Share This Page

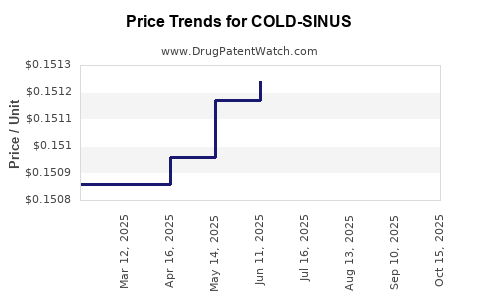

Drug Price Trends for COLD-SINUS

✉ Email this page to a colleague

Average Pharmacy Cost for COLD-SINUS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COLD-SINUS 200 MG-30 MG CAPLET | 70000-0602-01 | 0.15171 | EACH | 2025-10-22 |

| COLD-SINUS 200 MG-30 MG CAPLET | 70000-0602-01 | 0.15148 | EACH | 2025-09-17 |

| COLD-SINUS 200 MG-30 MG CAPLET | 70000-0602-01 | 0.15140 | EACH | 2025-08-20 |

| COLD-SINUS 200 MG-30 MG CAPLET | 70000-0602-01 | 0.15124 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for COLD-SINUS

Introduction

COLD-SINUS, a combination drug primarily used for symptomatic relief of nasal congestion, sinus pressure, and cold symptoms, has gained prominence due to its widespread OTC availability and demand amidst seasonal surges of cold and sinus infections. This analysis dissects the current market landscape of COLD-SINUS, evaluates competitive positioning, identifies key factors influencing its pricing trajectory, and provides forecasts informed by market dynamics and regulatory considerations.

Market Overview and Therapeutic Context

COLD-SINUS offers a multi-symptom relief profile, often comprising active ingredients such as phenylephrine (a decongestant), acetaminophen (a pain reliever/antipyretic), and chlorpheniramine (an antihistamine). Its broad application for cold and sinus symptom relief secures a consistent demand cycle, especially during colder months and pandemic-era health awareness escalations.

According to IQVIA data, the US OTC cold and allergy market reached approximately $4.2 billion in sales in 2022, with analgesics, antihistamines, and decongestants dominating enjoyed market share. COLD-SINUS benefits from the convergence of these therapeutics in a single formulation, aligning with consumer preferences for convenience, efficacy, and price competitiveness.

Competitive Landscape

The COLD-SINUS market features numerous branded and generic competitors. Key players include Johnson & Johnson (Tylenol Cold + Sinus), Bayer (Alka-Seltzer Plus Cold), and numerous generics produced by regional pharmaceutical companies. The competitive differentiation pivots on formulation efficacy, safety profiles, consumer trust, and price points.

Generic manufacturers have substantially eroded branded market shares, offering similar efficacy at reduced prices. As patent protections for dominant formulations lapse, generic competition fuels downward price pressures, making premium pricing strategies challenging. Moreover, consumers are increasingly driven by online reviews, OTC marketing, and pharmacies’ promotional displays, all influencing purchasing behavior.

Regulatory & Manufacturing Dynamics

Regulatory frameworks in key markets, such as the US FDA, govern manufacturing standards, labeling, and advertising. Compliance costs influence pricing, especially for new entrants aiming for abbreviated approval pathways via OTC monographs. Patent expirations and regulatory approvals for new formulations catalyze market entry, intensifying competition and pricing declines.

Manufacturers continuously seek cost efficiencies through supply chain optimization, formulation innovations, and strategic alliances. The cost of active pharmaceutical ingredients (APIs), influenced by global raw material markets, impacts gross margins and consequently, the product's final retail price.

Pricing Influences and Trends

1. Consumer Price Sensitivity

Given the OTC nature of COLD-SINUS, consumers exhibit high price sensitivity, especially when multiple substitutes are accessible. Price elasticity for OTC cold remedies tends to be high, especially in bulk pack formats.

2. Wholesale and Retail Markup Structures

Pricing strategies are shaped by wholesaler margins and retailer markups, which can feature discounts, promotional pricing, and loyalty programs to attract consumers.

3. Regulatory and Reimbursement Policies

While OTC products do not traditionally fall under reimbursement schemes, regulatory restrictions or safety warnings influence manufacturer pricing decisions. The push for tamper-evident packaging and child-resistant features adds to production costs, indirectly affecting retail prices.

