Share This Page

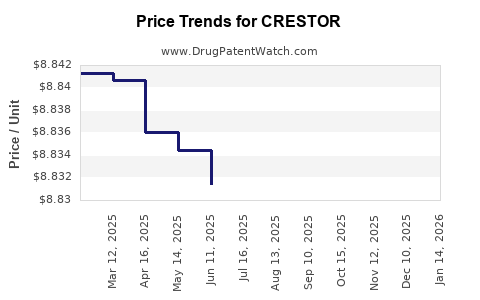

Drug Price Trends for CRESTOR

✉ Email this page to a colleague

Average Pharmacy Cost for CRESTOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CRESTOR 5 MG TABLET | 00310-7560-90 | 8.81932 | EACH | 2025-12-17 |

| CRESTOR 40 MG TABLET | 00310-7590-30 | 8.82808 | EACH | 2025-12-17 |

| CRESTOR 10 MG TABLET | 00310-7570-90 | 8.81433 | EACH | 2025-12-17 |

| CRESTOR 20 MG TABLET | 00310-7580-90 | 8.82360 | EACH | 2025-12-17 |

| CRESTOR 40 MG TABLET | 00310-7590-30 | 8.82399 | EACH | 2025-11-19 |

| CRESTOR 10 MG TABLET | 00310-7570-90 | 8.82381 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CRESTOR (Rosuvastatin Calcium)

Introduction

CRESTOR (rosuvastatin calcium) remains a cornerstone in the lipid-lowering therapeutic class, widely prescribed for managing hypercholesterolemia and reducing cardiovascular risk. As innovative biotech firms introduce next-generation statins and alternative therapies, market dynamics and pricing for CRESTOR face evolving pressures. This analysis explores current market conditions, competitive landscape, regulatory factors, and future price trajectories to inform strategic decision-making for stakeholders—including pharmaceutical companies, investors, and healthcare providers.

Market Overview of CRESTOR

Therapeutic Market and Revenue Trends

CRESTOR, developed by AstraZeneca (now part of AstraZeneca PLC following divestments or licensing agreements), generated approximately $4.4 billion in global sales in 2021, reflecting its pivotal role in cardiovascular disease management. The product's market share is bolstered by its efficacy profile and comparatively favorable tolerability.[1]

Annual revenue has demonstrated a declining trend post-2021, influenced by several factors:

- Patent expirations, notably in the U.S. (2016) and Europe, leading to increased generic competition.

- Entry of biosimilars and generics, contributing to significant price erosion.

- Growing adoption of alternative lipid-lowering agents, such as PCSK9 inhibitors.

Patent Landscape and Generic Entry

CRESTOR's primary patents, including composition of matter and formulation patents, expired globally over recent years, prompting generic manufacturers to introduce rosuvastatin products. In the U.S., the first generic entered the market in 2016, leading to a sharp decline in branded CRESTOR prices. Similar patterns emerged in Europe and other markets, catalyzing increased price competition and volume growth in generic sales.[2]

Regulatory Environment

Regulatory bodies, including the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA), have approved multiple generic rosuvastatin formulations. Special considerations—such as bioequivalence requirements—have facilitated expedited market entry for generics, intensifying competitive pressures.

Competitive Landscape

Generics and Biosimilars

The entry of multiple generic manufacturers has driven substantial price reductions. In the U.S., generic rosuvastatin prices fell by approximately 80-85% within the first year of market entry.[3] Current market pricing varies geographically, influenced by local procurement policies, reimbursement schemes, and healthcare infrastructure.

Innovative Alternatives

Though statins remain first-line therapy, newer agents such as PCSK9 inhibitors (e.g., evolocumab, alirocumab) and novel lipid-lowering drugs like bempedoic acid offer alternative options, especially for patients intolerant to statins or requiring greater LDL reductions. Their high costs exert downward pressure on branded statin prices and impact market share.

