Share This Page

Drug Price Trends for CLOBETASOL EMOLLNT

✉ Email this page to a colleague

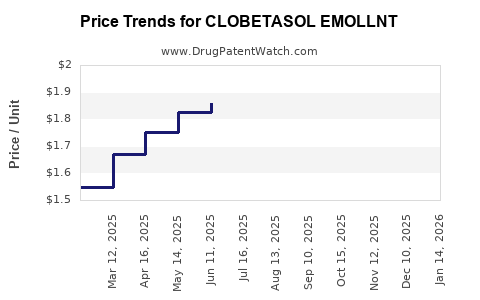

Average Pharmacy Cost for CLOBETASOL EMOLLNT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLOBETASOL EMOLLNT 0.05% FOAM | 45802-0637-32 | 1.80963 | GM | 2025-12-17 |

| CLOBETASOL EMOLLNT 0.05% FOAM | 45802-0637-32 | 1.76223 | GM | 2025-11-19 |

| CLOBETASOL EMOLLNT 0.05% FOAM | 45802-0637-32 | 1.81736 | GM | 2025-10-22 |

| CLOBETASOL EMOLLNT 0.05% FOAM | 45802-0637-32 | 1.96418 | GM | 2025-09-17 |

| CLOBETASOL EMOLLNT 0.05% FOAM | 45802-0637-32 | 2.07157 | GM | 2025-08-20 |

| CLOBETASOL EMOLLNT 0.05% FOAM | 45802-0637-33 | 1.85923 | GM | 2025-07-23 |

| CLOBETASOL EMOLLNT 0.05% FOAM | 45802-0637-32 | 2.17164 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clobetasol Emollient: Strategic Insights for Industry Stakeholders

Introduction

Clobetasol emollient is a topical corticosteroid formulation primarily used in dermatology to treat inflammatory skin conditions such as eczema, psoriasis, and dermatitis. Its distinctive formulation as an emollient enhances skin absorption and patient compliance. Understanding its market landscape, competitive dynamics, and future pricing trends is crucial for pharmaceutical companies, investors, and healthcare policymakers aiming to optimize product positioning and ensure sustainable profitability.

Market Overview and Current Landscape

The global dermatology therapeutics market, valued at approximately USD 20 billion in 2022, is expected to grow at a compound annual growth rate (CAGR) of around 6% through 2028 [1]. Clobetasol propionate, a high-potency corticosteroid, holds a substantial foothold, especially in markets with a high prevalence of chronic skin conditions.

Key drivers include rising incidences of dermatological disorders driven by urbanization, environmental factors, and increasing awareness about skin health. Moreover, the shift towards topical formulations over systemic therapies due to safety profiles enhances demand for products like clobetasol emollient.

Market segmentation reveals that North America dominates the market, supported by advanced healthcare infrastructure, regulatory approvals, and high treatment adoption. The Asia-Pacific region is expected to register the highest growth rate due to expanding healthcare access, increasing dermatological condition prevalence, and rising pharmaceutical manufacturing capacities.

Competitive landscape includes major pharmaceutical players like Johnson & Johnson, Teva Pharmaceuticals, Mylan, and Sandoz, alongside regional generic manufacturers. Patent expiry, especially post-2020, has led to a proliferation of generic versions, intensifying market competition and exerting downward pressure on prices.

Regulatory and Patent Considerations

Clobetasol emollient formulations often benefit from existing patents on the active ingredient; however, formulations such as emollients and combination products frequently face patent challenges post-expiry of older patents. The expiration of key patents has led to a surge in generics, which significantly impacts pricing strategies.

Regulatory pathways for approval differ across regions. In the US, the FDA requires demonstration of bioequivalence for generics under Abbreviated New Drug Applications (ANDAs), fostering market entry for multiple manufacturers. Similarly, in the European Union, centralized and decentralized procedures expedite approvals, increasing market competition.

Market Challenges

- Pricing Pressures: Broader availability of generics has resulted in aggressive discounting. Reimbursement policies, especially in payor-driven markets, tend to favor cost-effectiveness over brand premiums.

- Safety Concerns: Long-term corticosteroid use carries risks of skin atrophy and systemic absorption, prompting formulations with safety-focused claims that could influence pricing.

