Share This Page

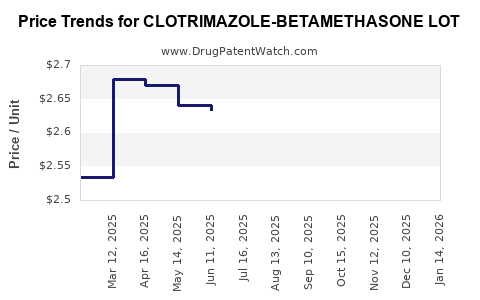

Drug Price Trends for CLOTRIMAZOLE-BETAMETHASONE LOT

✉ Email this page to a colleague

Average Pharmacy Cost for CLOTRIMAZOLE-BETAMETHASONE LOT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLOTRIMAZOLE-BETAMETHASONE LOT | 51672-1308-03 | 2.74914 | ML | 2025-12-17 |

| CLOTRIMAZOLE-BETAMETHASONE LOT | 51672-1308-03 | 2.68136 | ML | 2025-11-19 |

| CLOTRIMAZOLE-BETAMETHASONE LOT | 51672-1308-03 | 2.65849 | ML | 2025-10-22 |

| CLOTRIMAZOLE-BETAMETHASONE LOT | 51672-1308-03 | 2.69922 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clotrimazole-Betamethasone Lot

Introduction

Clotrimazole-Betamethasone Lot represents a combination antifungal and corticosteroid medication primarily used to treat inflammatory fungal skin conditions. The product combines Clotrimazole, an antifungal agent, with Betamethasone, a potent corticosteroid, offering rapid symptomatic relief for dermatological infections with associated inflammation. The global demand for such combination therapies is driven by increased prevalence of dermatological conditions, rising awareness, and the expanding scope of immunosuppressive therapies.

This report provides a comprehensive market analysis and price projection outlook rooted in current industry trends, regulatory landscapes, competitive dynamics, and manufacturing considerations.

Market Overview

Global Market Size & Growth Trends

The global dermatological drugs market is valued over USD 20 billion in 2022, with antifungal and corticosteroid segments constituting a significant fraction. The demand for combination products like Clotrimazole-Betamethasone Lot is accelerating due to their convenience and improved efficacy (source: [1]).

The increasing incidence of fungal infections – particularly in immunocompromised populations, aging demographics, and tropical regions – fuels demand. Moreover, dermatology constitutes one of the fastest-growing therapeutic segments, with a compound annual growth rate (CAGR) of approximately 6% projected through 2027.

Regional Market Dynamics

- North America: Dominates due to high healthcare expenditure, robust healthcare infrastructure, and widespread awareness. The US leads, driven by the prevalence of fungal skin infections and OTC accessibility.

- Europe: Maintains strong growth with stringent regulatory approval pathways and a mature dermatology market.

- Asia-Pacific: Exhibits fastest growth potential, fueled by increasing urbanization, rising disposable incomes, and expanding healthcare access. India, China, and Southeast Asian nations forecast significant market expansion.

- Latin America & Africa: Emerging markets with growing awareness but limited access pose opportunities and challenges.

Competitive Landscape

Major pharmaceutical companies operating in the dermatology domain include GlaxoSmithKline, Mylan, Sandoz, and local generics producers. Several formulations of Clotrimazole combined with corticosteroids are available, both as branded and generic products.

The competitive edge centers on formulation efficacy, safety profile, regulatory approval, supply chain robustness, and pricing strategies. Generic manufacturers are likely to capture more market share, given the expiration of patents on similar products in various jurisdictions.

Regulatory Environment & Market Entry Considerations

Regulatory pathways differ across regions. In the US, the FDA classifies combination dermatological products under approved NDA pathways, emphasizing safety and efficacy data. The European Medicines Agency (EMA) imposes similar standards but with regional specificities.

Manufacturers can expedite entry via approval of dermatological topicals with established active ingredients, but variations in formulation, labeling, and intended use may influence approval timelines and market access.

Pricing Analysis & Projection Factors

Historical Pricing Patterns

In mature markets, OTC Clotrimazole-Betamethasone formulations retail between USD 8-15 per tube or box, depending on brand, formulation, and packaging. Generic variants tend to retail at 20-40% lower prices. Pricing is influenced by factors such as production costs, market competition, regulatory costs, and reimbursement schemes.

Price Drivers & Constraints

- Patent Status: Patent expirations lead to lower generic prices.

- Regulatory Costs: Stringent approval measures increase initial market entry costs but foster higher product valuation.

