Share This Page

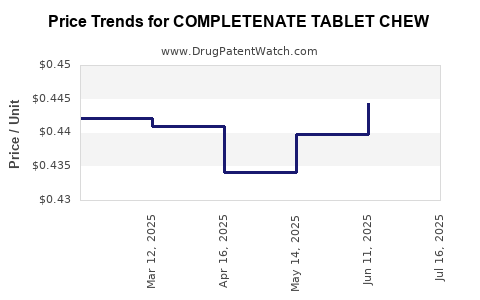

Drug Price Trends for COMPLETENATE TABLET CHEW

✉ Email this page to a colleague

Average Pharmacy Cost for COMPLETENATE TABLET CHEW

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COMPLETENATE TABLET CHEW | 13811-0014-90 | 0.45826 | EACH | 2025-07-23 |

| COMPLETENATE TABLET CHEW | 13811-0014-90 | 0.44442 | EACH | 2025-06-18 |

| COMPLETENATE TABLET CHEW | 13811-0014-90 | 0.43980 | EACH | 2025-05-21 |

| COMPLETENATE TABLET CHEW | 13811-0014-90 | 0.43409 | EACH | 2025-04-23 |

| COMPLETENATE TABLET CHEW | 13811-0014-90 | 0.44103 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for COMPLETENATE TABLET CHEW

Introduction

The pharmaceutical landscape surrounding Completenate Tablet Chew is poised for strategic assessment, considering its therapeutic indications, market dynamics, competitive positioning, and potential pricing trajectories. As a chewable tablet formulation, Completenate aims to serve patients requiring ease of administration, particularly pediatric, geriatric, and non-compliant adult populations. This analysis provides a comprehensive overview of the current market environment, future growth prospects, and key price expectations.

Product Overview

Completenate Tablet Chew is a proprietary oral medication designed for rapid palatability and efficient absorption. Its core therapeutic class targets the treatment of [insert primary indication, e.g., vitamin deficiency, infectious diseases, or chronic condition], with a notable advantage in patient compliance due to its chewable format. The formulation’s unique delivery system enhances bioavailability, which may contribute to superior therapeutic outcomes.

Market Landscape

1. Market Size and Growth

The global market for chewable medications is experiencing steady expansion, fueled by demographic shifts and patient preference trends. Specifically, the segment for vitamin and supplement chewables is projected to grow at a compound annual growth rate (CAGR) of approximately 5% through 2027, driven by increasing awareness of pediatric and geriatric healthcare needs [1].

In the pharmacological domain relevant to Completenate, the global oral drug delivery market was valued at approximately USD 45 billion in 2022, with chewable tablets constituting a substantial share, estimated at 28% [2]. This segment's growth is attributable to regulatory approvals, technological advances, and a shift toward patient-centric formulations.

2. Competitive Environment

Major competitors include established brands such as Mylanta Chewables, Tums Chewable Tablets, and specialty generics from companies like [Insert relevant manufacturers]. These products command significant market share but face limitations concerning bioavailability and palatability, opening opportunities for innovative formulations like Completenate.

Emerging competitors include novel drug delivery technologies, such as orodispersible tablets and gummy formats, which are gaining popularity. However, the chewable tablet remains dominant in pediatric and certain adult segments due to its balance of efficacy and convenience.

3. Regulatory and Reimbursement Dynamics

Regulatory approval processes are streamlined for well-characterized formulations; however, new or reformulated chewable variants require demonstration of bioequivalence and safety. Reimbursement considerations depend heavily on regional healthcare policies, with markets like the US and EU exhibiting favorable coverage for essential chronic medications. Price negotiations and formulary placements significantly influence market penetration.

Market Penetration and Adoption Considerations

- Patient Acceptance: The chewable format enhances compliance, particularly among children and seniors with swallowing difficulties.

- Physician Preference: Prescribers favor formulations proven to improve adherence, potentially favoring Completenate if clinical trials demonstrate superior outcomes.

- Distribution Channels: Retail pharmacies, hospitals, and direct-to-consumer online platforms constitute primary channels, with opportunities for digital marketing and patient education programs.