- Market Saturation: In mature markets, limited innovation results in price erosion and constrained revenue growth.

Price Dynamics

The pricing of clobetasol emollient varies significantly across regions:

- United States: Brand-name formulations priced around USD 120-150 per 60g tube, with generics ranging from USD 45-80 [2].

- Europe: Average prices hover between EUR 25-50 per 30g tube depending on the country and formulation.

- Emerging Markets: Prices often fall below USD 30 per 30g tube, driven by generic competition and purchasing power disparities.

Factors influencing pricing include:

- Patent status and exclusivity.

- Manufacturing costs, including formulation complexity.

- Regulatory fees and distribution expenses.

- Reimbursement and insurance coverage policies.

Future Price Projections (2023-2028)

Based on current trends, the following projections are reasonable:

- Generic Competition Impact: As patents expire or face challenges, expect a 15-25% annual decline in average prices for branded formulations as generics flood the market.

- Regional Variability: Prices in North America and Europe are likely to decline slower (~10-15% annually) due to patent protections retained on certain formulations and brand loyalty.

- Emerging Markets: Prices are projected to stabilize or decline minimally (~5-10%) as local manufacturing and procurement arrangements evolve.

- Innovative Formulations: Introduction of combination products or formulations with enhanced safety profiles could command premium pricing, offsetting generic price declines.

Strategic Implications for Industry Stakeholders

-

Pharmaceutical Companies: To sustain profitability, investing in novel formulations, such as combination therapies or formulations with improved safety/efficacy profiles, is critical.

-

Generic Manufacturers: Focus on cost-efficient manufacturing and strategic market entry in emerging markets to capitalize on volume sales.

-

Policymakers and Reimbursement Bodies: Emphasize policies that balance affordability with incentives for innovation, potentially influencing price stabilization.

-

Investors: Monitor patent expiry timelines and pipeline developments to gauge profit sustainability.

Conclusion

The market for clobetasol emollient is poised for continued growth driven by increasing dermatological disease prevalence and expanding healthcare access, especially in emerging economies. However, evolving patent landscapes and regulatory policies will exert downward pressure on prices, emphasizing the importance of innovation and strategic pricing.

Key Takeaways

- The global market for topical corticosteroids, particularly clobetasol emollient, remains robust due to high prevalence of dermatological conditions.

- Patent expiries have catalyzed significant generic proliferation, leading to sharp price declines, especially in mature markets.

- Regional variations in pricing reflect differences in patent status, healthcare infrastructure, and market maturity.

- Innovative formulations and combination therapies offer avenues for premium pricing amidst growing competition.

- Stakeholders must adapt strategies considering dynamic patent landscapes, regulatory environments, and regional market nuances to optimize profitability.

FAQs

1. How will patent expirations affect clobetasol emollient prices globally?

Patent expirations lead to increased generic competition, generally causing a 15-25% annual reduction in branded formulations' prices, especially in North America and Europe. In emerging markets, impact may be less pronounced initially, but competition is expected to grow.

2. Are there upcoming regulatory changes that could influence the market?

Regulatory agencies continue to streamline approval processes for generics and biosimilars, potentially accelerating market entry. Additionally, safety labeling updates could impact formulation development and pricing strategies.

3. How does regional healthcare reimbursement influence pricing?

Reimbursement policies significantly affect net prices. Countries with national healthcare systems or insurance coverage negotiate drug prices, often resulting in lower prices for generics compared to private pay markets.

4. What role does innovation play in maintaining profitability?

Developing formulations with enhanced safety, reduced dosing frequency, or combination therapies can command premium prices, offsetting declines caused by generic competition.

5. What are the growth prospects for clobetasol emollient in emerging markets?

Favorable demographic trends, increasing disease prevalence, and expanding healthcare access position emerging markets for moderate growth. Price sensitivity remains high, encouraging generic proliferation and potentially limiting premium pricing opportunities.

Sources:

[1] Research and Markets, "Global Dermatology Therapeutics Market," 2022.

[2] GoodRx, "Average Prices of Clobetasol Emollient," 2023.

More… ↓