Last updated: July 27, 2025

Introduction

Clobetasol propionate, a potent topical corticosteroid, is extensively used in dermatology to manage inflammatory and autoimmune skin conditions such as psoriasis, eczema, and dermatitis. Its efficacy, combined with its classification as a super-potent corticosteroid, ensures a significant presence within the dermatological drug market. This report provides a comprehensive market analysis of clobetasol, evaluates current market dynamics, explores major manufacturers, assesses regulatory considerations, and presents informed price projections.

Market Overview

Global Market Size and Growth Dynamics

The global dermatology pharmaceuticals market, driven by increasing prevalence of skin disorders, is expected to grow at a compound annual growth rate (CAGR) of approximately 4.5% from 2023 to 2028. Clobetasol, accounting for a substantial segment of topical corticosteroids, dominates the super-potent corticosteroid category. The rising burden of dermatological conditions, coupled with advancements in topical drug delivery systems, sustains demand momentum.

Prevalence and Demand Drivers

- Dermatological Disease Prevalence: The World Health Organization estimates hundreds of millions globally suffer from psoriasis and eczema, maintaining high demand for potent corticosteroids like clobetasol [1].

- Aging Population: Elderly populations exhibit increased skin conditions, fueling prescriptions.

- Off-label and Biopharmaceutical Use: Investigations into novel uses expand potential visibility.

- Healthcare Access and Awareness: Improved healthcare infrastructure and patient awareness elevate prescription rates.

Market Segments and Regional Insights

-

Regional Distribution: North America accounts for over 40% of the market, driven by high healthcare expenditure, regulatory approval, and widespread dermatological issues. Europe holds approximately 25%, with Asia-Pacific emerging as a significant growth region due to increasing awareness and expanding healthcare access.

-

Product Forms: Clobetasol is available primarily in ointment, cream, foam, and solution forms. Topical formulations predominate, with ointments and creams constituting over 70% of sales.

Regulatory Landscape and Patent Status

Clobetasol formulations are off-patent in many regions, leading to increased generic competition and price competition. Patents on specific formulations or delivery systems, where applicable, affect market exclusivity.

Key Market Players

Major manufacturers include:

- Glaxosmithkline (GSK): Producer of Clobetasol Propionate (Temovate/Ultravate).

- Meda Pharma: Offers generic formulations.

- Sun Pharmaceutical Industries: Provides both branded and generic products.

- Teva Pharmaceuticals: Supplies generic options.

- Pfizer: Involved in dermatology portfolios.

The entry of generic competitors significantly influences pricing, generally leading to decreased prices and increased accessibility.

Market Challenges and Opportunities

Challenges

- Safety Concerns: Prolonged use of potent corticosteroids can cause side effects such as skin atrophy, striae, and systemic absorption risk, which may lead to regulatory restrictions.

- Regulatory Compliance: Variability across jurisdictions complicates market access.

- Generic Competition: Intense price competition reduces profit margins.

Opportunities

- Innovations in Delivery Systems: Developing novel formulations, such as liposomal or foam vehicles, can command premium prices.

- Expanding Indications: Investigating new dermatological indications can broaden the market.

- Emerging Markets: Countries like India, China, and Brazil offer high growth potential due to rising dermatological disease prevalence and improving healthcare infrastructure.

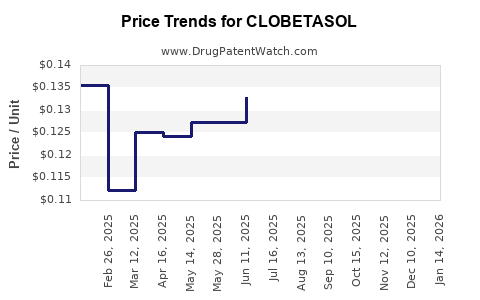

Price Dynamics and Forecasts

Current Pricing Landscape

- Brand-Name Clobetasol: In North America, the average retail price for a 15g tube ranges between $50–$70 (USD).

- Generic Clobetasol: The same quantity is available at approximately $12–$25, reflecting significant price erosion post-patent expiry.

- Impact of Formulation and Delivery System: Novel formulations can reach premium pricing tiers, up to 30% higher than traditional creams.

