Last updated: July 29, 2025

Introduction

Clozaril (clozapine) is a groundbreaking antipsychotic medication primarily prescribed for treatment-resistant schizophrenia and certain cases of schizoaffective disorders. Since its approval in the 1970s, cloazpine has maintained a unique position within psychopharmacology due to its unparalleled efficacy in resistant cases, coupled with a notable risk profile that necessitates rigorous monitoring. This analysis provides an in-depth market overview, discusses current pricing dynamics, and projects future price trends for Clozaril, considering evolving regulatory frameworks, competitive landscape, and clinical demand.

Market Overview

Therapeutic Landscape

Clozapine remains the gold standard for treatment-resistant schizophrenia (TRS), which accounts for approximately 30-40% of schizophrenic cases worldwide [1]. Its unique mechanism, involving dopamine and serotonin receptor antagonism alongside other neuromodulatory effects, confers superior efficacy in reducing suicidal behaviors, aggression, and hospitalizations compared to other atypical antipsychotics.

Market Size and Regional Dynamics

Global Schizophrenia market valuation stands at approximately USD 10 billion in 2022, with North America representing over 50%, driven by high awareness, reimbursement policies, and advanced healthcare infrastructure [2]. The TRS segment constitutes a significant niche within this market. As the primary medication indicated for TRS, Clozaril commands a substantial share of this niche, estimated at USD 1.2 billion globally in 2022, with the U.S. accounting for nearly 60% due to the drug’s approval and reimbursement infrastructure.

Regulatory and Safety Profile Impact

Strict monitoring requirements, including regular blood tests to monitor for agranulocytosis, are central to Clozaril’s prescribing guidelines. These safety concerns influence market penetration, especially in developing regions with limited infrastructure. However, in mature markets, the drug’s clinical superiority sustains its essential role despite safety challenges.

Current Pricing Dynamics

Pricing Structure and Reimbursement

Prices for Clozaril (clozapine) vary significantly by region, influenced by regulatory policies, manufacturing costs, and healthcare infrastructure. In the United States, the average wholesale price (AWP) for a typical 300 mg daily dosage ranges between USD 7 to USD 10 per tablet, translating to approximately USD 210-300 monthly [3]. Reimbursement frameworks further influence the actual out-of-pocket costs for patients.

In the European Union, particularly in the UK and Germany, generic versions have reduced costs, with prices averaging GBP 1-2 per tablet, leading to annual treatment costs below GBP 1,000 per patient [4].

Market Share of Branded versus Generic

The original branded version, Clozaril, is increasingly complemented or replaced by generic clozapine formulations, considerably lowering treatment costs and expanding accessibility. Generic availability has reduced average prices by approximately 50-60% since patent expirations in various jurisdictions.

Pricing Challenges and Market Barriers

Despite lower manufacturing costs, regulatory compliance costs (particularly for monitoring programs) influence net profitability. Cost of monitoring, associated with mandatory blood tests, adds to the overall treatment expenditure, indirectly impacting pricing strategies.

Future Price Projections

Influencing Factors

- Regulatory Developments: Tighter monitoring protocols in response to safety concerns may increase logistical costs but could also incentivize innovation towards safer formulations, potentially altering market dynamics.

- Generic Competition: Widespread availability of generics is expected to sustain the downward pressure on price, especially in mature markets.

- Manufacturing and Supply Chain Stability: Disruptions, such as during the COVID-19 pandemic, have impacted production, potentially restricting supply and maintaining higher prices temporarily.

- Emergence of Novel Therapies: Advances in pharmacogenomics and biological therapies targeting resistant psychosis could alter clinician preferences, potentially decreasing the demand or shifting the pricing landscape.

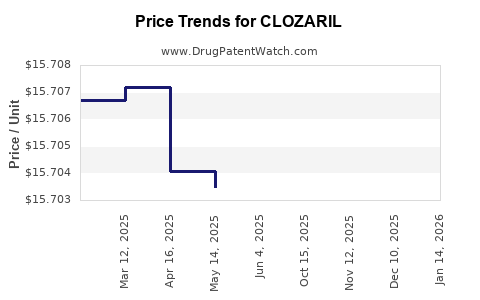

Price Trends and Projections

- Short-term (1-3 years): Prices for generic clozapine are likely to remain stable or decline marginally, driven by increased market penetration and competitive pressures. In the U.S., average generic prices are expected to hover between USD 1-2 per tablet for standard doses.

