Share This Page

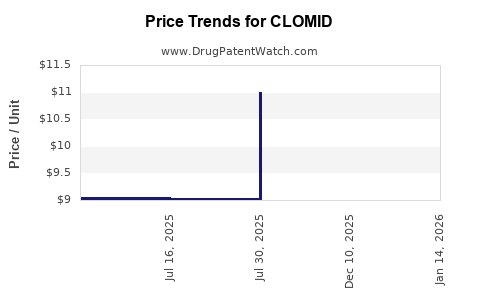

Drug Price Trends for CLOMID

✉ Email this page to a colleague

Average Pharmacy Cost for CLOMID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLOMID 50 MG TABLET | 00713-0885-09 | 11.15402 | EACH | 2025-12-17 |

| CLOMID 50 MG TABLET | 00713-0885-30 | 11.15402 | EACH | 2025-12-17 |

| CLOMID 50 MG TABLET | 00713-0885-30 | 11.00656 | EACH | 2025-08-01 |

| CLOMID 50 MG TABLET | 00713-0885-09 | 11.00656 | EACH | 2025-08-01 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clomid (Clomiphene Citrate)

Introduction

Clomid (clomiphene citrate) is a widely prescribed ovulatory stimulant used primarily in reproductive medicine. It gained FDA approval in 1967 and has since established itself as a cornerstone therapy for inducing ovulation in women with anovulatory infertility, particularly those with polycystic ovary syndrome (PCOS). Its off-label use has expanded into male infertility treatments and even for off-label purposes such as weight loss adjuncts, thus influencing market dynamics. Given its longstanding presence in the pharmaceutical landscape, understanding the current market, competitive environment, and future pricing projections is vital for stakeholders including manufacturers, investors, healthcare providers, and policymakers.

Market Overview

Historical Market Performance

Clomiphene citrate commands a substantial segment of the fertility drug market, valued at approximately USD 700 million in global sales (as of 2022), with steady demand driven by demographic trends and ongoing reproductive health concerns. Despite its age, Clomid retains a dominant position due to its efficacy, favorable safety profile, and low cost, especially within reproductive clinics and lower-income markets.

Regulatory Status

Clomid’s patent has long expired; thus, generic versions dominate the market. No recent patent protections or exclusive licensing restrict manufacturing, fostering competition and lower prices. The drug's regulatory status in various regions influences market access; for instance, some countries require specific approvals for off-label use, shaping overall consumption patterns.

Market Drivers

- Rising Infertility Rates: Globally, infertility affects 8-12% of couples (WHO, 2021), boosting demand for fertility treatments such as Clomid.

- Expanded Use Cases: Increasing off-label uses, including male infertility and other hormonal therapies, contribute positively to market volume.

- Accessibility and Cost-Effectiveness: Clomid’s low cost and oral administration make it preferred over injectable alternatives, especially in developing countries.

Market Challenges

- Emerging Alternatives: Newer ovulation induction agents, such as letrozole (an aromatase inhibitor), are increasingly favored due to potentially higher efficacy and safety profiles.

- Regulatory and Ethical Concerns: Off-label use and regulatory scrutiny in certain jurisdictions may impact market growth.

- Market Saturation: As a generic drug, pricing pressures from multiple manufacturers limit revenue expansion.

Competitive Landscape

The market for clomiphene citrate is highly fragmented, dominated by generic pharmaceutical companies. Key players include pharmaceutical giants like Teva Pharmaceuticals, Watson Pharmaceuticals, and manufacturers in India and China, alongside regional players serving local markets.

Market Share Dynamics

- Generic Manufacturers: Hold the majority share due to low entry barriers.

- Brand Name Presence: Clomid (manufactured by Sanofi/Aventis) retains brand recognition, though its market share is decreasing as generics proliferate.

- Emerging Biosimilar and Biotechnological Options: Currently limited due to the drug's non-biologic nature.

