Share This Page

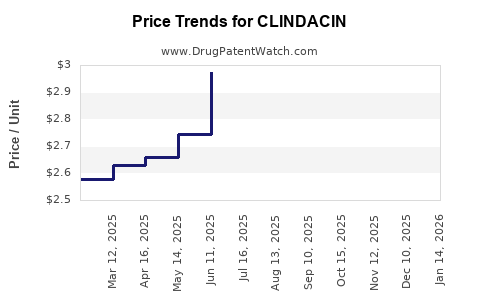

Drug Price Trends for CLINDACIN

✉ Email this page to a colleague

Average Pharmacy Cost for CLINDACIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLINDACIN 1% FOAM | 43538-0179-10 | 2.86174 | GM | 2025-12-17 |

| CLINDACIN 1% FOAM | 43538-0179-10 | 3.04215 | GM | 2025-11-19 |

| CLINDACIN 1% FOAM | 43538-0179-10 | 3.24573 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLINDACIN

Introduction

CLINDACIN, a trademarked formulation of clindamycin, is a widely utilized antibiotic primarily for treating bacterial infections such as skin and respiratory tract infections. Recognized for its efficacy against anaerobic bacteria and certain protozoan infections, CLINDACIN holds a significant position in both hospital and outpatient settings. As antibiotic stewardship evolves, understanding its market dynamics, competitive landscape, regulatory environment, and pricing outlook is vital for stakeholders aiming to optimize investment, production, and distribution strategies.

Market Overview and Key Drivers

Global Market Size and Segmentation

The global antibiotics market, estimated at approximately USD 50 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 3-4% through 2030. Clindamycin-based formulations, including CLINDACIN, comprise a substantial segment within the topical, oral, and injectable antibiotics categories.

The demand is particularly driven by the rising prevalence of skin infections, acne vulgaris, and dental infections. The increasing incidence of drug-resistant bacterial strains, such as MRSA, underscores the necessity for effective agents like clindamycin.

Regional Market Dynamics

- North America: Dominates due to high antibiotic utilization rates, advanced healthcare infrastructure, and stringent regulatory landscape. The U.S. accounts for nearly 40% of global clindamycin sales.

- Europe: Significant growth driven by antibiotic stewardship programs and the prevalence of skin and respiratory infections.

- Asia-Pacific: Fastest-growing market, propelled by expanding healthcare access, rising bacterial infection cases, and generic drug proliferation. China and India represent key regions with notable demand.

Key Market Participants

Leading pharmaceuticals producing clindamycin formulations include Pfizer, Mylan (now part of Viatris), and Teva. Several regional players also manufacture generic versions, intensifying market competition.

Regulatory and Intellectual Property Landscape

Clindamycin formulations like CLINDACIN are predominantly off-patent, enabling broader manufacturing and generic competition. However, patent expirations in major markets, such as the US (around 1998), have prompted a shift towards generics, intensifying price competition.

Regulatory bodies, including the FDA, EMA, and other regional agencies, enforce compliance for approval and post-market surveillance. The advent of biosimilars and new formulations that improve delivery or reduce resistance issues remains a focus for innovation.

Market Challenges

- Antibiotic Resistance: Increasing resistance diminishes clinical efficacy, potentially affecting demand.

- Pricing Pressure: Surge in generic options leads to aggressive pricing strategies, pressure on profit margins.

- Regulatory Scrutiny: Growing concern over antibiotic stewardship could lead to restricted usage; thus, market penetration may be affected.

Price Analysis and Projections

Current Pricing Landscape

The typical cost of CLINDACIN varies significantly across regions:

- United States: The retail price for a 300mg oral capsule ranges from USD 30 to USD 50 per prescription.

- Europe: Prices are comparable, with variations based on healthcare systems and insurance reimbursements.

- Asia-Pacific: Significantly lower, around USD 5 to USD 15 per course, driven by generic competition.

The prevalence of generic options has driven prices downward over the last decade, with some formulations now available at approximately 20-30% of branded prices.

Projected Price Trends (2023-2030)

- Short-term (2023-2025): Prices are expected to remain relatively stable due to market saturation and generic competition. Slight declines of 2-4% annually are anticipated, primarily in mature markets.

