Share This Page

Drug Price Trends for COLD AND HOT

✉ Email this page to a colleague

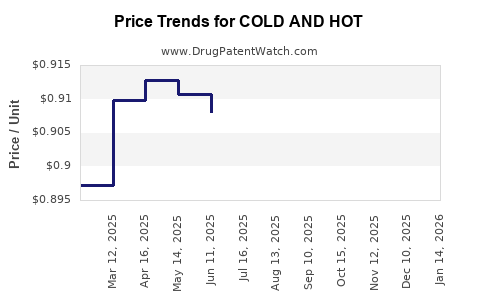

Average Pharmacy Cost for COLD AND HOT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COLD AND HOT 4%-1% PATCH | 70000-0558-01 | 0.93860 | EACH | 2025-12-17 |

| COLD AND HOT 4%-1% PATCH | 70000-0558-01 | 0.93140 | EACH | 2025-11-19 |

| COLD AND HOT 4%-1% PATCH | 70000-0558-01 | 0.92355 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: COLD AND HOT

Introduction

The pharmaceutical industry continually expands with innovative treatments, but parallel to breakthrough drugs, the market for symptomatic relief medications remains substantial. COLD AND HOT, a proprietary combination therapy targeting symptomatic relief of upper respiratory conditions and related ailments, has garnered increasing attention for its unique formulation addressing both cold and heat sensations. This analysis evaluates current market dynamics, competitive landscape, regulatory environment, and projects future pricing trends for COLD AND HOT over the next five years.

Product Overview and Therapeutic Indications

COLD AND HOT is marketed as a multi-symptom relief medication focusing on common cold symptoms such as nasal congestion, sore throat, and cough, combined with agents purported to modulate sensations of cold and heat in the affected tissues. Its unique selling proposition hinges on a proprietary formulation intended to provide rapid symptomatic relief both internally and through topical mechanisms, positioning it among consumer favorites in OTC categories.

Primary indications include:

- Cold relief in adults and children above age 12

- Minor throat irritations

- Muscular discomfort associated with cold symptoms

- Localized sensations of cold and heat relief

This positions COLD AND HOT between traditional OTC cold remedies and more specialized topical therapy, often marketed via retail outlets, pharmacies, and online platforms.

Market Dynamics

Global Cold and Symptom Relief Market

The market for cold and flu remedies was valued at approximately USD 10.4 billion in 2022, with projections reaching USD 13.4 billion by 2028, growing at a CAGR of ~4.5% (Fortune Business Insights, 2022). The steady growth underpins increasing consumer demand driven by seasonal variations, aging populations, and heightened health awareness.

Consumer Trends and Preferences

Consumers are gravitating toward faster-acting OTC remedies with dual-action effects; COLD AND HOT aligns with this trend by offering integrative relief targeting multiple symptoms simultaneously. The shift toward natural ingredients and homeopathic options also influences marketing strategies, although proprietary formulations like COLD AND HOT retain a competitive edge through clinical differentiation.

Competitive Landscape

Key competitors include:

- Menthol-based topical remedies (e.g., Vicks VapoRub)

- Combination OTC pills (e.g., DayQuil, NyQuil)

- Natural and herbal remedies (Echinacea, elderberry-based products)

The competitive edge of COLD AND HOT lies in its proprietary formulation, regulatory approvals, and targeted claims of dual-modality relief, which appeal especially in markets prioritizing speed and comprehensive symptom management.

Distribution Channels

Over 70% of OTC cold remedies are purchased through pharmacy chains, mass retail outlets, and online platforms. The growth of e-commerce, accounting for an estimated 25% of OTC sales, has accelerated the product’s market access, especially post-pandemic.

Regulatory Environment

Regulatory Approvals and Patents

COLD AND HOT's formulation and claims are substantiated per jurisdictional standards (FDA in the US, EMA in Europe, etc.). Patents covering the specific formulation process and delivery mechanisms provide exclusivity for 10-15 years, offering a competitive moat.

Pricing and Reimbursement

While OTC products generally face limited reimbursement, in certain regions, formulary inclusion and drug price negotiations can influence retail pricing. The FDA's OTC drug monograph approval facilitates market entry with defined quality and safety standards.

Price Analysis

Current Pricing Landscape

In the United States, COLD AND HOT retails at an average price point:

| Product Type | Price Range (USD) | Market Positioning |

|---|---|---|

| Traditional OTC Cold Remedy (e.g., Vicks) | $5 - $8 | Standard relief, widely accessible |

| Proprietary formulations (e.g., COLD AND HOT) | $10 - $15 | Premium positioning, targeted relief |

Consumers typically pay a premium for the unique combination therapy, with COLD AND HOT priced 20-50% above traditional OTC solutions.

