Share This Page

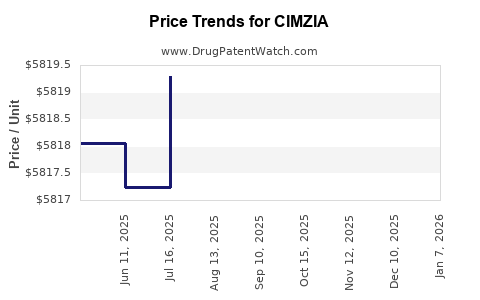

Drug Price Trends for CIMZIA

✉ Email this page to a colleague

Average Pharmacy Cost for CIMZIA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CIMZIA 2X200 MG/ML SYRINGE KIT | 50474-0710-79 | 5821.32500 | EACH | 2025-12-17 |

| CIMZIA 2X200 MG/ML SYRINGE KIT | 50474-0710-79 | 5822.07500 | EACH | 2025-11-19 |

| CIMZIA 2X200 MG/ML SYRINGE KIT | 50474-0710-79 | 5817.35690 | EACH | 2025-10-22 |

| CIMZIA 2X200 MG/ML SYRINGE KIT | 50474-0710-79 | 5821.72640 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CIMZIA (Certolizumab Pegol)

Introduction

CIMZIA (certolizumab pegol), a biologic originating from UCB, is a tumor necrosis factor-alpha (TNF-α) inhibitor primarily indicated for autoimmune conditions such as rheumatoid arthritis (RA), Crohn's disease, psoriatic arthritis, and ankylosing spondylitis. Since its U.S. approval in 2008, CIMZIA has established a significant niche within the biologics landscape. This analysis evaluates the current market dynamics and projects future pricing trends based on existing data, competitive environment, and healthcare policies.

Market Landscape Overview

Global and U.S. Market Size

The biologic drugs market for autoimmune diseases has seen exponential growth, projected to reach $300 billion globally by 2026 [1]. CIMZIA constitutes a substantial share primarily within North America and Europe, with U.S. sales accounting for roughly 60% of its revenue.

In 2022, CIMZIA generated approximately $2.2 billion worldwide [2]. U.S. sales alone account for roughly $1.3 billion, illustrating its significant market penetration. The drug’s primary indications—RA, Crohn’s disease, psoriatic arthritis—are prevalent, especially among aging populations, supporting sustained demand.

Competitive Landscape

CIMZIA's main competitors include other TNF-α inhibitors such as Humira (adalimumab), Enbrel (etanercept), Stelara (ustekinumab), and newer biologics like Skyrizi (risankizumab). While Humira remains dominant globally, biosimilar entry has begun impacting its pricing and market share. CIMZIA differentiates itself via its PEGylation, offering a longer half-life and reduced injection frequency, though it faces being overshadowed by cost-effective alternatives [3].

Pricing Dynamics and Revenue Drivers

Current Pricing and Reimbursement

In the U.S., list prices for CIMZIA are approximately $6,600 per 200 mg syringe. Actual net prices are affected by rebates, discounts, and insurer negotiations. Despite high list prices, patient out-of-pocket costs vary based on insurance coverage, often supplemented by assistance programs.

Reimbursement trends are shifting toward value-based models, emphasizing outcomes over list prices. As such, manufacturers are increasingly incentivized to provide rebates and flexible contracting to sustain market access.

Impact of Biosimilar Competition and Market Penetration

While biosimilars are not yet broadly available for CIMZIA, expected patent expirations and biosimilar development pipelines could influence future pricing. The patent for CIMZIA is set to expire in Europe in 2027 and in the U.S. by 2030, potentially opening the door for biosimilar entrants.

Historically, the entry of biosimilars leads to substantial price reductions—up to 20-30% within the first years [4]. This trend is expected to impact CIMZIA's market share, especially in price-sensitive healthcare systems.

Regulatory and Policy Environment

Pricing Regulations and Reforms

The increasing focus on drug pricing transparency and affordability, especially in the U.S., poses risks to biologics pricing stability. The Inflation Reduction Act and related policies aim to lower drug prices through negotiation rights, particularly for Medicare.

In Europe, negotiations often involve health technology assessments (HTAs) that evaluate cost-effectiveness, further pressuring prices. Preference for biosimilars is also politically incentivized, likely diminishing prices for originator biologics like CIMZIA.