Market Entry and Innovation

Currently, limited innovation exists around Clomid itself. Industry focus has shifted toward developing alternative agents with better efficacy profiles, fewer side effects, or tailored treatment protocols, which may impact shared market dominance.

Price Trends and Projections

Historical Pricing

Over the past decade, Clomid’s price has largely remained stable, attributed to the generic nature of the drug. Typical costs per tablet range from USD 0.10 to USD 1.00, depending on the region and manufacturer. Wholesale prices in the U.S. are around USD 5-10 per cycle, with retail prices varying accordingly.

Factors Influencing Price Stability

- Market Entry of Generics: Increased competition sustains low prices.

- Supply Chain Dynamics: Import/export policies, raw material costs, and manufacturing capacity influence pricing stability.

- Regulatory Changes: Reclassification or restrictions could temporarily influence prices.

Future Price Projections (Next 5-10 Years)

Given the current landscape, price stability is anticipated unless significant disruptions or policy changes occur. The following factors are likely to shape future pricing:

- Continued Market Saturation: Pressure on profit margins may keep prices low.

- Regional Variations: Developing countries might see further price reductions driven by local manufacturing, whereas markets with import restrictions could see price increases.

- Emergence of Alternatives: Short-term price competition may intensify if newer agents with superior profiles gain market share.

- Regulatory Environment: Stricter controls around off-label use, if enacted in key markets, could influence demand volumes and price points.

Overall, a modest decline in average price per cycle (approx. 2-3% annually) is projected, primarily due to increased market competition and commoditization of generic drugs.

Implications for Stakeholders

- Manufacturers: Continued focus on cost-efficient production and regional market expansion sustains profitability despite pricing pressures.

- Investors: Stable and low pricing make Clomid a low-margin, high-volume product with limited growth potential unless market or regulatory dynamics shift.

- Healthcare Providers: Cost-effectiveness supports widespread use, especially in resource-limited settings.

- Policymakers: Regulation can influence future demand and prices; monitoring off-label usage trends remains critical.

Key Takeaways

- Clomid remains a foundational drug in infertility treatment, bolstered by its affordability, oral administration, and broad acceptance.

- The market is characterized by intense generic competition, limiting pricing increases.

- Future price projections indicate relative stability with slight downward trends, driven by market saturation and competition.

- Emerging therapies and regulatory changes could influence future demand, potentially impacting pricing.

- Stakeholders should prioritize regional market insights, regulatory developments, and evolving clinical preferences to adapt strategies effectively.

FAQs

1. How does generic competition influence Clomid prices?

The proliferation of generic manufacturers keeps prices low due to increased supply and price competition, limiting profit margins but maintaining widespread accessibility.

2. Are there any upcoming regulatory changes that could impact Clomid pricing?

Potential regulations around off-label use, drug importing policies, or safety concerns could alter market dynamics, possibly affecting both demand and pricing.

3. How does Clomid compare to alternative ovulation induction agents like letrozole?

While Clomid remains cost-effective with a longstanding track record, letrozole is gaining favor for certain indications due to higher ovulation and pregnancy rates in specific populations, which could influence its market share and pricing.

4. What regional differences exist in Clomid market dynamics?

Developing countries often have lower prices due to local manufacturing, while developed nations may exhibit higher prices influenced by regulatory fees and healthcare reimbursement systems.

5. Is there potential for innovation in Clomid formulations?

Currently limited, as most innovation focuses on alternative agents or combination therapies. Nonetheless, sustained research into personalized dosing and delivery mechanisms may emerge.

Sources:

[1] World Health Organization. "Infertility: A Tabulation of Available Data." 2021.

[2] MarketWatch. "Global Fertility Drugs Market Size & Trends," 2022.

[3] EvaluatePharma. "Fertility Drugs Market Data," 2022.

[4] IMS Health. "Pharmaceutical Market Insights," 2022.

[5] U.S. Food and Drug Administration. "Drug Approvals and Regulatory Updates," 2022.

More… ↓