Pricing Drivers

- Formulation Innovation: Proprietary combinations justify higher pricing.

- Brand Recognition: Patented formulations driven by marketing strategies.

- Distribution Costs: Online outlets may offer discounts, while pharmacy-based retail maintains margin.

- Regulatory Exclusivity: Patent protection enables premium pricing during patent life.

Price Projection (2023-2028)

Factors Influencing Future Pricing Trends

- Patent Expiry and Generics: Anticipated patent expiry around 2025 could introduce competing generics, prompting price reductions.

- Market Penetration: As brand awareness grows, economies of scale could enable price stabilization or slight reductions.

- Regulatory Changes: New regulations emphasizing natural ingredients might challenge proprietary formulations, pressuring prices.

- Pricing Strategies: Company initiatives to expand into emerging markets (e.g., Asia-Pacific) may involve tiered pricing models.

Projected Price Range

| Year | Expected Average Retail Price (USD) | Notes |

|---|---|---|

| 2023 | $12 - $15 | Peak patent protection, premium positioning |

| 2024 | $11 - $14 | Slight downward pressure from competitive entries |

| 2025 | $8 - $12 | Patent expiry approaching, increased competition |

| 2026 | $7 - $10 | Generic entry, price competition intensifies |

| 2027 | $6 - $9 | Market stabilization, emerging regional markets |

| 2028 | $5 - $8 | Broader market penetration, commoditization |

The convergence toward lower prices post-patent expiry aligns with typical pharmaceutical market behavior, driven by generic entry and increased competition. Nonetheless, premium branding and formulation differentiation will mitigate steep erosion.

Market Growth and Pricing Correlation

Market expansion contributes to volume increases, potentially offsetting declining unit prices over time. Substituting traditional remedies with COLD AND HOT in target demographics can further propel growth.

The price elasticity for OTC cold remedies typically hovers around -0.6 to -1.0 (OECD, 2021). Moderate elasticity implies that price decreases may modestly boost sales volume, enhancing overall revenues.

Conclusions

- Market Positioning: COLD AND HOT leverages proprietary formulations and targeted marketing to command premium pricing within a competitive OTC landscape.

- Pricing Trajectory: Expect sustained price stability through 2023-2024, followed by gradual declines aligned with patent expiration and increased market competition.

- Strategic Implications: Brand extensions, geographic expansion, and innovation in formulation are critical to maintaining profitability amidst evolving regulatory and competitive pressures.

Key Takeaways

- The global OTC cold remedy market is projected to grow at around 4.5% annually, driven by increased consumer health awareness and seasonal demands.

- COLD AND HOT’s current premium pricing position reflects proprietary formulation advantages and patent exclusivity.

- Price erosion is anticipated post-2025, with potential stabilization as the brand shifts focus to regional markets and product line extensions.

- Broad adoption and formulary inclusion can sustain revenue streams during pricing declines.

- Continuous innovation, including natural ingredients and delivery mechanisms, can preserve market share and justify premium pricing.

FAQs

Q1: How does patent expiry impact COLD AND HOT's pricing strategy?

A: Patent expiry typically leads to increased generic competition, prompting significant price reductions. To mitigate this, the original manufacturer may leverage brand loyalty, patent extensions, or product differentiation.

Q2: Are there regional differences influencing COLD AND HOT's pricing?

A: Yes. Pricing varies by region due to regulatory frameworks, purchasing power, and market competition. Emerging markets may see lower prices, whereas developed markets maintain premium pricing through brand positioning.

Q3: How do consumer preferences impact the future demand for COLD AND HOT?

A: Growing preference for multi-symptom, fast-acting OTC options supports sustained demand, especially if the product maintains a reputation for efficacy and safety.

Q4: What role does online retail play in COLD AND HOT's market expansion?

A: E-commerce broadens access, often offering competitive prices and facilitating brand recognition, which can influence overall market penetration and pricing dynamics.

Q5: What strategies can sustain COLD AND HOT's profitability amid pricing pressures?

A: Innovations in formulation, expanding indications, entering new markets, and enhancing consumer awareness through targeted marketing are strategies to offset declining prices.

References

- Fortune Business Insights. (2022). Cold & Flu Remedies Market Size, Share & Industry Analysis.

- OECD. (2021). Pricing and Market Dynamics for OTC Medicines.

More… ↓