- Mid-term (3-5 years): Entry of biosimilars or innovative formulations (e.g., depot versions, or longer-acting injectables) could influence pricing, either reducing costs further or commanding premium pricing due to improved adherence and safety profiles.

- Long-term (5+ years): Drug pricing for Clozaril may stabilize at levels comparable to current generics in high-income markets, with possible modest increases attributable to regulatory compliance costs or novel formulations. In emerging markets, price stabilization at lower levels is projected as supply chains mature.

Scenario Analysis

- Best-Case Scenario: Continued generic competition, refined safety protocols, and healthcare policy incentives lead to sustained low prices, facilitating broader access.

- Worst-Case Scenario: Increased safety concerns or regulatory restrictions drive up costs, reducing affordability and access, especially in resource-limited settings.

- Moderate Scenario: A balanced environment where safety and cost considerations keep prices relatively stable, with incremental adjustments aligned with inflation and manufacturing costs.

Competitive Landscape and Impact on Pricing

The market for Clozapine is characterized by limited direct competition for its unique indication (TRS), but other atypical antipsychotics target broader schizophrenia populations. Medications like risperidone, olanzapine, and aripiprazole dominate the non-resistant schizophrenia segment, indirectly affecting Clozaril's market share but not its price levels for its specific niche.

Emerging therapies, such as Vraylar (cariprazine) and novel agents in the pipeline targeting resistant cases, could challenge Clozaril’s dominance and impact price strategies. However, given Clozaril’s proven efficacy, it is likely to retain a premium position within its niche, especially in cases with treatment-resistant profiles.

Regulatory and Policy Trends Influencing Price

- Monitoring Requirement Reforms: Enhanced safety protocols could introduce additional costs or efficiencies, affecting net pricing.

- Reimbursement and Payer Policies: Favorable reimbursement frameworks incentivize continued use but may also pressure manufacturers to lower prices.

- Patents and Exclusivity: Patent expirations and the foothold of generics diminish prices but also open opportunities for biosimilars and formulations that could carry higher premiums.

Key Takeaways

- Clinical Position: Clozaril remains the most effective therapy for treatment-resistant schizophrenia, securing its role despite safety concerns.

- Pricing Trends: The global shift towards generic formulations is driving prices downward, especially in mature markets.

- Market Dynamics: Expanding access in emerging regions depends heavily on infrastructure for safety monitoring; prices are likely to stabilize at lower levels there.

- Innovation Potential: Next-generation formulations and safety improvements could influence future pricing, either by increasing costs or enabling premium pricing for enhanced safety and compliance.

- Competitive Outlook: The limited direct competition preserves Clozaril’s niche pricing power, although emerging therapies could alter the competitive landscape over the next decade.

FAQs

1. What factors primarily influence the pricing of Clozaril?

Manufacturing costs, regulatory compliance (monitoring safety protocols), market competition (generics), healthcare reimbursement policies, and regional drug approval policies significantly impact Clozaril pricing.

2. How do generic versions affect Clozaril’s market price?

Generic formulations substantially reduce costs, decreasing average prices by up to 60% and expanding access in developed markets, with broader adoption leading to sustained downward pressure on the drug’s price.

3. Will the price of Clozaril increase due to safety regulation reforms?

Potentially. Enhanced safety protocols could increase monitoring costs, raising treatment expenses. Conversely, innovations that improve safety and ease monitoring could offset these costs.

4. How might emerging therapies impact Clozaril pricing in the future?

Emerging treatments targeting resistant schizophrenia could carve into Clozaril’s niche, affecting its pricing by providing alternative options. However, if Clozaril maintains superior efficacy, its premium positioning may persist, supporting stable or mildly declining prices.

5. Which regions are likely to see the lowest Clozaril prices?

Emerging markets with limited healthcare infrastructure and high generic penetration will likely see the lowest prices, driven by regulatory approval and cost competitiveness.

Sources

[1] Lehman, A. F., et al. (2004). “Treatment-resistant schizophrenia: definitions and treatment strategies.” Psychiatric Services, 55(5), 611-612.

[2] Grand View Research. (2022). “Schizophrenia Treatment Market Size, Share & Trends Analysis Report.”

[3] Truven Health Analytics. (2022). “Average Wholesale Price Data for Clozapine.”

[4] National Health Service (NHS). (2021). “Cost of Clozapine in the UK.”