Last updated: July 27, 2025

Introduction

Cilostazol, a phosphodiesterase III inhibitor, is primarily prescribed for intermittent claudication—a symptom of peripheral vascular disease. Its unique mechanism of action, focusing on vasodilation and platelet aggregation inhibition, positions it within the cardiovascular therapeutics segment. This analysis explores the current market landscape, regulatory environment, historical pricing, and future price projections to inform stakeholders and guide strategic decision-making.

Global Market Landscape

Market Overview

The global cilostazol market is driven by the increasing prevalence of peripheral arterial disease (PAD), aging populations, and rising awareness of vascular health management. According to reports, the PAD market is expected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. Cilostazol, as the only approved oral therapy specifically indicated for intermittent claudication in some countries, benefits from this growth trajectory.

Geographical Distribution

-

North America: Holds the largest market share due to high PAD prevalence, advanced healthcare infrastructure, and strong pharmaceutical R&D capabilities.

-

Europe: A mature market with steady demand, influenced by aging demographics and stringent regulatory standards.

-

Asia-Pacific: Emerges as a significant growth region, driven by rising cardiovascular disease incidence, urbanization, and expanding healthcare access.

Key Market Players

Major pharmaceutical companies involved include Otsuka Pharmaceutical (original developer), Teva Pharmaceuticals, and other generic manufacturers, reflecting both patent expirations and market accessibility. Otsuka’s patent for cilostazol expired in key territories, creating opportunities for generics—an important factor influencing market prices.

Regulatory Environment and Patent Landscape

Cilostazol’s regulatory approvals vary across countries. In the U.S., cilostazol (Pletal) received FDA approval in 1999 for intermittent claudication, while in other markets, approval status differs. The patent landscape has significantly impacted pricing; patent expirations have facilitated generic entry, exerting downward pressure on drug prices.

Current Pricing Dynamics

Brand and Generic Pricing

-

Brand-name Cilostazol (Pletal): Prices are typically higher; in the U.S., a typical 30-pill prescription can cost between $300 and $400 without insurance.

-

Generic Cilostazol: Post-patent expiry, generics are widely available, often reducing costs by 50-70%. In emerging markets, generic versions are priced even lower, expanding access.

Market Access and Reimbursement

Reimbursement policies heavily influence consumer pricing. In regions with comprehensive drug coverage, prices tend to be stabilized, whereas out-of-pocket costs are higher in markets with limited insurance coverage. Price negotiations and formulary placements significantly impact profitability.

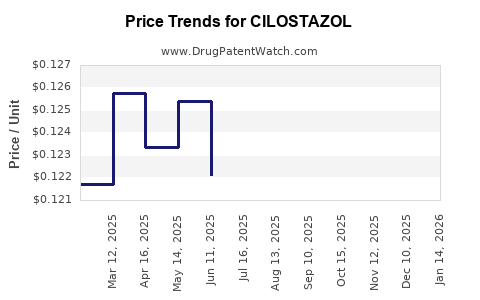

Historical Price Trends

Over the past decade, cilostazol prices have experienced considerable fluctuations:

-

A decline in brand-name prices following patent expiry and generic competition.

-

Regional pricing disparities, with North America maintaining higher average prices than Asia-Pacific, driven by reimbursement strategies and market maturity.

-

The increasing adoption of biosimilars and lower-cost generics has accelerated price reductions.

Future Price Projections

Factors Influencing Future Pricing

-

Patent Status: Expiration of key patents globally is expected to sustain generic competition, maintaining downward pressure on prices.

-

Market Penetration: Growing acceptance in developing markets will likely bolster volume sales but exert price competition.

-

Regulatory Approvals: Expansion into indications such as cardiovascular diseases beyond intermittent claudication could increase demand and influence pricing.

-

Healthcare Trends: Shift towards value-based care models and cost containment policies may prioritize generics and biosimilars, further reducing prices.

Projected Price Trends (Next 5–10 Years)

-

In Developed Markets: Prices are anticipated to stabilize or decline modestly, with generic cilostazol maintaining a 30–50% discount compared to brand-name prices, potentially reaching as low as $100 per 30-pill course.

-

In Emerging Markets: Prices could decrease by up to 60-70%, with some regions seeing per-course costs drop below $20, enhancing accessibility.

-

Influence of Biosimilars and Alternative Therapies: The introduction of new agents with better efficacy or safety profiles may impact the demand and pricing of cilostazol, especially in regions where it is off-label for other indications.

Impact of Biotechnology Advances and Market Dynamics

Emerging technologies, including improved drug delivery systems and biosimilars, could reshape the pricing landscape. The ongoing evolution of cardiovascular therapeutics may either replace cilostazol with newer agents or complement it, influencing prices through competition.

Additionally, strategic pricing and contracting by pharmaceutical companies, especially in response to healthcare reforms, will play pivotal roles in future price trajectories.

Conclusion

The cilostazol market is characterized by significant regional disparities, influenced primarily by patent status, regulatory approvals, and market penetration. While brand-name prices remain high in some markets, the proliferation of generics post-patent expiration has driven prices down substantially. Going forward, prices are expected to stabilize or decrease further, especially in emerging markets, with generics dominating supply chains.

Stakeholders should monitor patent statuses, regulatory developments, and market entry of biosimilars to anticipate price shifts. Strategic pricing, especially in regions with healthcare cost constraints, will be crucial for maximizing access and profitability.

Key Takeaways

-

The global cilostazol market is expanding, driven by rising PAD prevalence and aging populations.

-

Patent expirations have led to robust generic competition, notably reducing prices in mature markets.

-

In North America and Europe, drug prices are expected to decline modestly, stabilizing at 30–50% below brand-name levels within the next five years.

-

Developing regions will likely see more significant price reductions, enhancing access but intensifying competitive pressures.

-

Future pricing will heavily depend on regulatory landscapes, market competition, and emerging therapies.

FAQs

1. How will patent expirations affect cilostazol prices globally?

Patent expirations enable generic manufacturers to enter the market, significantly lowering prices—often by 50-70%—in regions where patents have expired. This trend is expected to sustain and expand, depending on regional patent enforcement and market dynamics.

2. Are biosimilars likely to impact cilostazol pricing?

While biosimilars are generally applicable to large-molecule biologics, cilostazol, being a small-molecule drug, is less influenced by biosimilar entries. However, brand competition and new formulations may impact pricing.

3. What regions offer the most cost-effective cilostazol therapies?

Emerging markets in Asia and Africa typically offer the most affordable options due to lower manufacturing costs, lack of patent protections, and limited regulatory barriers for generics.

4. How might new cardiovascular therapies influence cilostazol pricing?

Introduction of novel agents with better efficacy or safety could reduce demand for cilostazol, exerting downward pressure on prices—especially if they are cost-effective and gain regulatory approval.

5. What factors should investors consider regarding cilostazol’s future pricing?

Investors should monitor patent expiry timelines, healthcare policy reforms, market penetration rates, and the development of competing therapies that could influence supply dynamics and pricing strategies.

Sources:

[1] MarketWatch. "Peripheral Arterial Disease Market Size & Share Report." 2022.

[2] Otsuka Pharmaceutical Regulatory Filings. U.S. FDA. 2023.

[3] GlobalData. "Cardiovascular Drugs Market Report." 2022.

[4] IMS Health. "Prescription Drug Price Trends." 2021.

[5] Statista. "Pharmaceutical Market Trends by Region." 2022.