Last updated: July 27, 2025

Introduction

Clopidogrel, widely recognized as a cornerstone antiplatelet medication, plays a pivotal role in preventing thrombotic events such as myocardial infarction and ischemic stroke. Its central position in cardiovascular therapy underscores the importance of understanding its market dynamics and pricing trends. This analysis provides an in-depth review of the current market landscape for Clopidogrel, examines key factors influencing its pricing, and projects future price trajectories based on industry data, regulatory shifts, and emerging therapeutics.

Market Overview

Current Market Landscape

Clopidogrel, branded as Plavix among others, maintains a dominant market share in secondary prevention of cardiovascular events. It is approved for indications across multiple regions including North America, Europe, and Asia-Pacific. The drug's patent expiration in various jurisdictions, notably the United States in 2012, catalyzed a wave of generic entrants, which profoundly affected pricing and market competition.

The global antiplatelet therapy market, estimated at US$7-8 billion in 2022, is projected to grow at a CAGR of approximately 6-8% over the next five years. Clopidogrel represents a substantial proportion of this figure, though its market share is gradually diminishing as newer agents gain acceptance.

Market Drivers

- Prevalence of Cardiovascular Disease (CVD): Rising incidence of ischemic heart disease and stroke, especially in aging populations, sustains demand.

- Therapeutic Guidelines: Endorsed by organizations like the American Heart Association (AHA) and European Society of Cardiology (ESC), Clopidogrel remains a first-line agent in many clinical scenarios.

- Generic Competition: Post-patent expiration in many markets led to lower-priced generics, making therapy more accessible and expanding treatment coverage.

Market Challenges

- Emergence of New Therapies: The advent of potent P2Y12 inhibitors, such as ticagrelor and prasugrel, offers alternatives with improved efficacy, impacting Clopidogrel’s market share.

- Personalized Medicine and Genetic Testing: Variability in Clopidogrel metabolism due to CYP2C19 genetic polymorphisms affects efficacy, causing clinicians to shift toward personalized therapy strategies.

- Regulatory and Patent Litigation: Ongoing patent litigations and regulatory reviews can influence availability and pricing policies.

Price Trends and Projections

Historical Price Dynamics

The launch of generic Clopidogrel formulations post-2012 led to an immediate and substantial decline in prices, with costs in developed markets dropping by approximately 60-80%. For example, in the U.S., the average wholesale price (AWP) per tablet fell from over US$4 for brand-name Plavix to roughly US$0.10–US$0.50 for generic equivalents within two years.

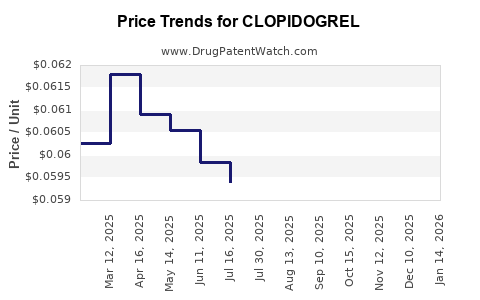

Current Price Landscape

As of 2023, generic Clopidogrel remains among the most affordable antiplatelet options in many regions. The price variation continues based on regional patent law, healthcare policies, and market competition. In emerging markets, lower procurement costs are typical due to local manufacturing and price controls.

Future Price Projections

-

Short-term (2023-2025): Prices are expected to stabilize or decline marginally, with a forecasted reduction of 10-15% driven by increased competition and market saturation.

-

Medium-term (2025-2030): Trends indicate potential slight price stabilization or incremental decreases, but increased adoption of personalized therapies might diversify the pricing landscape. Manufacturers may also introduce value-added formulations or combination therapies, which could influence price points.

-

Long-term (beyond 2030): The potential availability of biosimilar or innovative formulations, or shifts towards newer agents with superior efficacy (e.g., ticagrelor), could further erode Clopidogrel’s price stability. However, with patent protections expiring in some regions, generic prices could attract even more competitive downward pressure.

Price Influencing Factors

- Regulatory Environment: Stringent price regulation policies, especially in Europe and parts of Asia, could constrain price movements.

