Share This Page

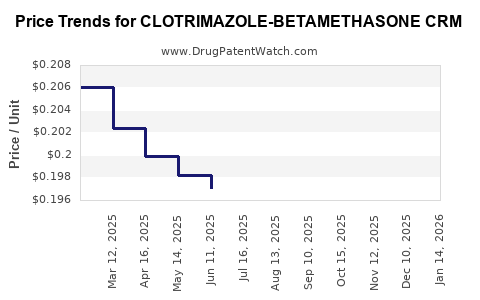

Drug Price Trends for CLOTRIMAZOLE-BETAMETHASONE CRM

✉ Email this page to a colleague

Average Pharmacy Cost for CLOTRIMAZOLE-BETAMETHASONE CRM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLOTRIMAZOLE-BETAMETHASONE CRM | 00472-0379-45 | 0.18697 | GM | 2025-12-17 |

| CLOTRIMAZOLE-BETAMETHASONE CRM | 16714-0496-01 | 0.22217 | GM | 2025-12-17 |

| CLOTRIMAZOLE-BETAMETHASONE CRM | 00472-0379-15 | 0.22217 | GM | 2025-12-17 |

| CLOTRIMAZOLE-BETAMETHASONE CRM | 16714-0496-02 | 0.18697 | GM | 2025-12-17 |

| CLOTRIMAZOLE-BETAMETHASONE CRM | 00168-0258-15 | 0.22217 | GM | 2025-12-17 |

| CLOTRIMAZOLE-BETAMETHASONE CRM | 51672-4048-06 | 0.18697 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLOTRIMAZOLE-BETAMETHASONE CRM

Introduction

Clotrimazole-Betamethasone combined topical medication (CRM) represents a significant therapeutic option for fungal infections associated with inflammation. Its dual action—antifungal and anti-inflammatory—addresses prevalent dermatological conditions like dermatitis, seborrheic dermatitis, and candidiasis. This analysis examines the current market landscape, competitive dynamics, regulatory environment, and provides comprehensive price trend forecasts for this combination product.

Market Overview

Global Demand Drivers

The global dermatology pharmaceutical market demonstrates a consistent upward trajectory, driven largely by increasing incidence rates of fungal skin infections, rising awareness of skin health, and expanded healthcare access. According to a report by MarketsandMarkets, the dermatology market is projected to grow from USD 22.22 billion in 2021 to USD 27.17 billion by 2026, expanding at a CAGR of approximately 4.2% [1].

Clotrimazole-Betamethasone CRM benefits from this growth, particularly in regions with high prevalence of fungal infections such as South Asia, Africa, and Latin America.

Target Demographics

Primary consumers include:

- Patients with dermatophyte infections, especially in outpatient settings.

- Hospitalized patients with secondary infections.

- Chronic dermatological inflammatory conditions.

Regional Market Penetration

Regions like North America and Europe exhibit mature markets with high brand saturation, whereas Asia-Pacific and Latin America show considerable growth potential due to rising prevalence and improving healthcare infrastructure.

Market Segments and Competitive Landscape

Product Classification

Clotrimazole-Betamethasone CRM is typically marketed as a topical corticosteroid-antifungal combination. The competitive landscape involves both branded and generic formulations.

Leading Players

Major pharmaceutical companies with existing dermatological portfolios dominate the market. Notably:

- GlaxoSmithKline

- Bayer

- Sandoz (Novartis)

- Mylan (now part of Viatris)

- Local/regional generic manufacturers

Branded products like Lotrisone (by GSK) have historically held significant market share, but generics now account for a growing segment.

Patent Status and Market Entry Barriers

While some formulations are off-patent, new formulations, improved delivery systems, or combination with other actives pose patent barriers, restricting generic entry and influencing pricing strategies.

Regulatory Environment

Regulatory agencies such as the FDA (USA), EMA (Europe), and region-specific authorities (e.g., CDSCO in India) enforce standards for topical products, focusing on safety, efficacy, and manufacturing quality.

In emerging markets, lack of stringent regulation sometimes results in proliferation of substandard products, impacting overall market dynamics.

Price Trends and Forecasting

Current Pricing Landscape

In mature markets:

- United States: The average retail price of branded Clotrimazole-Betamethasone CRM is approximately USD 12-18 per tube (15g–30g), driven by branding and manufacturing costs.

