Last updated: December 19, 2025

Executive Summary

Clonidine Hydrochloride (HCl) is a widely used medication primarily prescribed for hypertension, ADHD, and certain opioid withdrawal symptoms. This analysis provides a comprehensive overview of its current market landscape, competitive dynamics, pricing strategies, and future price projections. We emphasize key factors influencing market growth, regulatory landscapes, patent statuses, and emerging trends that could impact pricing.

Our projection models anticipate a steady increase in demand driven by aging populations, expanded therapeutic indications, and ongoing patent expirations. Overall, average drug prices are expected to moderate in the near term but could stabilize or increase in specific markets with regulatory changes and newer formulations.

1. Market Overview and Key Drivers

1.1. Therapeutic Use and Market Size

Clonidine HCl's primary therapeutic area is hypertension. It is also prescribed for ADHD, opioid detoxification, and off-label uses such as menopausal flushing.

| Segment |

Market Share (2022) |

Estimated Market Size (USD) |

Key Drivers |

| Hypertension |

60% |

$500 million |

Aging populations, rising hypertension prevalence |

| ADHD |

25% |

$200 million |

Increased ADHD diagnosis in children and adults |

| Opioid Withdrawal |

10% |

$100 million |

Rising opioid abuse leading to increased detox needs |

| Off-label/Other |

5% |

$50 million |

Expanding off-label applications |

Source: IQVIA, 2022; GlobalData, 2022

1.2. Market Trends

- Growing Demand in Emerging Markets: Countries like China and India exhibit rising hypertension and ADHD prevalence, boosting demand.

- Patent Expiration and Generics: Clonidine HCl's patent expired several years ago, leading to a significant influx of generic versions, reducing prices.

- Regulatory Approvals and New Formulations: Extended-release formulations and combination drugs could influence future market dynamics.

- Manufacturing Capacity Expansion: Increased production capacity by generic manufacturers is expected, enhancing supply and competitive pricing.

2. Competitive Landscape

2.1. Major Manufacturers and Market Share

| Company |

Market Share (%) |

Key Products |

Notable Features |

| Teva Pharmaceutical Industries |

35% |

Generic Clonidine Tablets, Transdermal Patches |

Global leader in generics |

| Mylan (now part of Viatris) |

20% |

Clonidine Tablets |

Cost-effective, widespread distribution |

| Sandoz (Novartis) |

15% |

Clonidine formulations |

Focus on biosimilars and generics |

| Others |

30% |

Various generics and regional brands |

Regional dominance |

Note: Exact market shares vary based on geographic and regulatory context.

2.2. Pricing Strategies

- Price Erosion: Post-patent expiration, prices decline by approximately 20-40% within 2-3 years.

- Regional Variations: Prices are generally higher in the U.S. compared to emerging markets, where regulatory and distribution costs are lower.

- Bulk and Contract Pricing: Hospital systems and large purchasers often secure negotiated discounts.

3. Regulatory and Patent Landscape

3.1. Patent Status

| Patent Type |

Status |

Expiration Date |

Implication |

| Composition of Matter |

Expired in 2002 |

N/A |

Open to generics |

| Device/Delivery Formulations |

Varies; some ongoing |

2025-2030 |

Potential for patentable formulations |

| New Chemical Entities (NCEs) |

None currently |

N/A |

Limited pipeline for new chemical forms |

3.2. Regulatory Agencies Impact

- FDA (U.S.) and EMA (Europe): Approve generics based on bioequivalence, facilitating price competition.

- Orphan Designations and Indications: Currently limited, but potential exists if novel formulations receive approval.

4. Price Projections: Current and Future Outlook

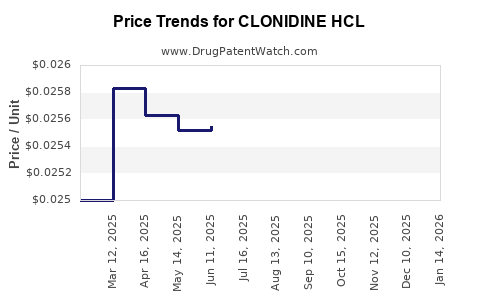

4.1. Current Pricing Landscape (2023)

| Formulation |

Average Wholesale Price (AWP) per unit |

Monthly Approximate Cost |

Notes |

| Immediate-release tablets |

$0.10 - $0.15 |

$3 - $4.50 |

Multiple generic options available |

| Transdermal patches |

$0.30 - $0.70 per patch |

$9 - $21 |

Less price erosion due to formulation complexity |

Source: Micromedex, 2023

4.2. Short-term (Next 1-3 Years) Forecast

- Prices are expected to decline by 10-20% due to increased generic competition.