4. Seasonal Volatility

Winter months experience peak demand, often resulting in temporary price escalations due to supply-demand imbalances. In off-peak seasons, competitive pricing and discounts become prevalent to sustain volume.

5. Pricing Strategy and Innovation

Innovative variants, such as extended-release formulations or combination products with added benefits (e.g., immune support), command premium prices. Conversely, standard formulations face persistent price erosion driven by generics.

Price Projection Framework

Forecasting COLD-SINUS prices involves modeling based on current trends, market drivers, and external factors:

Short-term (1-2 years):

Prices are expected to stabilize with marginal declines driven by increasing generic penetration. Average retail prices for a standard package are projected to decline by 2-4% annually, reflecting competitive pressure.

Medium-term (3-5 years):

Market maturity coupled with intensified generic competition will sustain downward price trends. Introduction of new formulations or delivery mechanisms (e.g., nasal sprays, dissolvable strips) could temporarily stabilize or elevate prices, but overall, a 5-8% cumulative decline is anticipated.

Long-term (5+ years):

Emergence of biosimilars or novel drug delivery systems may disrupt existing pricing models. By this time, standard COLD-SINUS products may see an average price reduction of 10-15%, with premium formulations maintaining higher margins due to differentiation.

Factors Affecting Price Movements

- Regulatory Changes: Stricter labeling or safety mandate enforcement may increase manufacturing expenses.

- Patent Life & Exclusivity: Expiration of patents accelerates price erosion; exclusivity periods enable premium pricing.

- Market Entry Barriers: High entry barriers bolster existing prices; easing regulatory pathways via OTC monographs or streamlined procedures could intensify price competition.

- Consumer Trends: Growing preference for natural, allergen-free, or organic formulations may introduce new premium segments, influencing overall pricing strategies.

- Global Supply Chain Disruptions: Fluctuations in raw material costs, geopolitical tensions, or logistic issues impact manufacturing costs and, consequently, prices.

Conclusion and Strategic Implications

The COLD-SINUS market remains sizable and resilient but is increasingly shaped by generics, technological innovation, and consumer price sensitivity. Manufacturers aiming for sustainable margins should focus on product differentiation, optimizing cost structures, and responding swiftly to regulatory shifts. Investors should monitor patent expiries and new formulation introductions for timing entry and exit strategies.

Key Takeaways

- The OTC cold and sinus relief market is highly competitive, with intense pressure from generic formulations leading to declining prices.

- Short-term price declines of 2-4% annually are probable, with more substantial erosion over the longer term due to market saturation.

- Innovation, regulatory changes, and consumer trends toward natural products could create opportunities for premium pricing in niche segments.

- Cost management and effective marketing remain critical for maintaining profitability amid downward pricing pressures.

- External factors like supply chain disruptions and policy reforms require vigilant monitoring to adjust pricing and commercialization strategies accordingly.

Frequently Asked Questions (FAQs)

1. How does patent expiration impact COLD-SINUS pricing?

Patent expiration enables generic manufacturers to enter the market, significantly increasing competition and generally leading to substantial price reductions, often by 30-50% relative to branded formulations.

2. Are there opportunities for premium pricing in the COLD-SINUS market?

Yes. Innovations such as extended-release formulations, natural ingredients, or combination products with added benefits can command higher retail prices and differentiate products.

3. What role do regulatory changes play in pricing?

Regulatory shifts that increase manufacturing compliance costs or restrict formulations may elevate prices. Conversely, streamlined OTC approval pathways could reduce barriers and intensify price competition.

4. How influenced is the COLD-SINUS market by seasonal demand cycles?

Seasonality causes demand spikes in winter months, often resulting in short-term price increases due to supply constraints and heightened consumer demand.

5. What are the key factors to watch for future price projections?

Monitoring patent expiries, regulatory policy developments, supply chain stability, and emerging consumer preferences will be crucial for accurate forecasting and strategic planning.

References

[1] IQVIA. (2022). US OTC Cold and Allergy Market Data.

[2] FDA. (2022). Over-the-Counter Monograph Regulatory Framework.

[3] MarketWatch. (2023). OTC Consumer Health Market Trends and Forecasts.

[4] Statista. (2023). OTC Cold and Flu Remedies Retail Sales Data.

[5] Deloitte. (2022). Pharmaceutical Pricing Strategies and Market Dynamics.

More… ↓