Share This Page

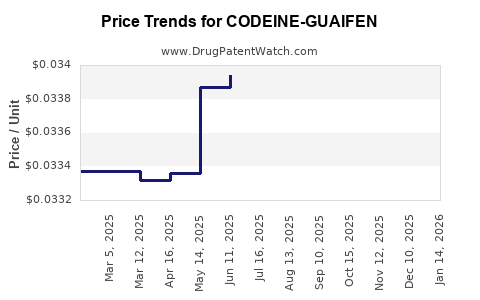

Drug Price Trends for CODEINE-GUAIFEN

✉ Email this page to a colleague

Average Pharmacy Cost for CODEINE-GUAIFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CODEINE-GUAIFEN 10-100 MG/5 ML | 69367-0272-16 | 0.03150 | ML | 2025-12-17 |

| CODEINE-GUAIFEN 10-100 MG/5 ML | 69367-0272-04 | 0.05913 | ML | 2025-12-17 |

| CODEINE-GUAIFEN 10-100 MG/5 ML | 58657-0500-04 | 0.05457 | ML | 2025-12-17 |

| CODEINE-GUAIFEN 10-100 MG/5 ML | 58657-0500-16 | 0.03150 | ML | 2025-12-17 |

| CODEINE-GUAIFEN 10-100 MG/5 ML | 58657-0500-04 | 0.05331 | ML | 2025-11-19 |

| CODEINE-GUAIFEN 10-100 MG/5 ML | 58657-0500-16 | 0.03163 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CODEINE-GUAIFEN

Introduction

Codeine-Guaifenesin, a combination primarily utilized as an analgesic and antitussive, remains a significant fixture in respiratory medicine, with broad applications across outpatient and inpatient settings. This dual-active pharmaceutical ingredient (API) blend combines codeine, an opioid analgesic and cough suppressant, with guaifenesin, an expectorant that facilitates mucus clearance. As regulatory scrutiny intensifies and the landscape of pain management evolves, understanding current market dynamics, pricing trends, and future projections of Codeine-Guaifenesin becomes essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Market Size and Growth Trajectory

The global market for cough and cold medications, including codeine-based formulations, was valued at approximately USD 4.2 billion in 2021, with expectations of a compound annual growth rate (CAGR) of around 3.4% through 2028 [1]. Within this landscape, Codeine-Guaifenesin formulations constitute a significant segment, particularly in North America and parts of Asia, where demand persists due to prevalence of respiratory infections and the longstanding acceptance of codeine-based OTC products.

Regulatory Environment

Notably, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are tightening controls over codeine-containing products, driven by concerns over misuse and addiction. Several jurisdictions now restrict OTC sales, requiring prescriptions, thus impacting market volume and pricing strategies [2].

Regional Market Dynamics

- North America: Dominates the market through mature distribution channels, though restrictions are emerging. Prices tend to be higher due to regulatory costs and quality standards.

- Asia-Pacific: Exhibits rapid growth, driven by expanding healthcare infrastructure, increasing disposable income, and high prevalence of respiratory illnesses. Regulatory frameworks are evolving, with some markets still permitting OTC sales.

- Europe: Faces a transition with some countries restricting OTC sales; pricing remains stable but is under downward pressure due to regulatory encumbrances.

Key Drivers and Challenges

Drivers

- Prevalence of respiratory illnesses: Respiratory infections and chronic cough conditions sustain demand.

- Consumer preference for combination therapies: Patients seek simplified regimens combining analgesic and cough suppressant effects.

- Emerging markets: Growing healthcare access enhances demand in developing regions.

Challenges

- Regulatory restrictions: Limit OTC sales, reducing accessible consumer markets.

- Opioid misuse concerns: Heighten scrutiny and potential manufacturing restrictions.

- Availability of alternatives: Non-opioid cough suppressants and pain relievers may reduce reliance on codeine-based products.

Current Pricing Landscape

Pricing Factors

- Regulatory status: Products requiring prescription typically command higher prices due to convenience and legality.

- Formulation and dosage: Extended-release or combination formulations influence pricing.