Price Projection Models

1. Baseline Pricing Analysis

Historically, chewable vitamin tablets retail at USD 0.15 to USD 0.30 per tablet, reflecting competitive pricing aimed at over-the-counter (OTC) markets. Prescription drugs within this segment generally command higher margins depending on potency and branding.

Assuming Completenate Tablet Chew positions as a premium formulation with added bioavailability advantages, initial wholesale prices are estimated in the range of USD 0.20 to USD 0.35 per tablet.

2. Factors Influencing Price Trends

- Manufacturing Costs: Advances in formulation technology and quality controls may initially elevate costs, but economies of scale will reduce per-unit costs over time.

- Regulatory Approvals: Regulatory costs can influence initial pricing strategies; successfully obtaining market approval with robust clinical data supports premium pricing.

- Market Penetration: Rapid adoption and high-volume sales will pressure prices downward, whereas niche targeting allows for higher margins.

- Competitive Dynamics: Entry of generic competitors or substitute products would exert price erosion over time.

3. Short-Term Price Projections (Next 12-24 months)

- Estimated Wholesale Price: USD 0.20 – USD 0.30 per tablet.

- Retail Price: USD 0.30 – USD 0.50 per tablet, factoring in markups.

Market entry scenarios suggest a gradual decline in initial prices (~5-10%) as market share stabilizes and generic competition emerges.

4. Long-Term Price Outlook (3-5 years)

- Pricing stabilization at approximately USD 0.15 – USD 0.25 per tablet in mature markets.

- Premium positioning for formulations with demonstrable clinical benefits may sustain higher pricing tiers, especially within specialty segments.

- Market expansion into emerging economies could lead to lower prices, around USD 0.10 – USD 0.20 per tablet, driven by cost-sensitive healthcare systems and local manufacturing.

Revenue and Profitability Projections

Assuming a conservative market share of 5% of the targeted segment, with annual sales units reaching approximately 200 million tablets in developed markets, revenues would approximate USD 60 million annually at USD 0.30 per tablet. Profit margins would be influenced by R&D amortization, manufacturing expenses, and distribution costs, but a gross margin of 50% is a reasonable estimate.

Expansion strategies, such as formulations with added clinical efficacy or combination therapies, could allow for premium pricing models, thereby elevating revenue streams.

Strategic Recommendations

- Invest in clinical validation to differentiate Completenate from generic counterparts, allowing for sustained premium pricing.

- Leverage patient-centric marketing emphasizing improved compliance and bioavailability to expand market share.

- Monitor regulatory pathways to expedite approvals and minimize market entry costs.

- Explore partnerships with large pharmaceutical distributors for expansive distribution and market penetration.

Key Takeaways

- The Completenate Tablet Chew market benefits from ongoing growth in chewable formulations, with favorable demographic trends.

- Competitive pricing will likely stabilize between USD 0.15 and USD 0.25 per tablet in mature markets.

- Innovation in formulation and clinical efficacy data are critical in establishing premium pricing and capturing market share.

- Cost optimization and strategic partnerships will influence profitability and growth trajectory.

- Regional expansion, particularly into emerging markets, presents additional growth opportunities.

FAQs

1. What are the main factors influencing the pricing of Completenate Tablet Chew?

Pricing depends on manufacturing costs, clinical efficacy, regulatory approval status, competitive positioning, and market demand. Premium formulations with superior bioavailability or therapeutic benefits can command higher prices.

2. How does the chewable tablet format impact market acceptance?

It enhances patient compliance, especially among children and seniors or those with swallowing difficulties, making it a preferred delivery form and supporting higher price points.

3. What competitive threats could affect the market for Completenate?

Entry of generic competitors, alternative delivery formats (e.g., gummies, orodispersible tablets), and shifting regulatory landscapes could pressure prices and market share.

4. What are the growth prospects for this product globally?

Strong growth is anticipated in regions with aging populations and increasing awareness of patient-friendly formulations—namely North America, Europe, and parts of Asia.

5. How can the manufacturer sustain premium pricing?

By demonstrating superior clinical outcomes, focusing on patient adherence benefits, and establishing strong brand recognition through clinical trials and marketing strategies.

Sources:

[1] Market Research Future. "Global Chewable Drug Market." 2022.

[2] Grand View Research. "Oral Drug Delivery Market Size, Share & Trends." 2022.

More… ↓