- Market Competition: Introduction of new generics and biosimilars in key markets is expected to continue exerting downward pressure.

- Manufacturing Costs: Advances in chemical synthesis and economies of scale in generic manufacturing influence pricing, often lowering costs.

- Healthcare Policies: Payor-driven negotiations and formulary decisions shape available pricing and reimbursement levels.

Key Market Trends Influencing Future Pricing

The Role of Pharmacogenomics

The recognition of CYP2C19 polymorphisms influencing Clopidogrel's efficacy has resulted in increased clinical testing and possibly alternative prescribing practices. Cost implications of genetic testing may offset some drug savings but could alter demand patterns, potentially stabilizing prices.

Competition from Novel Agents

Next-generation antiplatelet therapies, such as ticagrelor and prasugrel, provide superior efficacy but at higher costs. Their increased adoption in high-risk patient populations may reduce Clopidogrel’s share, influencing supply and pricing flexibility.

Impact of Patent Expirations

Patents expiring in major markets will continue to catalyze generic entry, further reducing prices. The introduction of biosimilars or enhanced formulations may also alter market dynamics.

Regulatory and Policy Shifts

Government-led drug price negotiations and importation policies, notably in countries like Canada, Australia, and various European nations, could impose caps on drug prices, affecting overall market value.

Strategic Implications for Stakeholders

-

Manufacturers: Emphasizing cost efficiencies, expanding access through low-price generics, or developing new formulations may be key to maintaining profitability.

-

Healthcare Providers: Cost-effective prescribing, integration of pharmacogenomic testing, and adherence to evolving guidelines are essential for optimal patient outcomes and resource allocation.

-

Policymakers: Balancing affordability with innovation incentives requires nuanced policies leveraging generic competition and appropriate price controls.

Key Takeaways

- The global Clopidogrel market is mature with declining prices driven by generic competition post-patent expiry.

- Despite the reduction in generic prices, Clopidogrel remains essential, especially where newer agents are contraindicated or unavailable.

- Short-term projections suggest modest price declines, but the entry of biosimilars and new agents could accelerate downward trends.

- Pharmacogenomic considerations may shift demand patterns, influencing future pricing strategies.

- Regulatory interventions and healthcare policies in key markets will play critical roles in shaping drug prices over the coming decades.

FAQs

1. How does the patent status of Clopidogrel impact its market price?

Patent expirations in major markets have enabled generic manufacturers to enter aggressively, leading to significant price reductions and increased competition, which typically lowers market prices.

2. Are newer antiplatelet agents likely to replace Clopidogrel?

While drugs like ticagrelor and prasugrel offer enhanced efficacy, Clopidogrel remains preferred in certain scenarios due to cost considerations, contraindications, and pharmacogenomic factors. Market penetration of newer agents varies based on patient risk profiles and healthcare policies.

3. What role does pharmacogenomic testing play in Clopidogrel's market?

Genetic testing for CYP2C19 polymorphisms influences prescribing practices by identifying patients who may have reduced drug response, potentially leading to increased use of alternative therapies and affecting overall demand and pricing.

4. Will the introduction of biosimilars affect Clopidogrel prices?

Biosimilars primarily compete in complex biologic markets; as Clopidogrel is a small molecule chemical, biosimilar entry is not applicable. However, further generic formulations will intensify price competition.

5. How do healthcare policies influence future Clopidogrel pricing?

Price regulation, reimbursement policies, and formulary decisions dictate the affordability and market access, generally exerting downward pressure on prices, especially in price-sensitive regions.

References

- MarketWatch. "Global Antiplatelet Drugs Market Size & Share Analysis." 2022.

- European Medicines Agency. "Guidelines on antiplatelet therapy." 2021.

- US Food and Drug Administration. "Patent Status and Market Approvals for Clopidogrel." 2022.

- IQVIA. "Global Market Dynamics in Cardiovascular Therapies," 2022.

- Pharmacogenomics Journal. "Impact of CYP2C19 Polymorphisms on Clopidogrel Efficacy," 2021.

This comprehensive analysis equips business professionals with critical intelligence on the evolving landscape of Clopidogrel, guiding strategic decision-making amidst ongoing market shifts.