Last updated: July 27, 2025

Introduction

Clindamycin phosphate is a widely used antibiotic belonging to the lincosamide class, primarily prescribed for bacterial infections including skin, respiratory, intra-abdominal, and gynecological conditions. Its efficacy against anaerobic bacteria and certain aerobic bacteria has sustained demand across global markets. This analysis examines the current market dynamics, key drivers, competitive landscape, regulatory considerations, and future price projections for clindamycin phosphate, providing insights crucial for pharmaceutical stakeholders, investors, and healthcare policymakers.

Market Overview

Global Market Size and Growth Trends

The global demand for clindamycin phosphate reflects the broader antibiotics market valued at approximately USD 40 billion in 2022, with a compound annual growth rate (CAGR) of around 3-4% over the past five years. The antibiotic segment accounts for a significant share, driven by rising bacterial infections and increasing antibiotic resistance challenges.

Within this landscape, clindamycin phosphate maintains a steady share due to its therapeutic efficacy, especially in skin and soft tissue infections, and its use as an alternative to penicillin in penicillin-allergic patients. The Asia-Pacific region, fueled by expanding healthcare infrastructure and rising infection rates, exhibits the fastest growth, projecting a CAGR of over 5% through 2028.

Market Segmentation

- By Formulation: Topical solutions, oral capsules/solutions, injectable formulations.

- By Application:

- Dermatology: Acne vulgaris, bacterial dermatitis.

- Respiratory infections.

- Gynecological infections.

- Surgical prophylaxis.

- By Distribution Channel: Hospitals, retail pharmacies, online pharmacies.

Key Market Drivers

-

Rising Incidence of Bacterial Infections

The increase in bacterial skin infections and respiratory tract illnesses drives sustained demand for clindamycin phosphate, further amplified by increases in immunocompromised populations.

-

Antibiotic Resistance and Alternative Therapies

Clindamycin's efficacy against methicillin-resistant Staphylococcus aureus (MRSA) provides a competitive edge compared to other antibiotics, bolstering its market position.

-

Expanding Healthcare Access

Growing healthcare infrastructure in emerging economies enhances availability and usage, elevating overall market volumes.

-

Regulatory Approvals and Product Launches

Innovations in formulations (e.g., sustained-release topical gels) and regulatory approvals expand usage indications and patient compliance, supporting revenue growth.

Competitive Landscape

Major Manufacturers

- Pfizer Inc. – One of the leading suppliers with a portfolio including clindamycin phosphate creams and capsules.

- Sun Pharmaceutical Industries – A key generics producer benefiting from economies of scale.

- Teva Pharmaceuticals – Notable for broad generic antibiotic offerings.

- Lupin Pharmaceuticals and Mylan – Expanding presence through strategic regional partnerships.

Pricing Strategies

The market exhibits a highly competitive landscape dominated by generics, leading to downward pressure on prices. Patent expirations of branded formulations have resulted in increased generic penetration, further reducing prices.

Patent and Regulatory Considerations

Patent expirations for key formulations occurred around 2010-2015, allowing generics to flood the market, which has contributed substantially to price erosion. Regulatory agencies like the FDA and EMA continue to oversee manufacturing standards, impacting product availability and pricing.

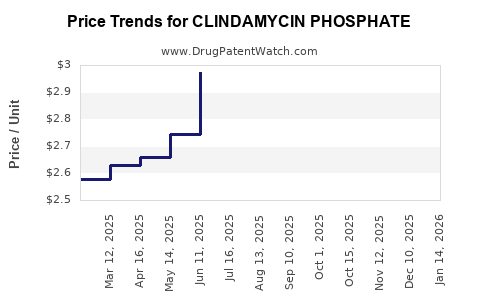

Pricing Dynamics and Projections

Current Price Landscape

- Oral Capsules (per 150mg): Approximately USD 0.50 – USD 1.20 per capsule, depending on brand and region.

- Topical Creams (15g tube): Ranges from USD 8 – USD 20.