- Brand versus generic: Generic formulations dominate due to cost efficiency, with price premiums for branded versions.

Average Pricing Trends

In North America, the retail price for a standard 100-mL bottle of OTC Codeine-Guaifenesin syrup averages between USD 5 and USD 12, depending on brand and formulation [3]. Prescription formulations tend to be priced higher, influenced by healthcare provider markup and dispensing costs.

In emerging markets, prices can be substantially lower—USD 1 to USD 4 per bottle—driven by lower healthcare costs and differing regulation.

Future Price Projections (2023-2030)

Influencing Factors

- Regulatory tightening: Projected to suppress market volume, increasing scarcity value but exerting downward pressure on prices.

- Manufacturing costs: Potential increases due to stricter quality standards and raw material availability.

- Market access expansion: Use of authorized generics and biosimilars in some markets might lead to competitive pricing pressure.

- Prescriptive shifts: Transition from OTC to prescription-only status in various jurisdictions may elevate unit prices but reduce overall volume.

Projection Summary

- North American Market: With prescriptive restrictions intensifying, expect stabilized or slightly declining average retail prices, with a CAGR of approximately -1% to 0% from 2023 to 2030.

- Emerging Markets: Prices likely to decline due to increased generic competition, with potential reductions of up to 10% annually in some regions unless regulatory barriers are eased.

- Global Average: A modest decline projected overall, with prices decreasing approximately 2% to 3% annually over the forecast period, driven by increasing generics and regulatory constraints.

Implications for Stakeholders

- Pharmaceutical Manufacturers: Diversify formulations, explore non-opioid combinations, and adapt pricing to regulatory landscapes.

- Healthcare Providers: Consider alternative therapies as regulation tightens and opioid misuse concerns rise.

- Investors: Monitor regulatory developments to anticipate shifts in market volume and profit margins; generic market entries may compress prices further.

Key Takeaways

- Market dominance: North America remains the largest market but faces rising restrictions impacting sales and prices.

- Regulatory impact: Growing restrictions are likely to suppress overall sales volumes, influencing average prices downward.

- Price sensitivity: Generics dominate the market, exerting continual price pressure, with branded and OTC formulations commanding premium prices only in certain markets.

- Emerging markets: Represent growth opportunities; however, price competition is fierce, and regulatory risk varies.

- Future outlook: Prices are projected to decline gradually over the next decade, with significant regional disparities based on regulation and market maturity.

FAQs

Q1: How will increased regulation affect the pricing of Codeine-Guaifenesin products?

Increased regulation, especially restrictions on OTC sales and tighter prescription controls, are expected to reduce market volume, leading to higher per-unit costs for prescribed products but overall market contraction and downward pressure on prices due to increased compliance costs and reduced availability.

Q2: Are there viable alternatives to Codeine-Guaifenesin that could influence its market pricing?

Yes. Non-opioid cough suppressants such as dextromethorphan and expectorants like polyethylene glycol are alternatives. Their availability and growing preference, especially amid opioid concerns, could suppress demand for Codeine-Guaifenesin, impacting prices.

Q3: What regions are most likely to experience price declines?

Emerging markets in Asia and Latin America are projected to see the steepest price declines due to increased generics, competition, and regulatory pressures. Conversely, North America might see stabilization owing to stricter regulations limiting new entries.

Q4: How might patent expirations influence the market and prices?

Patent expirations typically lead to an influx of generic competitors, which exerts significant downward pressure on prices. For Codeine-Guaifenesin, patent cliffs in regulated markets could accelerate price reductions.

Q5: What strategies can pharmaceutical companies adopt to mitigate declining prices?

Diversification into alternative formulations, developing non-opioid combination products, focusing on emerging markets, and engaging in value-added services (e.g., enhanced formulations, combination therapies) can help offset pricing pressures.

Sources

[1] Global Industry Analysts, Inc., "Cough and Cold Market Forecast," 2022.

[2] U.S. Food and Drug Administration, "Regulation of Opioid-Containing Medications," 2021.

[3] IQVIA, "Pharmaceutical Price Trends," 2022.

More… ↓