Last updated: August 3, 2025

Introduction

Clindamycin Phosphate, a semi-synthetic lincosamide antibiotic, has historically played a vital role in treating bacterial infections, especially skin, soft tissue, and intra-abdominal infections. Its formulation as a topical and injectable agent has maintained consistent demand. This analysis explores current market dynamics, competitive landscape, regulatory factors, and future price projections for Clindamycin Phosphate, equipping stakeholders with comprehensive insights for strategic decision-making.

Market Overview

Global Market Size and Growth Trends

The global antibiotic market, valued at approximately USD 50 billion in 2022, is experiencing steady expansion driven by rising bacterial infection prevalence, increasing antibiotic resistance, and evolving treatment guidelines [1]. Clindamycin Phosphate retains a significant share within the topical and injectable antibiotic sectors, with estimated global sales exceeding USD 600 million annually.

Demand remains robust owing to its distinct efficacy against anaerobic bacteria and MRSA strains, especially in hospital settings. The pharmaceutical market's shift toward injectable formulations, combined with an uptick in skin and respiratory infections, sustains Clindamycin Phosphate’s market relevance.

Key Market Segments

- Formulation Type: Topical gels and creams, oral capsules, injectable solutions.

- Application Areas: Skin infections, pneumonia, intra-abdominal infections, dental infections.

- End-User Industries: Hospitals, clinics, outpatient pharmacies.

Regional Dynamics

- North America: Leading region, driven by high antibiotic utilization and robust healthcare infrastructure.

- Europe: Steady growth, with stringent regulatory oversight influencing pricing.

- Asia-Pacific: Fastest-growing, propelled by increasing healthcare access, expanding pharmaceutical manufacturing, and rising bacterial infection rates.

- Emerging Markets: Growing demand, notably in Latin America and Africa, though price sensitivity influences market penetration.

Competitive Landscape

Major Players

- Pfizer: Industry leader with branded formulations (e.g., Cleocin).

- Sun Pharmaceutical: Significant generics manufacturer.

- Sagent Pharmaceuticals: Focused on injectable formulations.

- Other Generics Manufacturers: Mylan, Teva, and Hikma.

The dominance of generic formulations has compressed prices, intensifying competition. Patent expirations of key branded products have further democratized market access, fostering price competition.

Market Entry Barriers

- Regulatory Approvals: Stringent registration processes in various jurisdictions.

- Manufacturing Standards: Compliance with Good Manufacturing Practices (GMP).

- Pricing Regulations: Price controls in several regions restrict profitability.

Regulatory and Patent Landscape

While the original patents for Clindamycin Phosphate expired several years ago, secondary patents on specific formulations or delivery mechanisms may persist. Regulatory bodies, including the FDA and EMA, maintain rigorous standards for safety and efficacy, influencing market access processes.

In particular, recent focus on antibiotic stewardship and regulatory policies targeting antimicrobial resistance could influence the approval and pricing strategies of new formulations.

Pricing Trends and Projections

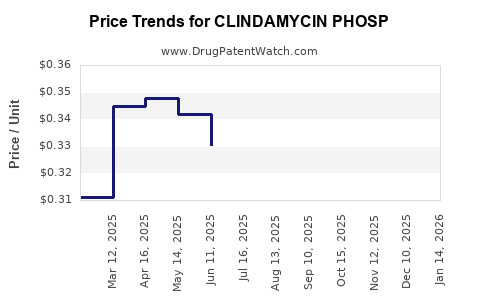

Historical Price Trends

Over the past decade, prices for Clindamycin Phosphate formulations have generally declined due to generic competition and increasing market saturation. For example:

- Injectable formulations: Wholesale prices decreased approximately 30% from 2010 to 2020.

- Topical formulations: Declined by around 25%, with regional variations.

Pricing strategies shifted toward volume-based sales, with payers advocating for cost-effective generics.

Forecasted Price Dynamics

Projections suggest the following trends up to 2030:

- Stability in Mature Markets: North America and Europe likely to see sustained price stability with minor fluctuations, heavily influenced by healthcare policies and antibiotic stewardship efforts.

- Price Compression in Generics: Continued decline in generic prices driven by intensified competition and production efficiencies in Asia-Pacific markets.

- Emerging Market Opportunities: Moderate price increases anticipated due to rising demand and expanding healthcare infrastructure, though price sensitivity remains high in these regions.

Influencing Factors

- Regulatory changes: Stricter approval pathways and quality standards may temporarily inflate costs but stabilize long-term pricing.

- Antibiotic Stewardship: Heightened restrictions on antibiotic use could reduce demand growth, exerting downward pressure on prices.

- Supply Chain Dynamics: Raw material costs and manufacturing capacities, especially in regions with increased local production, impact pricing structures.

Factors Shaping Future Market and Price Trends

Antimicrobial Resistance and Stewardship Policies

The global push to combat antimicrobial resistance (AMR) has led to more restrictive prescribing guidelines. While this reduces overuse, it constrains demand growth, thereby exerting pressure on pricing, especially in developed countries.

Innovation and New Formulations

Development of novel delivery systems, such as liposomal formulations or combination therapies, may command premium pricing but are less likely to significantly affect traditional Clindamycin Phosphate formulations due to cost considerations and market preference for generics.

Regulatory Environment

Evolving policies favoring biosimilars and generics will sustain generic price competition. Simultaneously, stricter regulatory requirements may increase costs for manufacturers, influencing pricing strategies.

Market Penetration in Developing Countries

Expanding access in Asia, Africa, and Latin America presents growth opportunities. Competitive pricing will be essential to capture these markets, likely leading to further price reductions.

Strategic Outlook

- Manufacturers should focus on cost-efficient production to remain competitive amid price pressures.

- Differentiation based on formulations (e.g., sustained-release injectables) can help sustain margins.

- Partnerships with local manufacturers in emerging markets could enhance penetration and volume sales, offsetting price declines.

- Monitoring antimicrobial stewardship policies is crucial for forecasting demand trajectories and adjusting marketing strategies accordingly.

Key Takeaways

- The global Clindamycin Phosphate market remains stable but highly competitive, predominantly driven by generic manufacturers.

- Prices have trended downward over the past decade, with further declines expected in saturated markets.

- Growth potential in emerging regions hinges on balancing affordability with expanding healthcare access.

- Regulatory and stewardship policies will continue to influence demand and pricing dynamics, requiring manufacturers to adapt proactively.

- Innovation in formulations offers growth avenues but should be aligned with cost-effective production to maximize market share.

FAQs

-

What factors are driving the price decline of Clindamycin Phosphate?

The primary factors include escalating generic competition, cost efficiencies in manufacturing, and regulatory pressures favoring low-cost generics, which collectively compress prices.

-

How will antimicrobial stewardship policies impact Clindamycin Phosphate demand?

Stricter stewardship efforts restrict unnecessary antibiotic use, potentially reducing demand growth in developed markets, thus influencing market prices downward.

-

Are there opportunities for premium pricing with new formulations?

Yes, innovative delivery mechanisms like liposomal versions could command higher prices, but mainstream Clindamycin Phosphate sales are expected to remain predominantly in the generic segment.

-

What regions are expected to exhibit the fastest price reductions?

Asia-Pacific, due to increasing local manufacturing capabilities and fierce price competition, will likely see the sharpest declines.

-

How can manufacturers counteract declining prices?

By optimizing production efficiency, diversifying formulations, entering emerging markets through strategic partnerships, and investing in innovation that adds value without significantly increasing costs.

References

[1] MarketsandMarkets. Antibiotics Market by Product, Application, and Region – Global Forecast to 2027. 2022.