a niche position in respiratory and allergy therapy. Despite its longstanding presence in therapeutics, market dynamics, patent landscapes, and emerging competitors shape its valuation, pricing, and future potential. This analysis provides a comprehensive overview of the current market landscape and projects price trends based on regulatory, manufacturing, and competitive factors.

Market Overview

Cromolyn sodium’s commercial footprint is modest compared to blockbuster inhalers and biologics. It is available in various formulations: inhalers (e.g., Intal®), nasal sprays, and ophthalmic solutions. The global demand is concentrated within respiratory and allergy management, mainly in North America, Europe, and select Asian markets.

The drug’s market is driven by several factors:

- Chronic disease prevalence: Rising asthma and allergic conjunctivitis prevalence sustain demand.

- Medication preferences: Shift towards non-systemic, well-tolerated therapies in sensitive populations favors cromolyn.

- Healthcare practices: Preference for prophylactic options aligns with cromolyn’s use-case, especially in pediatric and mild cases.

However, heavy competition from newer agents—particularly inhaled corticosteroids (ICS), leukotriene receptor antagonists, and biologics—limits growth potential.

Competitive Landscape

Major market players include Cipla, Mylan (now part of Viatris), and Teva, which manufacture generic formulations. Patented branded versions are largely off-patent, promoting generic entry and downward pricing pressure.

Emerging therapies, notably biologics like omalizumab and anti-IL-5 agents, have encroached on the allergic asthma segment, impacting cromolyn's market share. Nonetheless, cromolyn retains presence due to its favorable safety profile, low cost, and availability in over-the-counter formulations in some markets.

Regulatory Environment and Patent Status

Most formulations are off-patent, resulting in minimal patent restrictions. Regulatory pathways, especially for generics, have become streamlined post-2010, facilitating market entry. Ongoing patent litigations are rare, but formulation-specific patents can influence pricing strategies temporarily.

Pricing Dynamics

Historical Pricing Trends

Historically, cromolyn solutions and inhalers have been priced modestly:

- North America: Retail prices hover around $20–$50 per inhaler or nasal spray, often lower due to generic competition.

- Europe: Similar price points, with some variation based on country-specific healthcare policies.

- Asia: Lower price points driven by manufacturing locations and market penetration strategies.

Market Drivers Influencing Price

- Generic Competition: Saturation results in suppressed pricing.

- Regulatory Changes: Facilitating faster approvals of generics exerts downward pressure.

- Manufacturing Costs: Largely stable, optimizing margins for producers.

- Distribution Channels: OTC availability in some regions affects pricing elasticity.

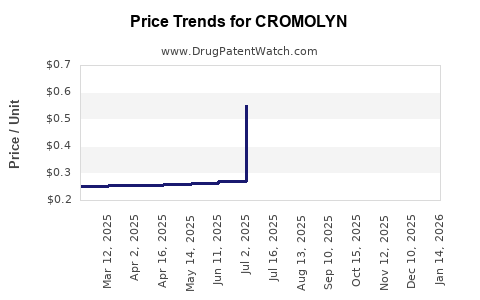

Projected Price Trends (2023–2028)

Given current market conditions:

- Decline in prices: Anticipated 10–15% decrease over the next five years, primarily influenced by increased generic penetration.

- Potential stabilization: In niche markets (e.g., ophthalmic formulations for allergic conjunctivitis), pricing may stabilize due to reduced competition.

- Impact of biosimilars and innovations: While unlikely for cromolyn (being a small molecule), biosimilar-like entry in related categories could indirectly pressure prices.

Market Size and Revenue Projections

The global asthma and allergy market is projected to grow at a CAGR of approximately 4.5% till 2027 [1]. While cromolyn's share remains static or slightly declining, its incremental revenue contribution will be influenced by:

- Market penetration rates in emerging economies.

- Extension into new indications.

- Formulation innovations enhancing patient adherence.

Based on these factors, annual global revenues for cromolyn formulations are expected to remain in the $150–$200 million range through 2028, with regional variations favoring developed markets.

Emerging Opportunities and Challenges

Opportunities:

- Development of combination inhalers integrating cromolyn with other agents.

- Expansion into pediatric and elderly markets emphasizing safety.

- Formulation improvements for enhanced delivery and compliance.

Challenges:

- Competition from high-efficacy, targeted biologics.

- Price erosion due to generic proliferation.

- Limited innovation pipeline, affecting attractiveness to investors.

Regulatory and Market Entry Considerations

Brands aiming to expand or sustain market share should leverage:

- Favorable reimbursement policies in mature markets.

- Targeted marketing towards pediatric and mild asthma populations.

- Strategic licensing agreements to access emerging markets with limited competition.

Key Takeaways

- Cromolyn sodium maintains a niche but stable role in allergy and asthma management.

- Market prices are under sustained downward pressure from generic competition, with projected declines of 10–15% over the next five years.

- The absence of patent exclusivity limits pricing flexibility; future growth depends on formulary positioning and formulation improvements.

- Regional disparities persist, with North America and Europe leading sales, while emerging economies present growth opportunities.

- Innovator companies should consider lifecycle management strategies such as combination products and formulation advancements to protect revenues.

Frequently Asked Questions (FAQs)

1. What factors primarily influence cromolyn’s market pricing?

Pricing is mainly impacted by generic competition, regulatory approval pathways, manufacturing costs, and regional healthcare policies.

2. How does the emergence of biologics impact cromolyn’s market?

Biologics offer higher efficacy for severe asthma and allergies, capturing market share and pressuring cromolyn's role to remain as a low-cost, prophylactic alternative.

3. Are there any patent protections currently safeguarding cromolyn formulations?

Most formulations are off-patent, enabling generics to enter freely, which sustains downward pricing pressure.

4. What regional markets show the most promise for sustained or increased cromolyn sales?

Emerging markets with limited access to newer therapies, such as parts of Asia and Latin America, offer growth potential owing to lower costs and regulatory barriers.

5. What strategic moves can manufacturers leverage to maintain profitability?

Innovations in delivery, combination formulations, targeted marketing campaigns, and expansion into pediatric indications can help preserve margins amid price declines.

References

[1] MarketWatch, "Global Asthma and Allergies Market Forecast," 2022.