Last updated: July 29, 2025

Introduction

CONSTULOSE is a pharmaceutical agent primarily used as a bulk-forming laxative. Its active ingredient, plant-based, offers a favorable safety profile for managing chronic constipation and other gastrointestinal conditions. As the demand for over-the-counter (OTC) laxatives continues evolving in global healthcare markets, understanding its market dynamics and price trajectory becomes crucial for stakeholders. This report provides an in-depth market analysis of CONSTULOSE, examining current market trends, competitive landscape, regulatory considerations, and future price projections.

Market Overview

Product Profile and Therapeutic Use

CONSTULOSE, derived primarily from cellulose, is a non-absorbable fiber that softens stool and promotes regular bowel movements. Its popularity stems from its minimal systemic absorption and favorable safety profile, making it suitable for various populations, including the elderly and those with chronic constipation.

The global demand for laxatives, including CONSTULOSE, is driven by increasing awareness of gastrointestinal health, aging populations, and lifestyle-related digestive issues. According to Grand View Research, the global laxatives market was valued at approximately USD 3.5 billion in 2021, expected to grow at a CAGR of ~3.7% through 2028 [1].

Market Drivers

-

Demographic Shifts: Aging populations in North America, Europe, and parts of Asia elevate demand for safe, long-term constipation management solutions.

-

Lifestyle Factors: Sedentary lifestyles, poor diet, and increased prevalence of gastrointestinal disorders contribute to rising OTC laxative sales.

-

Regulatory Approvals and Product Availability: Stringent regulatory environments influence product formulations and marketing, favoring established, safe agents like CONSTULOSE.

Competitive Landscape

CONSTULOSE competes primarily in the OTC space, against both bulk-forming agents (psyllium, methylcellulose) and stimulant laxatives (bisacodyl, senna). Its unique positioning as a plant-derived, non-absorbable fiber offers advantages over synthetic alternatives, especially regarding safety and tolerability.

Key competitors include:

- Psyllium (Metamucil): The leading brand, with broad market penetration.

- Methylcellulose (Citrucel): Popular in prescription and OTC markets.

- Commercial formulations of CONSTULOSE itself: Varying regional formulations from companies such as Johnson & Johnson, Bayer, and various generics.

Market share is fragmented, with dominant players maintaining preference through brand recognition, formulation convenience, and pricing strategies. Recent trends suggest an increasing shift towards natural and gluten-free remedies, favoring plant-based agents like CONSTULOSE.

Regulatory Environment

Global Regulatory Status

CONSTULOSE, classified as a dietary fiber and OTC laxative in many jurisdictions, benefits from a relatively lenient regulatory pathway, primarily requiring Generally Recognized As Safe (GRAS) status in the United States and corresponding approvals elsewhere.

Notably:

- In the US, the FDA considers bulk-forming laxatives like CONSTULOSE as dietary supplements or OTC drugs, depending on claims.

- In Europe, it aligns with regulations under the Novel Food Regulation if sourced as a novel ingredient.

Regulatory stability supports market expansion, particularly in emerging markets lacking stringent pharmaceutical registration pathways.

Pricing Dynamics

Current Pricing Landscape

The pricing for CONSTULOSE-based products varies significantly based on formulation, brand recognition, and geographic location. Average retail prices for bulk-forming fiber laxatives in major markets are:

- United States: USD 10–20 for a 300g to 450g container.

- Europe: EUR 8–15 for similar product sizes.

- Emerging Markets: USD 5–12, with higher variability.

Generic formulations tend to be priced lower than branded equivalents, creating competitive pressure but maintaining healthy margins for manufacturers.

Pricing Factors and Trends

- Raw Material Costs: Plant-derived cellulose prices fluctuate with agricultural commodity markets, influencing final product pricing.

- Manufacturing and Distribution: Packaging innovations and supply chain efficiencies reduce costs.

- Regulatory and Quality Standards: Increased compliance costs may marginally inflate prices.

- Market Penetration Strategies: Discounting in emerging markets and bundling with complementary products influence retail prices.