Factors Influencing Pricing

- Manufacturing Costs: Raw material prices, formulation complexity, and quality standards.

- Regulatory Approvals: Stringent requirements may increase costs but can justify higher pricing for patented formulations.

- Market Competition: The proliferation of generics exerts downward pressure.

- Market Penetration and Access: Reimbursement policies and healthcare provider prescribing habits impact retail prices.

Future Price Projections (2023–2028)

Given current trends, several factors inform the price trajectory:

- Increased Generic Competition: Likely to further suppress prices of standard formulations, with an expected decline of 5–10% annually in mature markets.

- Innovation in Delivery Systems: Premium-priced innovations may retain higher margins, potentially increasing prices by 3–5% annually for proprietary formulations.

- Emerging Markets: Lower price points due to economic factors, but rapid growth in demand can expand overall market value despite lower unit prices.

Projected Scenario:

| Year |

Estimated Average Price for 15g Tub (USD) |

Notes |

| 2023 |

$12–$25 (generic), $50–$70 (brand) |

Current market snapshot |

| 2024 |

$11–$23 (generic), $52–$72 (innovative) |

Slight decrease due to competition; premium options stable or slightly increase |

| 2025 |

$10–$20 (generic), $55–$75 (innovative) |

Continued generic price erosion; premium formulations maintain higher margins |

| 2026 |

$10–$18 (generic), $57–$77 (innovative) |

Market stabilization; innovation sustains premium prices |

| 2027 |

$10–$17 (generic), $58–$78 (innovative) |

Margins stabilize; emerging markets expand volume |

| 2028 |

$9–$16 (generic), $60–$80 (innovative) |

Overall declining trend for generics; premium formulations command higher pricing |

Regulatory and Reimbursement Outlook

Regulatory agencies such as the FDA, EMA, and counterparts in Asia regulate potency limits, formulation approvals, and safety monitoring, impacting pricing strategies.

In high-income markets, reimbursement policies typically favor proven efficacy, enabling premium pricing for innovative formulations. Conversely, price sensitivity in emerging markets ensures competitive pricing strategies.

Conclusion

The clobetasol market is poised for gradual price decline driven by generic competition, but innovations in delivery systems and expanding indications offer avenues for maintaining higher price points. The market's resilience hinges on balancing safety profiles, regulatory compliance, and demand in emerging regions.

Key Takeaways

-

Market Growth: Driven by increasing dermatological disease prevalence and aging populations, especially in North America and Asia-Pacific markets.

-

Price Trends: Generic versions exert downward pressure, with prices declining by approximately 5–10% annually in mature markets; innovative formulations maintain or increase premium pricing.

-

Competitive Landscape: Dominated by major pharma players and multiple generics, fostering aggressive price competition.

-

Opportunities: Novel delivery systems and expanding geographic reach—especially in emerging markets—can sustain profitability.

-

Regulatory Environment: Evolving safety regulations and approval standards influence market access and pricing strategies.

FAQs

Q1: How does patent expiry influence the price of clobetasol?

A: Patent expiry typically introduces generic competitors, leading to significant price reductions—often between 30–50%—as competition intensifies, making the drug more affordable but squeezing profit margins for original manufacturers.

Q2: Are there any new formulations of clobetasol on the horizon?

A: Yes, companies are developing innovative delivery systems, such as foam, liposomal, or microemulsion formulations, aimed at improving efficacy, reducing side effects, and justifying higher prices.

Q3: What regional factors impact the pricing of clobetasol?

A: Regulatory environments, healthcare reimbursement policies, economic status, and prevalence of dermatological conditions influence regional pricing strategies. High-income markets favor premium formulations, whereas emerging markets prioritize affordability.

Q4: What is the outlook for clobetasol in developing countries?

A: Growing demand due to rising skin disease prevalence, coupled with increasing healthcare access, creates opportunities. However, lower purchasing power necessitates competitive pricing to drive volume sales.

Q5: How do safety concerns affect the market dynamics of clobetasol?

A: Potential adverse effects restrict long-term use and may lead regulatory actions, impacting prescribing habits and limiting market growth. Manufacturers are investing in safer formulations to mitigate these concerns.

References:

[1] WHO. (2021). Global Burden of Skin Diseases. World Health Organization.