Last updated: July 27, 2025

Introduction

Chlorhexidine, a broad-spectrum antimicrobial agent, has become integral to infection prevention and control across diverse healthcare sectors. Its applications span antiseptic skin preparation, wound care, and oral hygiene, leading to a robust global demand. This analysis examines market dynamics, key drivers, competitive landscape, and future price projections for chlorhexidine, enabling stakeholders to make data-driven decisions.

Market Overview

Chlorhexidine was first introduced in the 1950s and has since established itself as a critical component of antiseptic protocols worldwide. The global market for chlorhexidine is projected to grow at a compounded annual growth rate (CAGR) of approximately 4-6% over the next five years [1]. This growth is fueled by increasing infection control standards, rising surgical procedures, and expanding applications in oral care.

Market Size and Segments:

- By Formulation: Solutions, gels, wipes, and sprays.

- By Application: Surgical hand antiseptics, skin disinfection, oral rinses, wound cleansers.

- By Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

North America and Europe currently dominate the market, due to advanced healthcare infrastructure and stringent regulations. However, Asia-Pacific exhibits the fastest growth trajectory owing to a burgeoning healthcare sector, increasing healthcare expenditure, and rising awareness.

Key Market Drivers

1. Rising Infection Control Needs

The global focus on infection prevention, magnified by the COVID-19 pandemic, has increased reliance on antiseptics like chlorhexidine. Surgical site infections (SSIs) and healthcare-associated infections (HAIs) remain significant concerns, driving demand for effective antiseptics.

2. Expansion in Dental and Oral Care

Chlorhexidine gluconate oral rinses are widely prescribed for periodontal disease management. The rising prevalence of oral health issues and patient awareness bolster demand for chlorhexidine-based products [2].

3. Regulatory Approvals and Standardizations

Regulatory approvals from agencies like the FDA and EMA bolster market confidence. The inclusion of chlorhexidine in infection control protocols enhances its application scope.

4. Growing Preference for Non-Antibiotic Agents

Healthcare providers prefer antiseptics over antibiotics for skin decolonization, given concerns over antimicrobial resistance. Chlorhexidine's efficacy makes it a preferred choice.

Competitive Landscape

Major players include:

- Johnson & Johnson (including Peridex, Hibiclens)

- 3M (Hospisept, Steri-Strip)

- GlaxoSmithKline (Hexilite)

- BASF

- Cara Therapeutics

These companies invest heavily in R&D, quality assurance, and regional expansion strategies. Patent protections and regulatory exclusivities influence pricing dynamics, with innovative formulations commanding premium prices.

Pricing Trends and Factors

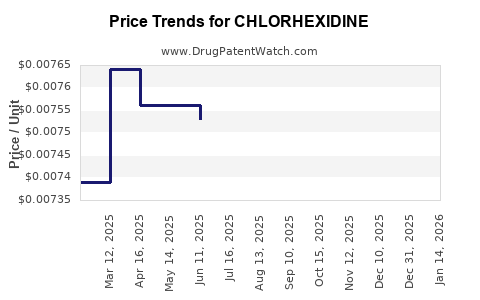

Current Pricing Landscape

Pricing varies significantly based on formulation, concentration, packaging, and regional factors:

- Hospital-grade solutions typically cost between $2–$10 per 100 mL.

- Oral rinses range from $8–$15 for 250 mL bottles.

- Wipes and gels are priced at approximately $1–$3 per unit or gram.

Price fluctuations are influenced by raw material costs, manufacturing expenses, regulatory compliance, and market competition.

Manufacturing and Raw Material Cost Influences

Chlorhexidine's synthesis involves complex organic processes, with raw materials like chlorhexidine digluconate experiencing price volatility due to supply chain disruptions, geopolitical factors, and raw material scarcity [3].

Regulatory and Patent Factors

Expiration of key patents and regulatory approvals open markets to generics, exerting downward pressure on prices. Conversely, proprietary formulations or enhanced delivery systems may command higher prices.

Future Price Projections (2023-2028)

Based on current market trajectories, the following projections are salient:

-

Stable Unit Pricing: The average price for standard chlorhexidine solutions is anticipated to decline modestly by circa 2-4% annually due to increasing generic competition [4].

-

Premium Formulations: Innovative products, such as sustained-release gels or combined antiseptics, are projected to maintain or increase current pricing, driven by value-add features and regulatory exclusivity.

-

Regional Variations: Prices in developed markets will likely stabilize or marginally decrease, while emerging markets could see greater price reductions owing to generic penetration.

-

Raw Material and Manufacturing Costs: Price increases from raw material shortages or supply chain constraints could temporarily overshadow downward pricing pressures, especially in 2023-2024.

Market Opportunities and Challenges

Opportunities

- Emerging markets offer growth potential due to expanding healthcare infrastructure.

- Product innovation in delivery systems, such as long-acting formulations, can command premium pricing.

- Growing demand for oral health products in Asia-Pacific boosts segment-specific opportunities.

Challenges

- Pricing erosion due to generic competition.

- Stringent regulatory environments may delay product approvals in certain regions.

- Raw material volatility can impact profit margins.

Regulatory Outlook

Ongoing regulatory harmonization efforts aim to streamline approvals, yet regional disparities persist. Companies investing in compliance and quality assurance are positioned to capitalize on expanding markets.

Key Takeaways

- The global chlorhexidine market is projected to grow at approximately 4-6% CAGR through 2028, driven by heightened infection control measures and expanding application sectors.

- Price trends indicate a gradual decline in standard formulations due to increasing generic competition, while value-added and patented formulations may sustain higher prices.

- Regional disparities significantly influence pricing, with mature markets stabilizing or reducing costs and emerging economies offering growth opportunities.

- Raw material costs and supply chain stability are critical factors influencing short-term pricing dynamics.

- Innovation in formulations and strategic market expansion are vital for maintaining profitability amid thin margins.

FAQs

1. What are the primary applications driving chlorhexidine demand?

Chlorhexidine is predominantly used for surgical hand antisepsis, skin disinfection before procedures, oral health rinses, and wound care, with infection prevention being the central driver.

2. How will patent expirations influence chlorhexidine pricing?

Patent expirations in key formulations will lead to increased generic competition, exerting downward pressure on prices and offering cost advantages to healthcare providers.

3. Are there regional regulatory challenges impacting market growth?

Yes, regulations vary globally, with some regions requiring extensive local clinical data or differing approval pathways, potentially delaying market entry and influencing pricing strategies.

4. What innovations are shaping the future market for chlorhexidine?

Development of sustained-release formulations, combination antiseptics, and novel delivery mechanisms are poised to attract premium pricing and expand therapeutic uses.

5. How will raw material price fluctuations impact supply stability?

Volatility in raw materials like chlorhexidine digluconate affects manufacturing costs, potentially leading to price adjustments and supply disruptions if shortages occur.

References

[1] Global Market Insights. (2022). "Chlorhexidine Market Size and Forecast."

[2] MarketsandMarkets. (2021). "Oral Care Market by Product and Region."

[3] Industry Reports. (2022). "Raw Material Cost Dynamics in Antiseptic Manufacturing."

[4] Transparency Market Research. (2022). "Future Outlook for Chlorhexidine."