Share This Page

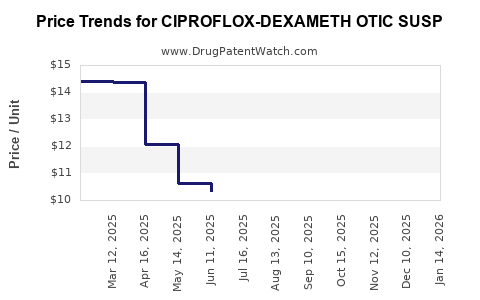

Drug Price Trends for CIPROFLOX-DEXAMETH OTIC SUSP

✉ Email this page to a colleague

Average Pharmacy Cost for CIPROFLOX-DEXAMETH OTIC SUSP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CIPROFLOX-DEXAMETH OTIC SUSP | 53746-0831-53 | 8.61573 | ML | 2025-12-17 |

| CIPROFLOX-DEXAMETH OTIC SUSP | 72485-0625-13 | 8.61573 | ML | 2025-12-17 |

| CIPROFLOX-DEXAMETH OTIC SUSP | 00781-6186-67 | 8.61573 | ML | 2025-12-17 |

| CIPROFLOX-DEXAMETH OTIC SUSP | 62756-0427-90 | 8.61573 | ML | 2025-12-17 |

| CIPROFLOX-DEXAMETH OTIC SUSP | 16714-0628-01 | 8.61573 | ML | 2025-12-17 |

| CIPROFLOX-DEXAMETH OTIC SUSP | 43598-0326-75 | 8.61573 | ML | 2025-12-17 |

| CIPROFLOX-DEXAMETH OTIC SUSP | 53746-0831-53 | 8.94976 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CIPROFLOX-DEXAMETHASONE OTIC SUSPENSION

Introduction

Ciprofloxacin-Dexamethasone Otic Suspension is a combination topical pharmaceutical designed to treat various ear infections, notably otitis externa and otitis media with external auditory canal involvement. Combining an antibiotic (ciprofloxacin) with a corticosteroid (dexamethasone), this formulation addresses both bacterial infection and inflammation, providing comprehensive treatment. Its position in the competitive landscape hinges on efficacy, safety profile, patent life, manufacturing costs, and market demand. This analysis explores current market dynamics and projects future pricing trajectories, offering strategic insights for stakeholders.

Current Market Landscape

Market Demand and Therapeutic Need

Otitis externa and media are prevalent, especially among pediatric and adult populations, creating a steady demand for effective topical treatments. The increasing prevalence of ear infections, partly attributed to rising allergies, environmental pollution, and antibiotic resistance, underscores the ongoing need for potent, safe therapies like ciprofloxacin-dexamethasone otic suspension (Cipro-Dex).

Competitive Environment

Currently, Cipro-Dex vies with several monotherapies and combination products, such as ofloxacin otic drops, neomycin-polymyxin B-hydrocortisone, and other fluoroquinolone-based ear drops. Its positioning benefits from its broad-spectrum activity, proven efficacy, and corticosteroid component that reduces inflammation.

Regulatory Status and Patent Considerations

Approved by the FDA in the United States (approved in 2015), Cipro-Dex remains under patent protection until approximately 2030. This exclusivity phase limits generic competition, allowing for premium pricing and market control. However, patent expiry could erode margins and introduce generics, significantly impacting price and market share post-2030.

Supply Chain and Manufacturing Trends

Manufacturing costs hinge on sourcing proprietary active pharmaceutical ingredients (APIs), quality control, and packaging standards. Companies may leverage economies of scale or seek cost reductions via regional manufacturing hubs, influencing retail and wholesale prices.

Market Segmentation and Geographic Opportunities

-

United States: As the largest single market for otologic therapies, pricing strategies align with payor policies, insurance reimbursements, and prescribing behaviors.

-

Europe: Variability exists due to differing healthcare systems; restorative generics could impact pricing post-patent expiration.

-

Emerging Markets: Growing healthcare infrastructure and rising awareness of ear infections create new opportunities; however, price sensitivity remains high.

