Last updated: August 1, 2025

Introduction

Clarinex, known generically as desloratadine, is a second-generation antihistamine primarily used to treat allergic rhinitis and chronic idiopathic urticaria. Its widespread adoption in allergy management and its position within the antihistamine market warrants a comprehensive market analysis and price projection. This report synthesizes current market dynamics, competitive landscape, regulatory considerations, and forecasted pricing trends to guide industry stakeholders.

Market Overview

Global Antihistamine Market Dynamics

The global antihistamine market has demonstrated steady growth, driven predominantly by increased prevalence of allergic conditions globally. According to MarketsandMarkets, the allergy treatment market is projected to reach USD 27.5 billion by 2025, expanding at a CAGR of approximately 8% from 2020 (source: [1]). Desloratadine, marketed as Clarinex by Merck, captures a significant segment within this space due to its favorable side effect profile and efficacy.

Key Therapeutic Indications

Clarinex is primarily prescribed for:

- Allergic rhinitis (seasonal and perennial)

- Chronic idiopathic urticaria

Enhanced patient compliance owing to its non-drowsy profile sustains demand momentum. The preference for second-generation antihistamines makes Clarinex a preferred choice among clinicians.

Market Penetration and Adoption

The drug's penetration varies geographically: high in North America, steady in Europe, and expanding within emerging markets such as Asia-Pacific due to rising awareness and healthcare infrastructure improvement. The patent landscape influenced market exclusivity until generic versions entered, affecting pricing and market share dynamics.

Competitive Landscape

Patents and Generic Competition

Merck’s patent for Clarinex expired in many jurisdictions around 2018-2020, paving the way for generic desloratadine formulations. This transition has induced downward pricing pressures and intensified competition from multiple pharmaceutical companies.

Major Competitors

- Brand names: Clarinex (Merck), Aerius (derived from levocetirizine) as a competing antihistamine.

- Generics: Numerous manufacturers produce generic desloratadine, often priced substantially lower than the brand-name version.

Market Differentiators

While generics dominate price-sensitive markets, branded Clarinex maintains a premium segment, attributed to clinical branding, physician trust, and perceived quality assurance. Market differentiation also stems from formulation innovations, such as once-daily dosing and improved tolerability.

Regulatory and Patent Considerations

Patent Status and Exclusivity

In the U.S., patent exclusivity for Clarinex ended by 2017, facilitating generic entry. Regulatory pathways across regions influence pricing strategies:

- The FDA’s ANDA process allows rapid approval of generics.

- The European Medicines Agency (EMA) follows similar generic approval procedures.

Regulatory Challenges and Opportunities

Emerging markets often experience less stringent patent enforcement, enabling local manufacturers to produce cost-effective generics. Conversely, ongoing patent litigations in certain jurisdictions can temporarily defer generic entry, maintaining higher prices.

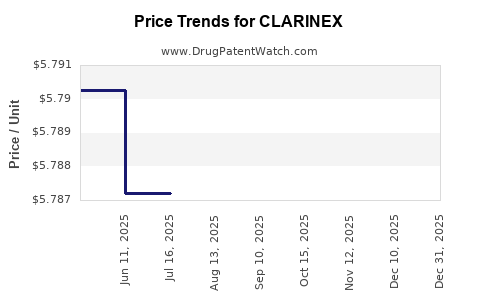

Price Trends Analysis

Historical Pricing Data

- Brand Clarinex: In the U.S., the average retail price per tablet has historically ranged between USD 0.50 to USD 1.00 prior to patent expiry.

- Generic Desloratadine: Post-generic entry, prices have declined by approximately 60-80%, with per tablet costs sometimes below USD 0.20.

Current Price Landscape

As of 2023, the retail price of branded Clarinex remains approximately USD 0.75–1.00 per tablet in the U.S., while generics retail at USD 0.10–0.20. Wholesale procurement prices are often lower, especially in large-volume institutional purchase agreements.

Factors Influencing Future Prices

- Manufacturing costs: Advances in synthesis and scale economies reduce costs.

- Market competition: Increased generic proliferation drives prices downward.

- Regulatory policies: Patent extensions or litigations may temporarily stabilize prices.

- Reimbursement policies: Payer incentives to favor generics impact retail pricing strategies.

Price Projections (2023–2028)

Short-term (2023–2024)

- Branded Clarinex prices are expected to remain relatively stable, assuming no patent or exclusivity renewals. However, physicians may continue to favor cheaper generics, limiting growth.

- Generic prices are projected to maintain their declining trend, possibly dipping to below USD 0.10 per tablet due to increased competition and manufacturing efficiency.

Medium-term (2025–2028)

- The decline in branded Clarinex prices will likely plateau as the market approaches the cost of manufacturing, compounded by price competition.

- Market saturation with generics, alongside potential entry of biosimilars or alternative therapies, may further suppress prices, possibly stabilizing around USD 0.05–0.10 per tablet in bulk sales.

Premium Segment Outlook

- Niche formulations or combination drugs incorporating desloratadine might sustain higher prices due to added value, but these components constitute a small share of the overall market.

Market Growth and Revenue Projections

Global demand is expected to grow at a CAGR of 6–8% driven by rising allergy prevalence. The market share for Clarinex remains substantial in segments favoring branded products, but overall revenue growth may moderate due to generic competition.

Key Drivers and Challenges

Drivers:

- Global increase in allergy-related disorders.

- Physician preference for second-generation antihistamines.

- Expansion into emerging markets.

Challenges:

- Price erosion from generic competition.

- Patent expirations and legal challenges.

- Regulatory hurdles in certain territories.

Key Takeaways

- The desloratadine market is mature, with robust generic competition exerting downward pressure on prices.

- Branded Clarinex's premium segment will likely see stable pricing for short-term but faces long-term erosion.

- Price projections suggest continued decline in generic prices, potentially stabilizing at minimal per-unit costs by 2028.

- Market growth hinges on rising allergy prevalence and expanding geographic penetration, especially in emerging markets.

- Strategic firms should monitor patent statuses and regulatory changes that could impact pricing and market access.

FAQs

1. What factors primarily influence the pricing of Clarinex?

Patent expiration, generic competition, manufacturing costs, regulatory environment, and market demand are key determinants.

2. How has the entry of generics affected Clarinex’s market share and pricing?

Generic entry has significantly reduced prices—by as much as 80%—and diminished the market share of the brandname Clarinex, especially in price-sensitive markets.

3. Are there regions where Clarinex retains a significant premium?

Yes; in regions with patent protections or where brand trust is high—such as the U.S. and parts of Europe—the branded drug maintains higher prices.

4. What is the outlook for Clarinex in emerging markets?

Increased access to healthcare and lower-cost generics dominate the landscape, with prices continuing to decline as manufacturing scales and patent protections are weaker.

5. Could future regulatory changes impact Clarinex’s market?

Yes; patent extensions, new approvals for biosimilars, or changes in drug reimbursement policies could alter the competitive and pricing environment.

Sources:

[1] MarketsandMarkets. "Allergy Treatment Market by Drug Class, Distribution Channel, and Region — Global Forecast to 2025."