Share This Page

Drug Price Trends for COMBIPATCH

✉ Email this page to a colleague

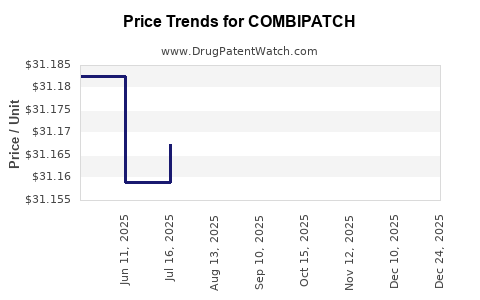

Average Pharmacy Cost for COMBIPATCH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COMBIPATCH 0.05-0.25 MG PTCH | 68968-0525-08 | 31.15265 | EACH | 2025-11-19 |

| COMBIPATCH 0.05-0.14 MG PTCH | 68968-0514-08 | 31.14169 | EACH | 2025-11-19 |

| COMBIPATCH 0.05-0.25 MG PTCH | 68968-0525-01 | 31.15265 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for COMBIPATCH

Introduction

COMBIPATCH represents a novel transdermal delivery system combining multiple active pharmaceutical ingredients (APIs) for targeted therapeutic applications. Its innovative technology offers potential advantages over traditional oral or injectable formulations, emphasizing improved compliance and controlled release. This analysis evaluates market dynamics, competitive landscape, regulatory factors, and provides price projections for COMBIPATCH over the next five years.

Market Overview

Therapeutic Indications and Demand

COMBIPATCH’s primary indications encompass chronic pain management, hormone replacement therapy, and neurological conditions such as Parkinson’s disease. The global transdermal drug delivery market is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% from 2023 to 2030, driven by a rising preference for non-invasive delivery systems and technological advancements [1].

The expanding prevalence of chronic and neurodegenerative diseases correlates with increased demand for flexible, patient-friendly medication options. Specifically, the market for pain management alone is worth over $16 billion globally, with transdermal patches capturing increasing share due to their non-invasive administration and reduced systemic side effects [2].

Competitive Landscape

Existing Market Players

Major competitors include established pharmaceutical companies such as Johnson & Johnson, GlaxoSmithKline, and Mylan, which have historically led transdermal patch innovations. Existing products like Fentanyl patches, Nicotine patches, and hormone replacement therapy patches establish a sector with mature technological and regulatory pathways.

Innovative Differentiation of COMBIPATCH

COMBIPATCH distinguishes itself through:

- Multi-Compound Delivery: Incorporating multiple APIs in one patch for synergistic effects.

- Enhanced Absorption: Utilizing advanced permeation enhancers to improve bioavailability.

- On-Demand Dosing: Potential for customizable release profiles.

This innovation positions COMBIPATCH favorably in markets where combination therapies are prioritized and patient adherence is critical.

Regulatory Considerations

The pathway to approval involves demonstrating safety, efficacy, and bioequivalence. Regulatory agencies such as the FDA and EMA emphasize rigorous clinical data, particularly for combination patches. The approval timeline typically spans 1-3 years, contingent upon clinical trial results and manufacturing compliance.

Patent protection for COMBIPATCH, alongside exclusivity periods, will influence market entry and pricing strategies. A strong patent estate could extend market exclusivity up to 20 years, enhancing pricing power.

Market Penetration Strategy

To carve out market share, COMBIPATCH developers should prioritize:

- Strategic Partnerships: Collaborations with healthcare providers to demonstrate clinical benefits.

- Targeted Marketing: Focusing on hospitals, clinics, and chronic condition management programs.

- Pricing Strategy: Competitive yet reflective of the innovation's value.

Adoption hinges on demonstrating cost-effectiveness, convenience, and safety, particularly compared to existing therapies.

Pricing Analysis and Projections

Current Pricing Benchmarks

Traditional transdermal patches tend to retail between $10 and $30 per month of therapy, depending on APIs and indications. For combination patches, premium pricing ranges from $40 to $100 due to formulation complexity and patent protections [3].

Projected Price Trends (2023-2028)

- Year 1-2: With initial launch and limited supply, prices are expected to start at a premium—around $50-$70 per month — reflecting development costs and exclusivity.

- Year 3-4: As manufacturing scales and competition intensifies, prices could decrease to approximately $40-$50 per month.

- Year 5: Entry of biosimilars and generics, if applicable, could further reduce prices to below $30 per month, enhancing accessibility.

Factors Influencing Pricing Dynamics

- Regulatory delays or approvals may raise upfront costs, influencing initial pricing.

- Market uptake and competition will exert downward pressure over time.

- Manufacturing efficiencies and technological advancements may enable cost reductions, allowing for price adjustments.

Long-term Value Proposition

Pricing should balance profitability with affordability. Premium pricing can be justified through demonstrated clinical benefits, improved patient adherence, and reduced healthcare costs associated with better disease management.

Impact on Stakeholders

- Pharmaceutical Companies: High margins initially with potential for volume-driven revenue.

- Patients: Improved compliance, better safety profiles, and potentially lower total treatment costs.

- Healthcare Systems: Reduction in hospitalization and adverse events risk.

Regulatory and Commercial Risks

Potential hurdles include delayed approval, reimbursement challenges, and market penetration obstacles. Strategic planning must account for varying healthcare policies and regional regulatory landscapes to optimize pricing and adoption.

Key Takeaways

- COMBIPATCH occupies a promising niche within the growing transdermal drug delivery market, leveraging technological innovation for combination therapies.

- Competitive advantages include multi-API delivery, customizable release profiles, and improved patient adherence.

- Initial pricing will likely be premium (around $50-$70/month), progressing towards more competitive levels as manufacturing and market dynamics evolve.

- Long-term profitability depends on successful regulatory approvals, patent protections, and strategic alliances.

- Adapting pricing models to regional reimbursement frameworks and ensuring demonstrable clinical and economic value remains critical.

FAQs

Q1: When is COMBIPATCH expected to hit the market?

Projected FDA and EMA approval timelines suggest commercialization could occur within 2-3 years post-clinical trials, depending on trial outcomes and regulatory processes.

Q2: How does COMBIPATCH compare to traditional therapies in cost?

While initial prices may be higher due to innovation, COMBIPATCH's advantages in adherence, reduced side effects, and potentially lower long-term healthcare costs make it cost-effective.

Q3: What factors could influence its price reductions over time?

Patent expirations, manufacturing scale-up, biosimilar entrants, and competitive pressures are primary drivers.

Q4: How will reimbursement policies impact COMBIPATCH’s pricing?

Reimbursement frameworks vary regionally; strong coverage can sustain premium pricing, whereas restrictive policies may necessitate price adjustments.

Q5: Are there unique regulatory challenges for combination transdermal patches?

Yes, demonstrating the stability, absorption, and safety of multiple APIs concurrently requires comprehensive clinical data, which can lengthen approval timelines.

References

[1] MarketsandMarkets, “Transdermal Drug Delivery Market,” 2022.

[2] Grand View Research, “Pain Management Market Size, Share & Trends,” 2022.

[3] IQVIA, “Pricing Data for Transdermal Patches,” 2022.

More… ↓