Share This Page

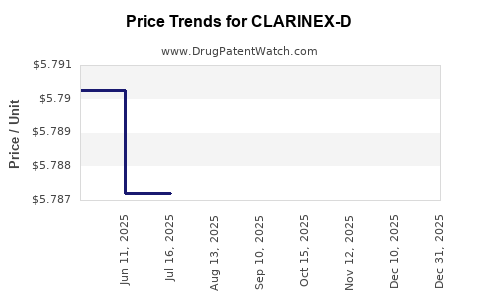

Drug Price Trends for CLARINEX-D

✉ Email this page to a colleague

Average Pharmacy Cost for CLARINEX-D

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLARINEX-D 12 HR 2.5-120 MG TB | 78206-0120-01 | 5.77057 | EACH | 2025-12-17 |

| CLARINEX-D 12 HR 2.5-120 MG TB | 78206-0120-01 | 5.76967 | EACH | 2025-11-19 |

| CLARINEX-D 12 HR 2.5-120 MG TB | 78206-0120-01 | 5.77960 | EACH | 2025-10-22 |

| CLARINEX-D 12 HR 2.5-120 MG TB | 78206-0120-01 | 5.77967 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLARINEX-D

Introduction

CLARINEX-D (desloratadine with pseudoephedrine) is an over-the-counter (OTC) antihistamine combined with a decongestant, primarily used for allergy relief. Its formulation targets consumers seeking a convenient remedy for allergic rhinitis and sinus congestion. This analysis examines market drivers, competitive landscape, regulatory considerations, and price dynamics to inform strategic decision-making.

Market Overview

Therapeutic Demand and Epidemiology

Allergic rhinitis affects approximately 10-30% of the global population [1], with seasonal and perennial variants. The widespread prevalence ensures a stable demand base for antihistamines like CLARINEX-D. Additionally, the rising incidence of allergic conditions linked to urbanization and pollution sustains consistent consumption patterns.

Market Segments and Channels

CLARINEX-D is positioned as an OTC medication, accessible at pharmacies, grocery stores, and online retail platforms. Consumer preference is shifting toward combination formulations that address multiple symptoms simultaneously, amplifying demand for products like CLARINEX-D.

Historical Sales and Market Penetration

In established markets like the United States, allergen-specific medication sales have grown steadily, with OTC antihistamines constituting a significant segment [2]. CLARINEX-D commands a notable share due to its efficacy and dual-action formulation but faces competition from generic and branded alternatives.

Competitive Landscape

Key Competitors

- Generic formulations: Numerous generics combine loratadine, cetirizine, or fexofenadine with pseudoephedrine or phenylephrine, generally at lower prices.

- Branded products: Allegra-D, Zyrtec-D, and Sudafed PE offer similar therapeutic profiles with varying price points and brand loyalty.

Market Positioning

CLARINEX-D leverages its status as a branded product with proven efficacy and a trusted safety profile. However, increased competition and availability of generics exert downward pricing pressure, eroding profit margins.

Regulatory and Patent Considerations

Patent expirations (if applicable) impact exclusivity, expanding generic market entry. Regulatory barriers influence formulary placement and consumer adoption, especially with OTC classification.

Regulatory Environment and Impact

Approval and OTC Status

Approval by regulatory bodies such as the FDA (U.S.) dictates labeling and safety standards. The OTC status enhances accessibility but intensifies price competition as barriers to market entry are relatively low.

Pricing Regulations and Reimbursement

While most OTC drugs are sold without direct reimbursement, insurance coverage and pharmacy benefits can influence effective consumer prices. In certain jurisdictions, pricing regulations or caps may regulate maximum retail prices for OTC medications.

Cost Structure and Pricing Dynamics

Manufacturing and Distribution Costs

Economies of scale in manufacturing generic active pharmaceutical ingredients (APIs) reduce costs over time. Distribution expenses, marketing, and regulatory compliance constitute the primary cost components influencing pricing.

Market Pricing Trends

- Premium positioning: Branded CLARINEX-D typically commands higher retail prices, emphasizing quality and reliability.

- Price erosion: Competition induces generic proliferation, leading to significant price decreases over time.

