Last updated: July 28, 2025

Introduction

COZAAR (losartan potassium) is a widely prescribed angiotensin II receptor blocker (ARB) used primarily for managing hypertension and reducing the risk of stroke in patients with hypertension and left ventricular hypertrophy. Since its FDA approval in 1995, COZAAR has established itself as a key player within the cardiovascular therapeutic landscape. This analysis examines the current market environment, competitive landscape, pricing dynamics, and future price projections for COZAAR.

Market Overview

Global Market Size and Growth Trajectory

The global antihypertensive drug market is valued at approximately USD 23 billion in 2022, with ARBs representing a significant segment due to their efficacy and safety profile (1). Within this, losartan holds a substantial market share, often viewed as a preferred first-line agent for hypertension management.

The growth of the ARB segment is driven by increasing hypertension prevalence, especially in aging populations, along with the long-established safety profile of agents like COZAAR. Market analysts project a compound annual growth rate (CAGR) of around 3-4% through 2030, sustained by ongoing cardiovascular disease awareness and guideline endorsements (2).

Key Market Drivers

- Epidemiology: Hypertension affects over 1.3 billion adults worldwide, with projections indicating continued rise due to lifestyle and demographic shifts (3).

- Clinical Guidelines: Recommendations favor ARBs as initial therapy for specific patient populations, reinforcing demand.

- Patent Expiry & Generics: The expiration of COZAAR’s primary patent in 2010 led to the proliferation of generic losartan, significantly impacting pricing and market share dynamics.

Competitive Landscape

Brand vs. Generic Market Share

Post-patent expiry, generics dominate COZAAR sales due to substantially lower prices. Major pharmaceutical companies such as Mylan, Teva, and Sandoz offer generic losartan, which accounts for over 60% of the antihypertensive ARB market share in many regions (4).

Other ARBs

While COZAAR remains a cornerstone, competitors such as valsartan, irbesartan, and candesartan offer similar therapeutic benefits, often with slight variations in efficacy, dosing, and side effect profiles. Recently, the advent of combination therapies and novel agents continues to influence the market dynamics.

Market Penetration and Prescribing Trends

COZAAR is prescribed globally, with higher penetration in developed markets like North America and Europe. However, in low- and middle-income countries, cost-effective generics have driven prescription volumes up, overshadowing branded formulations.

Pricing Dynamics

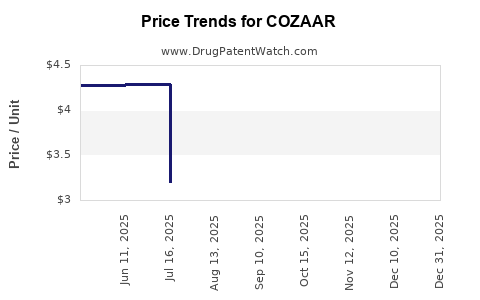

Historical Pricing Trends

Following patent expiry, COZAAR's price declined sharply. According to IQVIA data, the average wholesale price (AWP) for brand-name COZAAR was approximately USD 3.50 per 50mg tablet in 2010. By 2022, generic losartan's price dropped to approximately USD 0.20–0.25 per tablet, reflecting a 90% reduction (5).

Current Pricing Landscape

- Brand-name COZAAR: USD 3.00–3.50 per 50mg tablet (retail pharmacies), though its sales are largely limited to specific markets or rare cases needing branded formulations.

- Generics: USD 0.20–0.25 per 50mg tablet, making it highly accessible globally.

Factors Affecting Pricing

- Regulatory and Reimbursement Policies: Pricing varies significantly based on healthcare policies. Countries with centralized procurement tend to have lower prices.

- Market Competition: The proliferation of generics intensifies price competition, further reducing costs.

- Supply Chain Dynamics: Manufacturing costs, demand fluctuations, and patent litigation influence pricing stability.

Future Price Projections

Impact of Patent Landscape and Regulatory Trends

While COZAAR’s patent expired over a decade ago, the potential for new formulations, combination therapies, or extended-release versions could temporarily influence pricing but are unlikely to disrupt generics’ dominance.

Emerging Market Trends

- Increased Generic Penetration: As more generic manufacturers enter the market, prices are expected to remain stable or decline marginally.

- Market Consolidation: Larger pharmaceutical firms may negotiate discounts with suppliers, maintaining low generic prices.

- Pricing in Developing Markets: Cost considerations will continue to drive low pricing, potentially stabilizing around USD 0.15–0.20 per tablet.

Potential Price Fluctuations

A modest increase in prices may occur if new patent filings or formulations emerge; however, circumstances are unlikely to significantly alter the prevailing prices, given generic competition and cost pressures.

Regulatory and Economic Factors Influencing Future Prices

- Regulatory Approvals: New formulations or biosimilar entrants could temporarily shift pricing dynamics.

- Reimbursement Policies: Governments’ willingness to reimburse branded versus generic losartan heavily influences retail prices.

- Healthcare Budget Constraints: Increased focus on cost-effectiveness will favor low-cost generics.

Market Projections Summary

| Period |

Expected Price Range (USD per tablet) |

Key Drivers |

| 2023–2025 |

USD 0.20–0.25 |

Dominance of generics, competitive pricing |

| 2026–2030 |

USD 0.20–0.30 |

Patent and formulation innovations unlikely to impact overall prices significantly |

| Post-2030 |

Stable at USD 0.15–0.25, barring market disruptions |

Continued generic proliferation, market saturation |

Key Market Opportunities and Challenges

Opportunities

- Expanding into emerging markets with cost-sensitive healthcare systems.

- Development of fixed-dose combinations to enhance adherence.

- Biosimilar development following the expiration of certain formulations.

Challenges

- Market saturation driven by low-cost generics.

- Pricing pressure from regulatory agencies and payers.

- Competitive innovation from newer agents or combination therapies.

Key Takeaways

- Price decline post-patent expiration has stabilized, with generics dominating the market and sustaining low price points.

- Market growth is driven by hypertension prevalence, but pricing remains constrained by intense competition.

- Strategic expansion into emerging markets offers growth potential, albeit at low price margins.

- Potential innovations or formulations are unlikely to significantly alter the existing price landscape in the near term.

- Regulatory environments and reimbursement policies will continue to play critical roles in shaping future prices.

FAQs

1. Will the price of COZAAR increase in the future?

Unlikely, barring new patent filings or formulations. Current market trends favor sustained low generic prices driven by competition and production efficiencies.

2. How does generic competition impact COZAAR’s pricing?

Generic competition has reduced the retail price by over 90% since patent expiry, maintaining affordable prices and limiting the potential for substantial increases.

3. Are there any upcoming formulations that could influence COZAAR prices?

No significant new formulations or biosimilars are currently anticipated to impact the existing price landscape significantly.

4. How does regional variation affect COZAAR pricing?

Pricing varies substantially based on healthcare policies, reimbursement systems, and procurement mechanisms. Developing countries tend to have lower prices due to cost-sensitive policies.

5. What is the outlook for COZAAR in emerging markets?

Market penetration is expected to increase, driven by affordability and expanding healthcare infrastructure, although prices will remain low owing to high generic competition.

References

[1] GlobalData. (2022). Hypertension Drugs Market Analysis.

[2] MarketResearch.com. (2023). Cardiovascular Therapeutics Market Forecast.

[3] World Health Organization. (2022). Hypertension Fact Sheet.

[4] IQVIA. (2022). Oncology and Cardiovascular Drugs Market Trends.

[5] FDA Database. (2010). Patent and Market Data for Losartan.