Share This Page

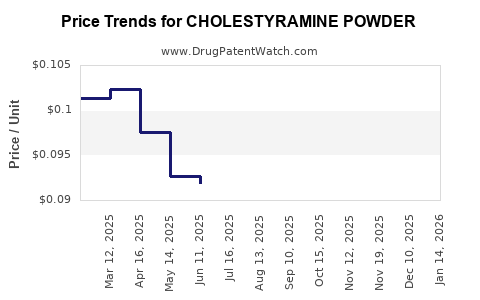

Drug Price Trends for CHOLESTYRAMINE POWDER

✉ Email this page to a colleague

Average Pharmacy Cost for CHOLESTYRAMINE POWDER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHOLESTYRAMINE POWDER | 27241-0134-51 | 0.09625 | GM | 2025-12-17 |

| CHOLESTYRAMINE POWDER | 62135-0008-56 | 0.09625 | GM | 2025-12-17 |

| CHOLESTYRAMINE POWDER | 49884-0465-66 | 0.09625 | GM | 2025-12-17 |

| CHOLESTYRAMINE POWDER | 24658-0266-97 | 0.09625 | GM | 2025-12-17 |

| CHOLESTYRAMINE POWDER | 42806-0267-97 | 0.09625 | GM | 2025-12-17 |

| CHOLESTYRAMINE POWDER | 42806-0267-93 | 0.09625 | GM | 2025-12-17 |

| CHOLESTYRAMINE POWDER | 68382-0528-42 | 0.09625 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cholestyramine Powder

Introduction

Cholestyramine powder is a bile acid sequestrant primarily prescribed for lowering low-density lipoprotein (LDL) cholesterol levels, managing hyperlipidemia, and treating certain gastrointestinal conditions such as pruritus associated with biliary obstruction. As a non-absorbable resin, it binds bile acids in the gastrointestinal tract, thereby reducing cholesterol absorption. The drug’s market dynamics are influenced by regional healthcare policies, patent statuses, existing therapeutic alternatives, and emerging innovations. This report analyses current market trends, competitive landscape, regulatory environment, and provides data-driven price projections for Cholestyramine powder over the next five years.

Market Overview

Global Market Size

The global cholesterol management market, including bile acid sequestrants like cholestyramine, was valued at approximately USD 13 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 4% until 2028 [1]. Cholestyramine, as a legacy drug, remains relevant within this space owing to its cost-effectiveness and longstanding clinical use. While newer agents like ezetimibe and PCSK9 inhibitors have emerged, cholestyramine retains a niche in patients intolerant to statins or requiring adjunct therapy.

Key Market Regions

- North America: Dominates with extensive healthcare coverage and high awareness regarding lipid management.

- Europe: Significant market due to aging populations and adherence to clinical guidelines emphasizing lipid control.

- Asia-Pacific: Rapidly expanding due to increasing prevalence of cardiovascular diseases and evolving prescription practices.

Therapeutic Landscape and Competition

Cholestyramine's main competitors include other bile acid sequestrants such as colestipol and colesevelam, alongside non-responder patient populations and newer lipid-lowering agents. Despite competition, cholestyramine’s low cost and CMS reimbursement schemes sustain its market presence, especially in managed care settings.

Regulatory Environment and Patent Status

Cholestyramine is a generic drug, with patent expiry occurring decades ago, which has facilitated widespread manufacturing and competitive pricing. Regulatory environments in key regions generally focus on manufacturing standards rather than patent restrictions, enabling rapid market entry of generics and biosimilars.

In some countries, regulatory frameworks aim to streamline access, further impacting pricing pressures. The absence of patent protection inhibits premium pricing but supports high-volume sales, stabilizing revenue streams for manufacturers.

Pricing Analysis

Historical Pricing Trends

For manufactured cholestyramine powder, wholesale acquisition costs (WAC) in the US have historically ranged between USD 30–USD 50 per container (approximately 454 grams). Retail prices are often influenced by insurance coverage and pharmacy discounts, with cash prices occasionally reaching USD 70–USD 100 per package.