- Online channel effects: E-commerce platforms offer lower prices, pressuring brick-and-mortar retail margins.

Current Price Range

Based on recent market surveys (Q1 2023), retail prices for a 30-tablet pack range from USD 10-20 for branded CLARINEX-D, with generics selling at USD 5-12 [3]. The price differential reflects brand equity, formulation quality, and consumer perceptions.

Price Projection and Future Market Trends

Short-term Outlook (1-2 years)

- Price stability for branded CLARINEX-D is likely to decline gradually as generic entries increase.

- Enhanced competition could result in a 10-15% reduction in retail prices for the branded product, influenced by aggressive marketing campaigns and market share preservation strategies.

- Online platforms are anticipated to intensify price transparency, further pressuring retail margins.

Medium to Long-term Outlook (3-5 years)

- Price erosion trend continues, with generic formulations possibly halving the current retail prices due to manufacturing efficiencies and market saturation.

- Patent status and regulatory exclusivity will significantly impact the timing and extent of price declines.

- Innovation and formulation improvements could temporarily stabilize prices but are unlikely to reverse downward pressure unless significant differentiation is achieved.

Factors Affecting Price Dynamics

- Regulatory changes, such as OTC reclassification or new safety requirements.

- Market penetration strategies by generic manufacturers.

- Consumer preferences shifted toward value-oriented purchasing.

- Global market expansion opportunities in emerging markets with less price sensitivity.

Strategic Implications

For Manufacturers and Marketers

- Focus on maintaining brand differentiation through efficacy and safety.

- Enhance digital presence to capitalize on direct-to-consumer channels.

- Explore formulation innovations, such as sustained-release variants, to command premium pricing.

For Investors and Retailers

- Monitor patent expirations and regulatory changes to anticipate price declines.

- Leverage online sales channels to improve margins amid declining retail prices.

- Diversify product portfolios to mitigate risks associated with price erosion.

Key Takeaways

- Steady Demand Base: The global prevalence of allergic rhinitis ensures consistent demand for CLARINEX-D, positioning it well within OTC therapeutic markets.

- Competitive Pressure: A landscape increasingly populated with generics will continue to exert downward pressure on prices, especially over the next 3-5 years.

- Price Trends: Expect branded CLARINEX-D retail prices to decline by approximately 10-15% in the short term, with further reductions over the medium term as generics capture market share.

- Market Strategies: Differentiation through formulation innovation, targeted marketing, and digital channels will be crucial for maintaining profitability.

- Regulatory Uncertainty: Potential changes in OTC regulations and patent statuses could significantly influence pricing trajectories.

FAQs

1. What factors most influence the price of CLARINEX-D?

Market competition, patent status, manufacturing costs, regulatory environment, and consumer demand are primary drivers that shape the drug’s pricing.

2. How does the rise of generics impact CLARINEX-D’s price?

Generics typically lead to significant price reductions due to their lower production costs and increased market volume, often eroding the branded drug’s market share and pricing power.

3. Are online sales channels affecting CLARINEX-D prices?

Yes, online platforms promote price transparency, resulting in lower retail prices and increased competition, especially for OTC medications like CLARINEX-D.

4. What's the outlook for CLARINEX-D in emerging markets?

Emerging markets with less developed pharmaceutical patent regimes may see faster generic adoption, further driving prices downward in these regions.

5. What strategies can manufacturers use to sustain profitability amid price declines?

Innovation in formulations, expanding indications, enhancing brand loyalty through quality assurance, and leveraging digital marketing channels are effective approaches.

References

[1] Bousquet J, et al. "Allergic Rhinitis and Its Impact on Asthma (ARIA): 2016 Revision." Allergy, 2016.

[2] IQVIA. "OTC Drug Market Insights," Q1 2023.

[3] Retail Pharmacy Price Surveys, Q1 2023.

In conclusion, the market for CLARINEX-D is poised for moderate pricing declines driven by increasing generic competition and evolving consumer preferences. While current pricing offers opportunities for brand differentiation, long-term sustainability will depend on innovation and strategic positioning amid an increasingly congested OTC landscape.

More… ↓