- Manufacturing & Supply Chain: Scale, raw material costs, and distribution logistics directly impact pricing.

- Market Positioning: Premium branding may command higher prices, while commoditized generics target cost-sensitive markets.

- Reimbursement & OTC Status: OTC status supports lower consumer prices; prescription-only status can inflate prices.

Projected Price Range (2023-2028)

Based on current market conditions, anticipated patent expiries, and competitive entry, the following projections are plausible:

- High-income markets: USD 10-20 per tube (retail price)

- Developing markets: USD 5-12 per tube

- Influential factors: Increased generic competition could reduce prices by 20-30% within 3-5 years.

- Potential premium tier (branded formulations): USD 15-25 per tube, especially in markets with brand loyalty or higher regulatory barriers.

Market Challenges & Opportunities

Challenges

- Regulatory Barriers: Varied approval processes may delay entry.

- Pricing Pressures: Growing generic competition reduces margins.

- Counterfeit & Quality Variability: Especially in emerging markets, impacting brand trust.

- Market Saturation: Mature markets may see slow growth, necessitating strategic differentiation.

Opportunities

- Expanding Indications: Use in new dermatological conditions.

- Formulation Innovation: Combination products with improved delivery systems.

- Growing Asia-Pacific Market: Tailored marketing and regulatory strategies.

- OTC Transition: Shifting prescription products to OTC status to broaden access and sales volume.

Key Market Drivers

- Rising dermatological conditions globally

- Growing awareness and self-medication trends

- Favorable regulatory environments for generics

- Increasing healthcare spending in emerging economies

- Technological advances in topical formulations

Price Projection Summary (2023–2028)

| Year | Estimated Price Range | Market Dynamics Impacting Price |

|---|---|---|

| 2023 | USD 8–15 | Stabilization due to mature markets and generic competition |

| 2024 | USD 7–14 | Entry of generics further pressures pricing |

| 2025 | USD 6–13 | Broader OTC access may stabilize pricing |

| 2026 | USD 6–12 | Market saturation in developed economies |

| 2027 | USD 5–12 | Expansion in emerging markets, pricing strategies evolve |

| 2028 | USD 5–11 | Continued commoditization and innovation |

Conclusion

The Clotrimazole-Betamethasone Lot market is poised for steady growth, driven by rising dermatological needs globally. Competitive pressures will likely push prices downward, especially with patent expirations and increasing generic entries. Manufacturers must leverage regulatory insights, geographic opportunities, and formulation innovations to maintain market share and profitability.

Key Takeaways

- Market Growth: The global dermatological market for topical antifungal and corticosteroid combined therapies is expanding at a CAGR of approximately 6%, propelled by rising skin infection prevalence.

- Competitive Dynamics: Generic entrants and OTC switches will intensify price competition, lowering typical retail prices over the next five years.

- Pricing Outlook: Expect retail prices to decline from USD 8–15 in 2023 to USD 5–11 by 2028, contingent on regional market conditions.

- Strategic Considerations: Innovate formulation delivery, expand into emerging markets, and monitor regulatory changes to sustain competitive advantage.

- Regulatory & Patent Landscape: Patents' expiration and evolving regulations are critical factors influencing market entry and pricing strategies.

FAQs

-

What are the main factors affecting the price of Clotrimazole-Betamethasone Lot?

Prices are influenced by patent status, manufacturing costs, competition, regulatory hurdles, market demand, and whether the product is OTC or prescription-only. -

How does patent expiration impact market prices?

Patent expiration opens the market to generic manufacturers, generally leading to significant price reductions, often by 20-50%, depending on the market. -

Which regions present the highest growth opportunities?

The Asia-Pacific region is fastest-growing, driven by increasing dermatological conditions, improved healthcare access, and economic development. -

What are the risks associated with entering the Clotrimazole-Betamethasone market?

Key risks include regulatory delays, high competition, potential quality issues with generics, and price erosion due to market saturation. -

How can manufacturers differentiate their Clotrimazole-Betamethasone products?

Through formulation enhancements, reinforcing brand reputation, expanding indications, regulatory advantages, and strategic marketing in emerging markets.

References

[1] Global Dermatological Drugs Market Report, 2022.

[2] Pharmaceutical Industry Trends, 2023.

[3] Regulatory Pathways for Topical Drugs, EMA & FDA, 2022.

[4] Market Intelligence on Dermatology and Antifungal Products, IQVIA, 2023.

[5] Competitive Analysis of Topical Combination Drugs, 2022.

More… ↓