- Injectable Formulations: Significantly higher, around USD 50 – USD 100 per vial.

Factors Influencing Prices

- Generic Competition: An abundance of generics has driven prices down globally.

- Regulatory Changes: Stringent approval processes can stabilize prices temporarily but typically favor longer-term reductions.

- Raw Material Costs: Fluctuations in starting materials, including specific dichlorobenzene derivatives, influence production costs.

- Market Demand: Rising infection rates sustain demand, supporting stable pricing in some segments.

Future Price Projections (2023–2028)

- Pricing Stabilization: Prices for oral and topical formulations are anticipated to stabilize due to mature generic markets.

- Further Decline in Prices: Expect a continued gradual decrease (approximately 2-3% annually) driven by increased competition and manufacturing efficiencies.

- Premium Formulations: Novel delivery systems (e.g., controlled-release topical gels) could command higher prices, counteracting general downward trends.

- Regional Variations:

- North America and Europe: Prices may decline marginally due to high generic competition but remain relatively stable owing to quality standards.

- Asia-Pacific and emerging markets: Prices may see sharper reductions due to aggressive generic manufacturing and procurement policies.

Impact of Policy and Innovation

Potential regulatory shifts, such as stricter antimicrobial stewardship policies and the development of resistance, could influence demand and pricing. Conversely, advancements in formulation technology or combination therapies may create premium segments that sustain higher prices.

Regulatory and Market Challenges

- Antimicrobial Resistance (AMR): Rising resistance may limit clinical efficacy, reducing demand and pressuring prices.

- Generic Market Saturation: Excess supply can lead to price wars, further diminishing profit margins.

- Regulatory Barriers: Stringent approval procedures and quality compliance requirements, especially in mature markets, could impede new entrants but also restrict price hikes for existing products.

Strategic Opportunities

- Innovation in Delivery Systems: Introduction of sustained-release topical formulations can establish premium pricing.

- Expansion in Emerging Markets: Capitalizing on increasing infections and healthcare access can expand market share.

- Combination Therapies: Co-formulations with other antibiotics could command higher prices and improve treatment outcomes.

Key Takeaways

- The global clindamycin phosphate market remains steady, driven by high clinical efficacy and resistant bacterial strains.

- The market is dominated by generics, with prices trending downward, particularly in mature markets.

- Price projections indicate a gradual decline over the next five years, with regional variations influenced by competition and regulatory landscapes.

- Innovation in formulations and expanding access in emerging economies represent significant growth opportunities.

- Monitoring antimicrobial stewardship policies and resistance trends is critical, as they directly impact market dynamics and pricing strategies.

FAQs

1. How has patent expiration affected clindamycin phosphate prices?

Patent expirations around 2010-2015 led to an influx of generic competitors, resulting in significant price reductions and increased market accessibility.

2. What regions are expected to exhibit the highest growth for clindamycin phosphate?

The Asia-Pacific region, benefiting from expanding healthcare infrastructure and rising infection rates, is projected to exhibit the fastest growth through 2028.

3. Are there new formulations of clindamycin phosphate that could influence the market?

Yes. Innovations such as sustained-release topical gels or combination therapies are emerging, which may command higher prices and expand therapeutic indications.

4. How does antimicrobial resistance impact the future of clindamycin phosphate pricing?

Rising resistance may reduce clinical utility, potentially decreasing demand and exerting downward pressure on prices unless new formulations or combination approaches are developed.

5. What strategies can manufacturers adopt to stay competitive in the clindamycin phosphate market?

Investing in formulation innovations, focusing on emerging markets, and aligning with antimicrobial stewardship initiatives can help maintain profitability amid price declines.

References

- Market Analysis Report, Global Antibiotics Market, 2022.

- Pharmaceutical Market Trends, IQVIA, 2022.

- Regulatory Agency Publications – FDA and EMA Guidelines on Antibiotics, 2021.

- Industry Reports, Global Generic Antibiotics Market, 2022.

- World Health Organization Data on Antibiotic Resistance, 2022.