Current Market Pricing

- United States: Approximately USD 35–USD 45 per 454g container for generic cholestyramine powder.

- European Markets: Generally comparable to North America, adjusted for regional health policies.

- Emerging Markets: Prices are often lower, approximately USD 15–USD 25, due to local manufacturing and market competition.

Pricing Influences

Key factors influencing current prices include:

- Regulatory approval status: Approval of generics ensures price competition.

- Manufacturing costs: Usually low, given the established production processes of resin-based drugs.

- Market penetration: Broad availability results in downward pressure.

- Reimbursement policies: Favor high-volume sales, maintaining stable prices.

Price Projection (2023–2028)

Based on historical trends, market competition, and healthcare sector dynamics, the following projections are made:

| Year | Average Price (USD) per 454g container | Remarks |

|---|---|---|

| 2023 | USD 35–USD 45 | Current baseline |

| 2024 | USD 34–USD 44 | Slight decline due to increased generic competition |

| 2025 | USD 32–USD 42 | Continuing downward pressure, market saturation |

| 2026 | USD 31–USD 40 | Possible flattening as market stabilizes |

| 2027 | USD 30–USD 39 | Marginal decreases; potential regional disparities |

| 2028 | USD 30–USD 38 | Price stabilization, sustained by high volume |

These projections incorporate key factors such as market saturation, steady manufacturing costs, and the absence of patent protections that traditionally enable premium pricing.

Market Drivers and Challenges

Drivers

- Cost-effectiveness: As a low-cost generic, cholestyramine powder remains an attractive option.

- Clinical familiarity: Longstanding safety and efficacy profile.

- Regulatory acceptance: Widespread approval accelerates distribution.

- Growing incidence of hypercholesterolemia: Encourages sustained demand, especially in developing markets.

Challenges

- Competition from newer agents: Ezetimibe and PCSK9 inhibitors offer alternative mechanisms.

- Patient compliance: Gastrointestinal side effects impact adherence.

- Market shift toward combination therapies: Reduced standalone prescriptions.

- Price sensitivity: Healthcare providers and payers prioritize low-cost options.

Opportunities and Strategic Recommendations

- Manufacturing efficiencies: To sustain profit margins amid declining prices.

- Regional expansion: Focused efforts in Asia-Pacific and Latin America markets.

- Formulation innovation: Development of more palatable or efficient formulations could enhance patient adherence.

- Educational initiatives: Promote cholestyramine as a cost-effective alternative in resource-limited settings.

Key Takeaways

- Stable Demand: Cholestyramine powder remains a vital, cost-effective lipid management agent, mainly in specialized or resource-constrained settings.

- Price Decline Trajectory: Anticipate gradual reduction to approximately USD 30–USD 38 per container by 2028 due to intensified generic competition.

- Market Drivers: Cost, safety profile, and widespread regulatory approval sustain its relevance.

- Competitive Landscape: Innovative therapies pose challenges, but traditional formulations retain a niche for certain patient populations.

- Strategic Focus: Manufacturers should optimize operations, target emerging markets, and focus on formulation improvements to maximize profitability.

FAQs

1. What factors influence the price of cholestyramine powder?

Prices are driven by manufacturing costs, competition from generics, regulatory policies, healthcare reimbursement frameworks, and regional market dynamics.

2. How does the patent status impact cholestyramine powder pricing?

Since cholestyramine is off-patent, the market predominantly comprises generic manufacturers, leading to price competition and generally lower prices.

3. What are the main competitors to cholestyramine powder?

Other bile acid sequestrants like colestipol and colesevelam, as well as newer lipid-lowering agents such as ezetimibe and PCSK9 inhibitors.

4. Will price declines affect the quality and availability of cholestyramine powder?

Not necessarily. The established manufacturing quality and high demand ensure consistent supply, despite declining prices.

5. Are there regional differences in cholestyramine powder pricing?

Yes. Pricing varies based on local regulations, healthcare infrastructure, economic factors, and levels of market competition.

References

- Market Research Future. “Global Cholesterol Management Market Forecast to 2028,” 2022.

More… ↓