In the context of the growing OTC market, price elasticity remains moderate; consumers are willing to pay premium prices for natural, safe options, though generics drive volume-based competition.

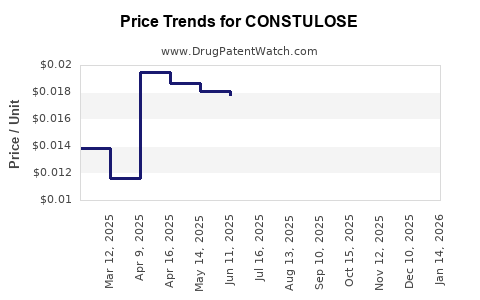

Price Projections (2023–2030)

Considering current market dynamics, regulatory stability, and consumer trends, the following price projections emerge for CONSTULOSE products:

-

Short-Term (2023–2025): Slight decrease or stabilization in average retail prices (~0–3%), driven by intensified generic competition and efficiency gains in manufacturing. Premium natural formulations may command modest premiums (~5–8%).

-

Mid-Term (2025–2027): Introduction of innovative delivery formats, such as sachets or ready-to-drink solutions, could facilitate modest price increases (~2–5%) due to added convenience and differentiation.

-

Long-Term (2027–2030): Pricing is anticipated to stabilize or slightly decline as market saturation occurs, with a potential slight uptick (~3–6%) in premium segments focusing on organic or gluten-free labels.

Underlying this projection, the market's growth in regions like Asia-Pacific and Latin America will be characterized by affordable pricing strategies to capture emerging middle-class consumers. Conversely, developed markets will see incremental premiumization aligned with innovation and natural product positioning.

Market Expansion Opportunities

Emerging markets represent a significant avenue for expansion, driven by increasing healthcare awareness and infrastructure development. The rising adoption of natural, plant-based products presents further opportunities for CONSTULOSE.

Additionally, product line extensions—combining CONSTULOSE with probiotic formulations or flavor enhancements—could open new pricing tiers and expand consumer base.

Challenges and Risks

- Regulatory Changes: Stricter classification or new regulations could hinder market access or elevate compliance costs.

- Consumer Preferences: Shifts toward alternative therapies or dietary interventions could impact demand.

- Pricing Pressure: Intense competition from generic and private-label products may suppress pricing and margins.

Key Takeaways

- Growing Global Demand: An aging population and lifestyle-related gastrointestinal issues underpin demand for CONSTULOSE.

- Competitive Pricing: Generics and regional manufacturers exert considerable pressure, maintaining affordability.

- Innovation and Positioning: Premium formulations and natural branding can support slight price premiums.

- Regionally Divergent Trends: Developed markets will sustain moderate price stability, while emerging markets present opportunities for affordable expansion.

- Regulatory Stability: Favorable regulatory conditions bolster market growth prospects.

FAQs

1. What is the current market size for CONSTULOSE globally?

While specific sales data for CONSTULOSE alone are limited, the overall laxatives market exceeds USD 3.5 billion globally, with bulk-forming agents like CONSTULOSE occupying a substantial share, especially in OTC segments.

2. How does CONSTULOSE compare in price to other bulk-forming laxatives?

CONSTULOSE generally aligns with or slightly underweights brands like Metamucil or Citrucel, pricing between USD 10–20 for standard packages, depending on region and formulation.

3. What factors influence the future price of CONSTULOSE products?

Raw material costs, manufacturing efficiency, regulatory compliance, competitive dynamics, and consumer preferences primarily influence pricing trajectories.

4. Are there regional differences in CONSTULOSE market prospects?

Yes. Developed regions like North America and Europe focus on premium, natural formulations with stable prices, while emerging markets offer volume-driven growth with lower price points.

5. What are the key growth strategies for manufacturers of CONSTULOSE?

Innovating with delivery formats, packaging, formulations targeting niche demographics (e.g., organic, gluten-free), and expanding into emerging markets are effective strategies.

References

[1] Grand View Research. “Laxatives Market Size, Share & Trends Analysis Report,” 2022.