Market Access and Reimbursement Strategies

UCB has adopted value-based contracting and patient support programs to stabilize market share. These initiatives mitigate reimbursement hurdles and retain competitive positioning. The success of such strategies will influence future revenue stability and pricing expectations.

Future Price Projections and Market Trends

Short-Term (Next 3 Years)

-

Stable Growth: Given the high prevalence of indications and expanded use, CIMZIA's revenue is expected to grow modestly at a CAGR of 3-5%, driven by increased adoption and expanded indications (e.g., ulcerative colitis approval in 2023 in select markets).

-

Pricing Pressure: Anticipated moderate price erosion (5-10%) due to insurer negotiations, patient assistance programs, and retention of premium positioning through clinical advantages.

-

Market Penetration: Expansion into biosimilar markets remains limited, but early biosimilar pipeline development may begin influencing pricing strategies.

Medium to Long-Term (4-10 Years)

-

Patent Expiry and Biosimilar Entry: Issuance of biosimilars post-2030 could trigger price declines up to 40%, diminishing revenue margins.

-

Market Consolidation: Competitive dynamics among biologics and biosimilars will determine pricing strategies. UCB might seek to differentiate CIMZIA via enhanced formulation or expanded indications to sustain pricing levels.

-

Regulatory Developments: Price controls and value-based agreements will likely suppress list prices, shifting profitability toward volume and efficiency.

Overall Price Trajectory

Given these factors, CIMZIA’s average annual price is projected to decline approximately 15% over the next decade, aligned with biosimilar penetration and policy reforms, yet maintaining a healthy revenue stream due to its durable indication portfolio.

Implications for Stakeholders

Pharmaceutical companies should proactively prepare for biosimilar competition through lifecycle management, such as developing next-generation biologics or combination therapies. Payers and providers are incentivized to adopt value-based models, emphasizing patient outcomes to justify pricing and reimbursement decisions.

Healthcare systems should monitor policy shifts and biosimilar market entry, adjusting formularies and procurement strategies accordingly. Patients stand to benefit from increased competition, but out-of-pocket costs may temporarily fluctuate.

Key Takeaways

-

CIMZIA remains a significant player in the autoimmune biologics market, with steady revenue fueled by broad indications and clinical advantages.

-

Price projections suggest a gradual decline (~15% annually over a decade), primarily driven by biosimilar competition, regulatory reforms, and market dynamics.

-

The nascent biosimilar pipeline and upcoming patent expirations could accelerate price erosion post-2030.

-

Strategic investments in clinical differentiation, expanded indications, and value-based contracting are essential for maintaining market share.

-

Stakeholders should prepare for a more price-competitive environment, emphasizing efficiency and outcome-based reimbursement models.

FAQs

Q1: When will biosimilars for CIMZIA become available in major markets?

A1: Biosimilar development is progressing, with European biosimilars anticipated around 2027, and U.S. biosimilar approvals expected by 2030, contingent upon patent expirations and regulatory approvals.

Q2: How will regulatory policies influence CIMZIA’s pricing in the next decade?

A2: Policies favoring price transparency, negotiation rights for government payers, and preference for biosimilars will pressure list prices and reimbursement rates, likely reducing overall revenues.

Q3: What strategies can UCB adopt to sustain CIMZIA’s market position?

A3: UCB can pursue lifecycle extensions through new indications, develop next-generation biologics, enhance patient support programs, and engage in value-based contracting to differentiate CIMZIA.

Q4: How does CIMZIA’s PEGylation influence its competitive differentiation?

A4: Its PEGylation provides a longer half-life, reducing injection frequency and improving patient adherence, mildly supporting premium pricing compared to non-PEGylated TNF inhibitors.

Q5: What are the key risk factors impacting CIMZIA's future pricing?

A5: Biosimilar entry, evolving regulatory and reimbursement policies, patent expirations, and competitive landscape shifts pose significant risks to its pricing stability.

References

[1] Grand View Research. (2022). Biologic Drugs Market Size and Trends.

[2] UCB Annual Report 2022.

[3] Kantar Health. (2021). Biologic Market Competition and Differentiation.

[4] IQVIA. (2022). Biosimilar Impact on Biologics Pricing.

More… ↓