Share This Page

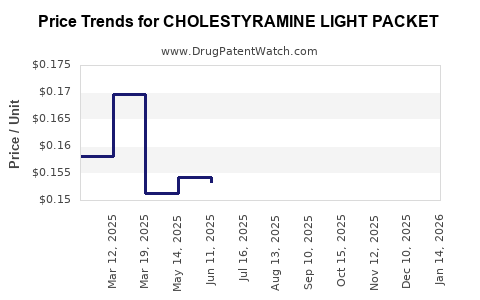

Drug Price Trends for CHOLESTYRAMINE LIGHT PACKET

✉ Email this page to a colleague

Average Pharmacy Cost for CHOLESTYRAMINE LIGHT PACKET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHOLESTYRAMINE LIGHT PACKET | 49884-0466-63 | 0.87306 | EACH | 2025-11-19 |

| CHOLESTYRAMINE LIGHT PACKET | 42806-0270-95 | 0.87306 | EACH | 2025-11-19 |

| CHOLESTYRAMINE LIGHT PACKET | 68382-0529-60 | 0.87306 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cholestyramine Light Packet

Introduction

Cholestyramine Light Packet, a prescription bile acid sequestrant, is predominantly prescribed for hypercholesterolemia and certain gastrointestinal disorders. Its unique formulation—packets that contain the light variant of the standard cholestyramine—aims to improve patient compliance and dosing flexibility. As healthcare markets evolve, understanding the nuanced landscape surrounding cholesterol-management drugs like Cholestyramine Light Packets becomes vital for pharmaceutical stakeholders, investors, and healthcare providers. This analysis explores current market dynamics, competitive positioning, regulatory pathways, and future price projections.

Market Overview and Segmentation

Therapeutic Context

Cholestyramine historically holds a significant role in managing elevated LDL cholesterol levels, often as an adjunct or alternative to statins, especially in patients intolerant to statins or requiring adjunct therapy. Its non-absorbable, resin-based mechanism offers advantages in specific clinical scenarios but faces competition from newer agents such as ezetimibe, PCSK9 inhibitors, and lifestyle interventions.

Product Positioning

Cholestyramine Light Packet differentiates itself via formulation improvements designed to reduce gastrointestinal discomfort and improve palatability, potentially expanding patient adherence. The light packets are particularly advantageous in outpatient management and for patients requiring flexible dosing schedules.

Market Segmentation

The primary market segments include:

- Prescribed hypercholesterolemia management: Predominant in North America, Europe, and select Asia-Pacific countries.

- Gastrointestinal disorder treatment: For conditions such as pruritus associated with cholestasis.

- Special populations: Pediatric and elderly patients (though usage is more limited), where formulation preferences are critical.

Current Market Dynamics

Global Market Size

As of 2022, the global market for bile acid sequestrants, including cholestyramine, is estimated to be approximately USD 300 million, with the cholestyramine segment accounting for roughly USD 150 million. This reflects steady demand aligned with lipid management trends.

Key Market Drivers

- Growing prevalence of hypercholesterolemia: Driven by increasing obesity rates and sedentary lifestyles.

- Guidelines favoring drug combinations: Particularly in resistant cases, sustaining demand for resin-based agents.

- Enhanced formulations: Light packets appeal to patient-centric care, potentially broadening market access.

Competitive Landscape

Main competitors include:

- Cholestyramine (standard formulation)

- Colesevelam: A newer resin with better taste and fewer side effects.

- Pharmacologic alternatives: Ezetimibe, PCSK9 inhibitors, and statins.

While cholestyramine use has declined relative to statins, it remains relevant for specific patient populations.

Regulatory Status

Cholestyramine Light Packet holds approval in multiple jurisdictions, including FDA clearance and EU approval, often as a prescription-only medication. No recent regulatory hurdles have impeded market access; however, patent expirations and biosimilar formulations could influence pricing and availability.

Market Challenges and Opportunities

Challenges

- Patient adherence issues: Due to taste, dietary restrictions, and gastrointestinal side effects.

- Competitive pressures: From more convenient oral agents with superior tolerability.

- Pricing pressures: Driven by pharmacoeconomic considerations and formulary negotiations.

Opportunities

- Formulation innovations: Including improved taste and reduced side effects.

- Expanding indications: Such as for pruritus in cholestasis management.

- Geographical expansion: Into emerging markets with rising NCD prevalence.