Price Dynamics and Projection Strategies

Factors Influencing Price

-

Patent Protection: During patent exclusivity, prices typically remain stable or increase marginally, driven by manufacturing costs and market demand.

-

Market Penetration: Adoption rates influence economies of scale, which can facilitate price adjustments.

-

Regulatory and Reimbursement Policies: Payer negotiations and formulary placements significantly impact achievable prices.

-

Competition and Generics: Post-patent, generic entrants are expected to drive prices downward, sometimes by 50% or more.

Historical Pricing Trends

Currently, the average retail price of branded ciprofloxacin-dexamethasone otic suspension ranges from $60 to $80 per 15 mL bottle in the U.S., with variations based on pharmacy and insurance coverage[1]. Generic versions, once approved, are projected to reduce prices by approximately 40-60%.

Short-term Price Projections (Next 3-5 Years)

-

During patent exclusivity: Prices are likely to sustain or increase marginally, reflecting inflation, supply chain costs, and value proposition. A projected rise of 3-5% annually is plausible, reaching $65-$85 per bottle.

-

Post-patent expiration (~2030): Competitive pressure will lead to rapid price decline, decreasing to $30-$50 per bottle within 1-2 years post-approval of generics[2].

Long-term Outlook (5-10 Years)

- In mature markets, the eventual availability of generics will suppress prices sharply, influencing profitability and market share strategies.

- Innovative formulations or delivery methods (e.g., sustained-release drops) could stabilize higher pricing if clinical advantages are demonstrated.

Strategic Considerations

- Patent protection should be maximized with clinical data to strengthen exclusivity.

- Market penetration prior to patent expiry can secure sustainable revenue streams.

- Pricing strategies should prepare for post-generic competition, possibly through patient assistance programs or value-added services.

Implications for Stakeholders

Pharmaceutical Manufacturers: Optimizing manufacturing efficiencies and investing in formulation improvements can justify premium pricing and extend market viability.

Investors: Monitoring patent timelines and competitor entries is critical for valuation strategies.

Healthcare Providers: Understanding pricing shifts can inform formulary decisions and patient counseling.

Payers and Policymakers: Engagement with pricing negotiations ensures affordability while supporting innovation incentives.

Key Takeaways

- Patent Life Is a Key Driver: Exclusive rights protect premium pricing through roughly 2030, but impending patent expiration will substantially reduce prices.

- Pricing Remains Stable During Exclusivity: Expect marginal year-over-year increases in retail prices, driven by demand and cost factors.

- Generics Will Disrupt Pricing Post-Patent: Prices could decrease by up to 50% or more once generics enter the market, emphasizing the importance of timing in strategic planning.

- Market Demand Is Steady: Growing incidence of ear infections sustains demand, providing robustness to pricing stability during the patent term.

- Healthcare Policy Influences Pricing: Reimbursement policies and formulary placements impact attainable prices internationally.

FAQs

1. What factors influence the current price of ciprofloxacin-dexamethasone otic suspension?

Market exclusivity, manufacturing costs, demand, insurance reimbursement policies, and competition shape current pricing levels.

2. How will patent expiration affect the drug’s price?

Patent expiry will open the market to generics, leading to significant price reductions—often 50% or more—within 1-2 years.

3. Are there any alternative therapies to ciprofloxacin-dexamethasone otic suspension?

Yes, alternatives include monotherapies like ofloxacin otic drops or other antibiotic-steroid combinations, with prices varying based on patent status and formulary positioning.

4. What geographic markets present growth opportunities for this drug?

The U.S. remains the primary market, but emerging markets in Asia, Latin America, and parts of Europe offer growth potential amid rising ear infection incidences.

5. How can stakeholders prepare for post-patent market conditions?

Investing in formulation innovations, expanding indications, and establishing strong brand recognition can maintain profitability as generics dominate pricing strategies.

References

[1] GoodRx (2023). Ciprofloxacin Otic Drop Prices.

[2] IQVIA (2022). Otic Medication Market Trends and Forecasts.

More… ↓