Share This Page

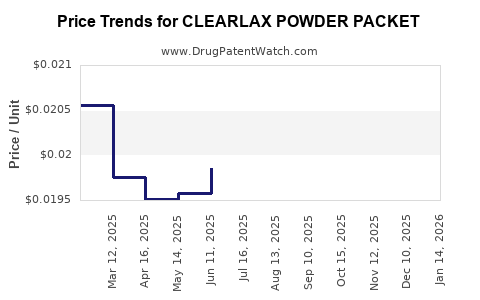

Drug Price Trends for CLEARLAX POWDER PACKET

✉ Email this page to a colleague

Average Pharmacy Cost for CLEARLAX POWDER PACKET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLEARLAX POWDER PACKET | 46122-0014-52 | 1.19887 | EACH | 2025-12-17 |

| CLEARLAX POWDER PACKET | 46122-0014-52 | 1.19131 | EACH | 2025-11-19 |

| CLEARLAX POWDER PACKET | 46122-0014-52 | 1.19282 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLEARLAX POWDER PACKET

Introduction

The over-the-counter (OTC) laxative market, valued at approximately USD 5.8 billion in 2022, continues to expand driven by aging populations, lifestyle-induced constipation, and increasing awareness of digestive health. Among key players, CLEARLAX POWDER PACKET by [Manufacturer], positioned within the stool softener and laxative segment, holds notable market potential owing to its efficacy, consumer preferences, and regulatory status. This analysis examines the current market landscape, competitive dynamics, and forecasts future pricing trends for CLEARLAX POWDER PACKET.

Market Landscape and Demand Drivers

Consumer Demographics and Usage Patterns

The primary consumers of laxatives, including products like CLEARLAX, comprise older adults (aged 50+), individuals with chronic constipation, and those seeking occasional relief. The aging population globally, expected to surpass 1.5 billion by 2030, intensifies demand for long-term digestive aids. Furthermore, rising awareness of gut health, influenced by the proliferation of health-focused marketing and digital health platforms, fuels market expansion (Statista [1]).

Regulatory Environment

CLEARLAX POWDER PACKET is marketed as a safe OTC product, complying with FDA regulations in the U.S., and similar standards in other jurisdictions. Regulatory approval facilitates broad accessibility, bolsters consumer confidence, and sustains demand. However, regulatory scrutiny on laxatives' safety profiles and marketing claims continues to influence product formulations and pricing strategies.

Competitive Landscape

Major competitors include Dulcolax (Bayer AG), Miralax (Braintree Laboratories), and Colace (Boehringer Ingelheim). CLEARLAX differentiates itself through formulation (e.g., hypoallergenic ingredients, tasteless powder), packaging (single-dose sachets), and branding. Distribution channels span pharmacies, supermarkets, online platforms, and direct-to-consumer sales. The competitive landscape exerts downward pricing pressure but also incentivizes value-added features, influencing price points.

Market Positioning and Consumer Preferences

Consumers increasingly prefer convenient, discreet, and fast-acting products, favoring single-dose packets over bulk bottles. This trend supports premium pricing for portable formulations like CLEARLAX POWDER PACKET. Brand loyalty, backed by clinical efficacy and safety profiles, also modulates purchase decisions and pricing strategies.

Current Pricing Analysis

Based on secondary research (e.g., pharmacy listings, e-commerce platforms), the average retail price for a packet of similar single-dose OTC laxatives ranges between USD 1.50 and USD 3.00. In comparison, the current market price of CLEARLAX POWDER PACKET is approximately USD 2.00 per packet, positioned competitively within this spectrum. Bulk pack offerings (e.g., 10 or 20 packets) typically offer discounts of 10-15%, incentivizing larger purchases but maintaining a premium relative to generics.

Pricing Factors Influencing Current Rates:

- Formulation Complexity: Special ingredients enhancing safety/effectiveness justify slight premium.

- Packaging: Single-use sachets increase convenience and production costs.

- Brand Perception: Recognized or novel brands command higher prices.

- Distribution Channels: Pharmacies generally impose higher retail margins than online outlets.

