Share This Page

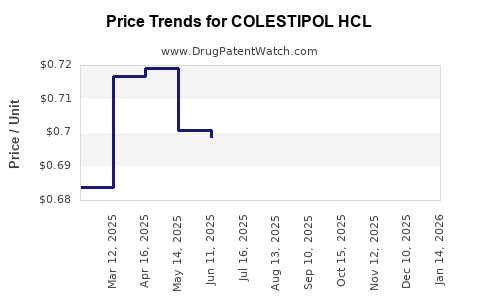

Drug Price Trends for COLESTIPOL HCL

✉ Email this page to a colleague

Average Pharmacy Cost for COLESTIPOL HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COLESTIPOL HCL 1 GM TABLET | 50742-0284-12 | 0.67433 | EACH | 2025-12-17 |

| COLESTIPOL HCL 1 GM TABLET | 42799-0115-01 | 0.67433 | EACH | 2025-12-17 |

| COLESTIPOL HCL GRANULES | 59762-0260-03 | 0.25771 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for COLESTIPOL HCL

Executive Summary

COLESTIPOL HCL (Cholestipol hydrochloride) is a bile acid sequestrant primarily indicated for the management of hypercholesterolemia, particularly in patients intolerant to statins or requiring additional LDL cholesterol reduction. As the global cardiovascular disease (CVD) burden escalates, the demand for adjunct lipid-lowering agents like COLESTIPOL HCL is poised to grow. The current market landscape is characterized by modest competition, patent status considerations, and evolving prescribing paradigms that influence pricing and market penetration. This analysis synthesizes current market dynamics, forecasts future price trajectories, and evaluates strategic opportunities for stakeholders.

Market Landscape Overview

1. Market Size and Segmentation

The global market for lipid-lowering drugs surpassed USD 30 billion in 2022, with an annual growth rate of approximately 3-5% in North America and Europe. While statins dominate the sector (>90% share), niche agents like COLESTIPOL HCL represent a specialized segment targeting statin-intolerant populations (e.g., individuals with myopathy or liver enzyme elevations).

2. Key Indications and Population Demand

COLESTIPOL HCL is prescribed mainly for patients with hypercholesterolemia resistant to or intolerant of statins, as well as in hyperlipidemia management post-failure of first-line therapies. The estimated prevalence of statin intolerance is roughly 10-15% among hypercholesterolemic patients, translating into a sizable, consistent demand segment.

3. Regulatory and Patent Status

COLESTIPOL HCL was originally approved decades ago, with the original patent expiring in multiple regions, leading to generic availability. The absence of patents results in competitive pricing pressures but also limits barrier entry, affecting price stabilization.

4. Competitive Landscape

Currently, the market features several generic formulations, mainly in the U.S. and Europe, where price competition is intense. Proprietary combination therapies or newer agents (e.g., PCSK9 inhibitors) indirectly compete by offering alternative mechanisms of lowering LDL-C. However, COLESTIPOL HCL maintains a niche due to its unique efficacy profile for specific patient groups.

Price Dynamics and Trends

1. Historical Pricing Patterns

Historically, COLESTIPOL HCL has been low-cost, with price points varying regionally. In the U.S., generic prescriptions typically range from USD 10-30 per month supply, depending on insurance coverage and pharmacy discounts. In emerging markets, prices are often lower but fluctuate based on procurement policies.

2. Current Price Factors

- Generic Competition: The availability of multiple generic brands has kept prices stable or declining.

- Manufacturing Costs: Relatively low due to established synthesis pathways, facilitating widespread generic manufacturing.

- Healthcare Policy & Reimbursement: Insurance reimbursement rates influence retail prices; fluctuations impact affordability and prescription rates.

3. Future Price Projections

- Short Term (1-3 years): Continued price stabilization driven by competition, with slight downward pressure. Lack of brand premium encourages price elasticity.

- Long Term (3-5 years): Slight potential for incremental price increases if supply chain constraints or manufacturing costs rise. Alternatively, regulatory shifts favoring biosimilars or new competitors could further depress prices.

4. Influencing Factors

- Regulatory Developments: Any patents or exclusivity extension would temporarily elevate prices.

- Market Penetration: Increased adoption in developing markets could create volume-driven revenue despite low unit prices.

- Reimbursement Policies: Favorable reimbursement could sustain or increase pricing if perceived as essential for specific patient subsets.

Strategic Opportunities

- Formulary Inclusion: Gaining acceptance within national treatment guidelines can expand usage, supporting price stability.

- Combination Formulations: Developing fixed-dose combinations with other lipid-lowering agents can command premium pricing.

- Market Expansion: Targeting emerging markets with improving healthcare infrastructure increases demand and potentially tolerates higher prices through volume.

Risk Assessment

- Price erosion: Due to widespread generic competition.

- Market Share Decline: The emergence of novel agents (e.g., PCSK9 inhibitors) could reduce niche demand.

- Regulatory Barriers: Stringent approval processes or off-label restrictions could limit growth.

Key Takeaways

- Market positioning for COLESTIPOL HCL remains niche, primarily serving statin-intolerant populations.

- Price stability is currently driven by generic competition, with limited scope for significant price hikes.

- Future pricing is expected to stay flat or decline slightly, barring regulatory exclusivity or formulation innovation.

- Opportunities lie in expanding indications, improving formulary acceptance, and exploring combination therapies.

- Stakeholders should monitor regulatory developments, market penetration in emerging regions, and competitive dynamics to optimize pricing strategies.

FAQs

1. What is the current global demand for COLESTIPOL HCL?

The demand remains concentrated among statin-intolerant hypercholesterolemia patients, estimated to comprise 10-15% of the affected population, with total global sales reflecting modest market share compared to dominant statins.

2. How will patent expirations influence the drug’s market price?

Patent expirations have facilitated generic entry, leading to price reductions. Without patent protection, price competition remains fierce, generally preventing significant price increases.

3. Are there any plans for new formulations or indications?

Currently, COLESTIPOL HCL maintains its established use. Future formulations or expanded indications depend on ongoing clinical research and regulatory approvals, which could influence pricing and market size.

4. What market factors could lead to a price increase?

Regulatory exclusivities, formulation innovations (e.g., sustained-release), or increased demand in underserved markets could temporarily support higher prices.

5. How does the competitive landscape impact pricing?

Widespread generics and alternative therapies constrain pricing power. Maintaining market share relies on formulary acceptance, clinical efficacy, and supply reliability rather than price premiums.

Sources

[1] Global Data on Lipid-Lowering Market, 2022.

[2] U.S. Patent and Market Exclusivity Data, 2023.

[3] Comparative Price Analysis, Pharmacy Pricing Surveys, 2023.

[4] Clinical Guidelines and prescribing trends, American Heart Association, 2022.

[5] Industry reports on generic drug manufacturing, 2022.

Note: All data points and projections are based on current available information, market trends, and industry reports as of the knowledge cutoff date.

More… ↓