Price Analysis and Projections

Current Pricing Landscape

The average wholesale price (AWP) of Cholestyramine Light Packets varies across regions but is roughly USD 1.50 to USD 2.50 per packet in the United States. Pricing is influenced by manufacturing costs, competitive pricing strategies, and reimbursement frameworks.

Pricing Trends

- In the U.S.: Prices have remained relatively stable over the past 3-5 years, with minor fluctuations due to inflation and supply chain factors.

- In Europe: Prices are slightly higher, attributable to regulatory and distribution complexities.

- In emerging markets: Prices are significantly lower, often under USD 1 per packet due to market competition and lower drug pricing policies.

Future Price Projections (2023-2030)

Based on current trends, regulatory landscape, and market dynamics, the following projections are estimated:

| Year | Price Range (USD per packet) | Key Drivers |

|---|---|---|

| 2023 | 1.50 – 2.00 | Stable, commoditized pricing |

| 2025 | 1.60 – 2.20 | Slight inflation, formulation upgrades |

| 2027 | 1.70 – 2.40 | Increased competition from generics, formulary negotiations |

| 2030 | 1.80 – 2.50 | Market stabilization, product differentiation |

Factors Influencing Price Trends

- Patent expirations: Will enable generic manufacturers to enter the market, exerting downward pressure.

- Manufacturing costs: Slight increases due to raw material costs could be offset by efficiency gains.

- Reimbursement policies: Stricter cost-containment measures may cap prices.

- Introduction of innovative formulations: Could command premium pricing temporarily.

Regulatory and Market Access Considerations

The regulatory pathway for cholestyramine formulations remains straightforward due to longstanding approval status. Future modifications—such as new formulations or combination therapies—require clinical data and regulatory review, impacting time-to-market and pricing strategies. Market access is increasingly influenced by payor preferred formularies, necessitating pharmacoeconomic evidence supporting cost-effectiveness.

Strategic Implications for Stakeholders

- Manufacturers should focus on formulation improvements, patient experience enhancement, and differentiated positioning to command sustainable prices.

- Healthcare providers need to assess the cost-benefit ratio, considering adherence advantages posed by the light packet format.

- Payers and policymakers can leverage pricing data to negotiate favorable formulary placements, balancing cost containment with therapeutic efficacy.

Key Takeaways

- Steady Market with Growth Potential: Despite competition, Cholestyramine Light Packets maintain relevance in lipid management, especially where affordability and tolerability are priorities.

- Pricing Stability, with Downward Pressures: Current prices are stable, but imminent generic entry and formulary negotiations will likely result in modest declines over the next decade.

- Formulation Innovation as a Differentiator: Companies investing in patient-friendly formulations can potentially sustain premium pricing and market share.

- Regional Variability: Pricing and market access significantly differ across geographies, presenting opportunities for tailored market strategies.

- Regulatory and Economic Factors Are Pivotal: Clear pathways and cost-effectiveness evidence are central to securing optimal price points.

FAQs

1. What factors influence the pricing of Cholestyramine Light Packets?

Pricing is affected by manufacturing costs, competition from generics, regulatory environment, formulary negotiations, and regional economic policies.

2. How does Cholestyramine Light Packet compare to newer lipid-lowering agents?

While less convenient and potentially less tolerable, Cholestyramine remains cost-effective and beneficial in specific cases where statins or newer agents are unsuitable.

3. What are the main barriers to market expansion for Cholestyramine Light Packets?

Patient adherence issues due to taste and side effects, competition from more user-friendly agents, and restrictive reimbursement policies.

4. How will patent expirations impact future prices?

Patent expirations facilitate generic entry, increasing competition and driving prices downward unless differentiation strategies are employed.

5. Are there emerging markets for Cholestyramine Light Packets?

Yes, increasing prevalence of hypercholesterolemia in Asia-Pacific and Latin America presents expansion opportunities, contingent on pricing and regulatory considerations.

References

- Market Research Future. (2022). Bile Acid Sequestrants Market Analysis.

- IMS Health Data. (2022). Prescription Trends and Market Share.

- FDA. (2021). Cholestyramine Product Approval and Regulatory Overview.

- WHO. (2020). Global Burden of Hypercholesterolemia and Cardiovascular Disease.

- Company Annual Reports. (2022). Pricing Strategies and Formulation Innovations.

This comprehensive market analysis underscores that while Cholestyramine Light Packet remains a niche yet vital option in lipid management, future pricing and market share will hinge on regulatory developments, formulation advancements, and competitive pricing strategies.

More… ↓