- Mid-term (2025-2028): Slight upward pressure may emerge if antimicrobial resistance prompts new formulations or restricted usage, reducing supply or necessitating specialized versions.

- Long-term (2028-2030): Prices could stabilize or slightly decline further, contingent on patent landscape, generics pipeline, and regulatory changes. The emergence of new, resistant strains may also influence demand and pricing.

Influencing Factors

- Innovation & Formulation Development: Fixed-dose combinations or delivery methods enhancing compliance may command premium pricing.

- Regulatory Restrictions: Stricter prescribing guidelines could limit market volume, impacting revenue but potentially supporting higher prices for specialized formulations.

- Market Penetration of Generics: Continued erosion of brand premium prices; however, niche formulations may retain higher price points.

Future Opportunities and Threats

Opportunities

- Development of Novel Formulations: Liposomal, nano-formulated, or sustained-release versions could command higher prices.

- Emerging Markets: Growing healthcare infrastructure and disease burden create expansion opportunities.

- Combination Therapies: Partnering with other antimicrobial agents may extend patent exclusivity and market share.

Threats

- Resistance Development: Resistance diminishes clinical utility, threatening future demand.

- Regulatory Limitations: Enhanced antimicrobial stewardship policies could restrict prescribing, impacting sales volumes.

- Market Saturation: Dominance of generic manufacturers limits pricing flexibility and margins.

Conclusion and Strategic Implications

The market for CLINDACIN remains consequential within the broader antibiotics landscape, driven by infection prevalence, resistance trends, and generics proliferation. Price projections suggest stability in the short term with a cautious potential for modest declines influenced by competitive pressures. Stakeholders should monitor resistance patterns, regulatory developments, and emerging formulation innovations to refine pricing and market strategy.

Investors and manufacturers should consider advancing formulation innovations or niche indications to sustain revenue streams amid downward price pressures. Additionally, engaging with antimicrobial stewardship initiatives can mitigate demand restrictions while fostering innovation in clinical application.

Key Takeaways

- The global CLINDACIN market is influenced by rising bacterial infections and resistance patterns, with significant growth prospects in Asia-Pacific.

- Patent expirations have led to robust generic competition, exerting downward pressure on prices across all regions.

- Current prices vary markedly, but future projections indicate stability with potential slight declines; novel formulations and regional market expansion may alter this outlook.

- Resistance development and regulatory evolution pose significant strategic risks but also present opportunities for innovative formulations and targeted therapies.

- Stakeholders should prioritize R&D for new delivery mechanisms, monitor resistance trends, and adapt to regional regulatory landscapes to optimize profitability.

FAQs

1. What factors primarily influence CLINDACIN pricing strategies worldwide?

Market competition, patent status, regional healthcare policies, antibiotic resistance trends, and formulation innovations are key influences on CLINDACIN pricing.

2. How does antibiotic resistance affect the market and pricing of CLINDACIN?

Rising resistance diminishes clinical efficacy, potentially reducing demand; however, it can also prompt development of specialized formulations with premium pricing.

3. Are there significant regional differences in CLINDACIN prices?

Yes, prices are highest in North America and Europe due to brand premiums and healthcare infrastructure, while Asia-Pacific generally features lower prices driven by generics.

4. What role do generics play in shaping CLINDACIN's market outlook?

Generics dominate market share, exerting downward pressure on prices and margins, while also enabling broader accessibility.

5. What strategic moves should manufacturers consider to sustain profitability?

Invest in innovative formulations, explore niche indications, participate in stewardship programs, and monitor regulatory changes to adapt pricing and marketing strategies.

References

[1] MarketsandMarkets. “Antibiotics Market by Product, Route of Administration, Application, and Region – Global Forecast to 2030.” 2022.

[2] EvaluatePharma. “Pharmaceutical Market Outlook 2022.”

[3] U.S. Food and Drug Administration. “Approved Drugs Database.”

[4] European Medicines Agency. “Market Data and Insights.”

[5] IQVIA. “Global Medicine Spending and Usage Trends.” 2022.

More… ↓