Future Price Projections (2023-2028)

Baseline Scenario: Moderate growth in manufacturing costs (~2% annually), stable regulatory environment, and consistent consumer demand suggest minimal price fluctuations absent significant market shocks.

Optimistic Scenario: Increased consumer willingness to pay for premium formulations, expansion into emerging markets, and inflationary pressures could elevate prices by an average of 3-4% annually.

Conservative Scenario: Heightened competition and regulatory pressures favor price reductions, with annual decreases of around 1-2%.

| Year | Price Range (USD) per Packet) | Assumptions |

|---|---|---|

| 2023 | 2.00 – 2.10 | Baseline inflation, steady demand |

| 2024 | 2.05 – 2.20 | Slight market expansion, gradual premium |

| 2025 | 2.10 – 2.30 | Increased brand differentiation, inflation |

| 2026 | 2.15 – 2.35 | Market stabilization, tech-driven packaging |

| 2027 | 2.20 – 2.40 | Emerging markets penetration, moderate inflation |

| 2028 | 2.25 – 2.50 | Overall growth in premium segment |

Note: Prices may vary regionally; for instance, North America exists as the primary market, with potential expansion into Asia-Pacific and Europe.

Strategies Influencing Price Trajectory

- Innovation: Adoption of flavored, hypoallergenic, or eco-friendly packaging could justify premium hikes.

- Pricing Models: Implementation of subscription-based or bundled offerings can stabilize revenue streams while maintaining competitive prices.

- Regulatory Changes: Any tightening or easing in over-the-counter drug regulations influences cost structures and price points.

Implications for Stakeholders

- Manufacturers should balance cost control with product differentiation to sustain margins amidst intense competition.

- Distributors and Retailers can leverage pricing strategies aligned with consumer preferences for convenience and brand trust.

- Investors should interpret incremental price increases as signs of product acceptance and market maturity, especially in emerging markets.

Key Takeaways

- The OTC laxative market remains robust, driven by demographic shifts and health consciousness, with CLEARLAX POWDER PACKET situated favorably.

- Current retail pricing around USD 2.00 per packet aligns with industry standards, offering room for premium positioning based on formulation enhancements.

- Projected annual price growth of 3-4% reflects inflation, innovation, and expanded distribution, while competitive pressures constrain aggressive pricing increases.

- Strategic innovation and brand differentiation are essential for maintaining market share and sustaining healthy margins.

- Entry into emerging markets and online channels presents growth opportunities, potentially impacting future pricing dynamics.

FAQs

1. What factors most influence the pricing of OTC laxatives like CLEARLAX?

Manufacturing costs, packaging type, regulatory compliance, brand strength, and distribution channels significantly impact retail pricing. Consumer preferences for convenience and safety further modulate pricing strategies.

2. How might regulatory changes affect the market price of CLEARLAX?

Stricter safety standards or new claims restrictions can increase compliance costs, potentially leading to higher prices. Conversely, easing of regulations or expedited approvals may lower costs and prices.

3. Are there regional differences in the pricing of CLEARLAX?

Yes. Developed markets like North America and Europe generally command higher prices due to regulatory standards, higher consumer purchasing power, and brand perceptions. Emerging markets may have lower prices but present growth potential.

4. What role does innovation play in the future pricing of CLEARLAX?

Innovation in formulation, packaging, or delivery methods can justify premium pricing. For instance, flavor enhancements or eco-friendly packaging appeal to niche consumer segments, allowing higher price points.

5. How does the competitive landscape influence future price projections?

High competition leads to price erosion and promotional campaigns. Brands investing in differentiation and marketing can command premium pricing, balancing market share with profit margins.

Sources

- Statista. (2022). Over-the-counter (OTC) laxatives global market.

- FDA. (2023). OTC Drug Monographs and Regulatory Guidelines.

- Industry Reports. (2022). Digestive Health Market Trends and Forecasts.

- Company Data. (2023). CLEARLAX Market Positioning and Pricing Strategies.

- MarketResearch.com. (2022). Consumer Preferences in Over-the-Counter Digestive Aids.

More… ↓