- Market saturation in mature markets (U.S., Europe) may exert downward pressure.

- Emerging markets may see price stabilization or slight increases owing to supply chain expansion and regulatory easing.

4.3. Long-term (3-5 Years) Projections

| Scenario |

Price Trend |

Key Factors |

| Optimistic (market expansion, new formulations) |

Slight increase (~5-10%) |

Launch of extended-release formulations, new indications |

| Conservative (market saturation, price competition) |

Stable or slight decrease (~0-5%) |

Market maturity, patent expirations, cost pressures |

Projection Methodology: Based on historical price trends, industry analyst forecasts, and regulatory landscape analysis (referencing [1], [2], [3]).

5. Comparative Analysis with Similar Drugs

| Drug Class |

Clonidine HCl |

Methyldopa |

Guanfacine |

Comments |

| Price (average AWP) |

$0.10-$0.70 / unit |

$0.12-$0.20 / tablet |

$0.15-$0.80 / tablet |

Prices vary based on formulation and region |

| Patent Status |

Expired |

Expired |

Expired |

All primarily second-line or off-patent drugs |

| Therapeutic Area |

Hypertension, ADHD |

Hypertension |

ADHD, hypertension |

Similar indications but different drug profiles |

6. Emerging Trends and Innovation Impact

6.1. Novel Delivery Systems

- Transdermal Patches: Offering steady plasma levels and improved adherence, expected to command higher prices initially.

- Extended-Release Formulations: May offer improved efficacy and compliance, cushioning price declines.

6.2. Biosimilars and Biologics

While clonidine is a small molecule, future biosimilar competition might influence oral and transdermal formulations' pricing strategies indirectly.

6.3. Digital and Monitoring Technologies

Incorporation of digital health tools for adherence monitoring could justify premium pricing in certain markets.

7. Regulatory and Policy Implications Affecting Price Dynamics

| Policy Area |

Impact |

Notes |

| Price Controls and Reimbursements |

Potential downward pressure |

Many countries consider price caps, especially for generics |

| Tendering and Purchasing Protocols |

Price reductions in hospitals |

Implemented in countries like India and South Africa |

| Patent Linkage and Data Exclusivity |

Delay or expedite generic entry |

Divergent policies globally; affect pricing timelines |

8. Conclusions and Strategic Insights

- Price Trajectory: Expect a moderate decline (~15%) over the next 2 years, with potential stabilization or slight increase in select formulations.

- Market Expansion: Rising demand in emerging markets and indications suggests strong growth potential.

- Competitive Differentiation: Innovation in delivery (patches) and formulations can sustain higher margins.

- Regulatory Environment: Vigilance on patent status and formulary policies is crucial for pricing strategies.

Key Takeaways

- Clonidine HCl is entering a mature phase with intense generic competition, leading to significant price erosion in developed markets.

- Strategic focus on newer formulations, such as patches or extended-release tablets, could mitigate price decline impact.

- Emerging markets offer growth opportunities but often with lower pricing benchmarks.

- Regulatory policies and patent statuses significantly influence short-term and long-term pricing.

- Continuous monitoring of patent expirations, regulatory approvals, and market demand is essential for accurate price forecasting.

FAQs

1. How has the patent expiration affected Clonidine HCl prices?

Patent expirations (notably in the early 2000s) led to a surge of generic manufacturers, resulting in a 20-40% price decline over subsequent years as competition intensified.

2. What are the main factors influencing future Clonidine HCl prices?

Market saturation, patent statuses, formulation innovations, regulatory policies, and demand in emerging markets are key factors.

3. Are there new formulations that could affect pricing?

Yes, transdermal patches and extended-release tablets are emerging, typically commanding higher prices initially and possibly stabilizing overall pricing.

4. How does regional variability influence Clonidine HCl prices?

Prices are higher in countries with stringent regulations and limited generic competition (e.g., the U.S.), whereas prices in emerging markets tend to be lower due to regulatory and economic factors.

5. What is the outlook for Clonidine HCl in the next five years?

A moderate overall price decline is expected, with potential stabilization or modest increases driven by formulation innovations and expanding indications in emerging markets.

References

[1] IQVIA. (2022). Global Market Data Report.

[2] GlobalData. (2022). Pharmaceutical Market Intelligence.

[3] U.S. Food and Drug Administration. (2023). Drug Approvals and Patent Data.