- India: Generics priced lower, approximately INR 30-50 (~USD 0.4-0.6), benefiting from local manufacturing.

Prices vary based on:

- Brand versus generic status

- Packaging size

- Formulation innovations

- Regional market factors

Factors Influencing Future Pricing

- Patent Expirations: Patent cliffs could lead to price reductions due to increased generic competition.

- Manufacturing Costs: Raw material prices, especially betamethasone, impact end-user pricing.

- Regulatory Changes: Stricter approvals may increase initial costs but stabilize markets long-term.

- Market Penetration Strategies: Expansion into emerging markets and private-label proliferation could drive prices downward.

- Technological Innovations: Sustained releases or combination formulations may command premium pricing.

Projected Price Trends (2023-2030)

| Year | Developed Markets (USD) | Emerging Markets (USD) | Key Drivers |

|---|---|---|---|

| 2023 | 12-18 (branded) / 4-8 (generic) | 0.4-0.6 (generic) | Patent expirations; increased generics |

| 2025 | Slight decrease (~10%) for generics | Stable or marginal decrease | Greater generic penetration, manufacturing efficiency |

| 2027 | Stabilization with potential premium for innovative formulations | Possible introduction of value-added products | Market saturation in mature regions, innovation-driven pricing |

| 2030 | Competitive pricing, potential further declines in commoditized segments | Continued affordability focus | Market maturity and regulatory pressures |

Note: Prices are indicative, subject to regional economic variables and competitive shifts.

Strategic Market Opportunities

- Emerging Markets: High growth potential due to increasing skin infection prevalence; price-sensitive strategies needed.

- Formulation Innovation: Development of long-acting or combined dosage forms could command premium pricing.

- Brand Differentiation: Education, quality assurance, and clinical data support command higher prices and market trust.

- Regulatory Approvals: Achieving approvals in new markets expands reach, impacting overall pricing structures.

Challenges and Risks

- Generic Competition: Lower-cost entrants could erode margins.

- Regulatory Hurdles: Delays or rejections impact launch timings and price windows.

- Market Saturation: In mature markets, limited growth could constrain pricing power.

- Supply Chain Disruptions: Raw material shortages or geopolitical issues can increase costs.

Conclusion

The Clotrimazole-Betamethasone CRM market is poised for steady growth, primarily driven by expanding demand for effective dermatological therapies. Price trajectories suggest a gradual decline in unit cost, especially in mature markets, due to increasing generic competition and market saturation. However, strategic innovation and market expansion in emerging economies offer avenues for premium pricing and higher margins. Manufacturers focusing on quality, regulatory compliance, and localized strategies will better capitalize on this robust market landscape.

Key Takeaways

- The global dermatological drug market, including Clotrimazole-Betamethasone CRM, is expected to grow at a moderate CAGR (~4.2%), with significant regional variations.

- Prices are declining in mature markets due to generic competition but remain lucrative in emerging economies.

- Patent expirations will accelerate generic entry, exerting downward pressure on prices.

- Development of innovative formulations and market expansion will enable premium pricing opportunities.

- Manufacturers should prioritize regional regulatory compliance, supply chain resilience, and strategic marketing to optimize profitability.

FAQs

-

What are the primary factors influencing Clotrimazole-Betamethasone CRM pricing?

Market competition, patent status, manufacturing costs, regulatory environment, and regional economic factors primarily influence pricing. -

How will patent expirations impact the global market?

Patent expirations typically lead to increased generic market entries, reducing prices but expanding accessibility. -

Which regions present the best growth opportunities?

Emerging markets such as India, Southeast Asia, and parts of Africa, with rising prevalence and improving healthcare access, offer significant growth potential. -

Are there innovation trends affecting the market?

Yes, sustained-release formulations, combination therapies, and delivery systems like patches are emerging, enabling premium pricing. -

What risks should manufacturers consider?

Risks include intense generic competition, regulatory hurdles, supply chain disruptions, and market saturation in mature regions.

Sources:

[1] MarketsandMarkets. “Dermatology Drugs Market by Disease Type, Product, and Region – Global Forecast to 2026.”

More… ↓