Price Projection Framework

Historical Trends

Historically, CRESTOR's price trajectory exhibits an initial high-value period during patent exclusivity, followed by steep declines post-generic entry. For example, in the U.S., the average wholesale price (AWP) for brand CRESTOR decreased from over $200 per month per patient pre-patent expiry to approximately $30-50 after generics entered.[4]

Projected Future Pricing Scenarios

Based on current trends, market dynamics, and regulatory forecasts, we delineate three plausible price trajectories over the next five years:

-

Conservative Scenario:

Continued generic proliferation and market saturation could sustain prices at current generic levels (~$20-$50/month), with minimal incremental decreases due to manufacturer competition and price sensitivity. -

Moderate Scenario:

Introduction of biosimilars or more aggressive pricing strategies by generic manufacturers may induce further declines, possibly stabilizing around $10-$20/month, considering manufacturing cost reductions and market consolidation. -

Optimistic Scenario:

Strategic positioning, such as value-based pricing for branded CRESTOR in niche segments or under negotiated healthcare agreements, could maintain premium positioning in specialized markets, ensuring prices hover around $50-$75/month. However, this scenario is less likely given current generic dominance.

Influence of Emerging Budget Constraints

Health systems globally face increasing budget constraints, prompting formulary restrictions, tiered copay schemes, and shifting towards cost-effective generics. Such policies will likely reinforce downward price pressures for CRESTOR, particularly in countries with strict drug reimbursement limits.[5]

Implications for Stakeholders

-

Pharmaceutical Companies:

Innovators must consider lifecycle management strategies—such as drug repositioning, combination therapies, or new indications—to sustain revenue streams. Investment in biosimilar development and licensing arrangements might further influence pricing. -

Healthcare Providers and Payers:

Cost-effectiveness analyses increasingly favor generics for broad patient populations. Stakeholders should monitor evolving costs to optimize formulary decisions and ensure access. -

Investors:

Future revenue projections for CRESTOR depend largely on patent licensing or exclusivity extensions, which seem unlikely given current patent statuses. Diversification into emerging lipid-lowering therapies could mitigate risks associated with generic price erosion.

Conclusion

CRESTOR's market continues to evolve amidst escalating generic competition and the emergence of novel therapeutics. While the initial patent-driven high-value phase has transitioned into a mass market with significantly reduced prices, strategic positioning could sustain certain segments of its valuation. Over the next five years, price declines are projected to plateau at low levels for generic formulations but may stabilize if branded options retain niche advantages through value-based pricing or specialized indications.

Key Takeaways

- Post-patent expiration, CRESTOR prices have declined sharply, aligning with global generic market trends.

- Price projections indicate future stabilization at low-cost generic levels (~$10-$50/month), with limited upside barring new patent protections or novel formulations.

- Market competition, healthcare policies, and alternative therapies substantially influence price trajectory and revenue potential.

- Strategic lifecycle management remains essential for branded drug owners, including exploring new indications or combination therapies.

- Stakeholders should focus on cost-effective formularies and leverage generic availability to optimize patient access and economic efficiency.

FAQs

Q1: How has the expiration of CRESTOR's patents affected its market pricing?

Patent expirations in 2016 facilitated rapid generic entry, resulting in over 80% price reductions in key markets like the U.S., drastically reducing branded sales and shifting market share toward generics.

Q2: What are the main factors driving future price declines for CRESTOR?

Increasing generic competition, healthcare systems' emphasis on low-cost generics, and the availability of alternative therapies such as PCSK9 inhibitors will exert continued downward pressure.

Q3: Can CRESTOR command higher prices in any market segment?

Yes, in niche segments where brand loyalty, formulary restrictions, or specific medical indications permit, branded CRESTOR may retain a premium, albeit limited.

Q4: How do emerging lipid-lowering therapies influence CRESTOR's market and prices?

Innovative therapies like PCSK9 inhibitors, which are more effective but costly, potentially reduce demand for statins in certain populations, impacting volume and pricing strategies for CRESTOR.

Q5: Is there potential for reformulation or new indications to sustain CRESTOR’s value?

While reformulations or expanded indications may marginally extend lifecycle value, patent protections would be necessary to shield pricing and market exclusivity; such strategies are under evaluation.

Sources

[1] AstraZeneca PLC. ("CRESTOR (rosuvastatin calcium) Prescribing Information", 2022).

[2] IQVIA. ("The Impact of Patent Expirations on Statin Market Dynamics", 2021).

[3] Pharmacy Times. ("Generic rosuvastatin price declines post-approval", 2022).

[4] Wolters Kluwer. ("Drug Price Trends Post-Patent Expiry", 2021).

[5] OECD Health Data. ("Pricing and Reimbursement Policies for Statins", 2022).

More… ↓