Share This Page

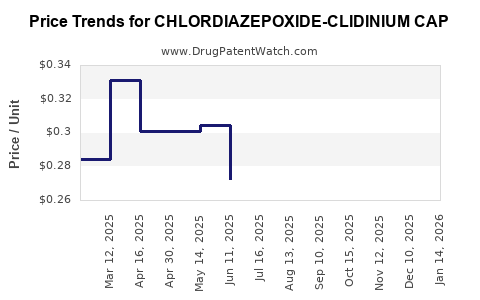

Drug Price Trends for CHLORDIAZEPOXIDE-CLIDINIUM CAP

✉ Email this page to a colleague

Average Pharmacy Cost for CHLORDIAZEPOXIDE-CLIDINIUM CAP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHLORDIAZEPOXIDE-CLIDINIUM CAP | 59651-0524-01 | 0.25439 | EACH | 2025-12-17 |

| CHLORDIAZEPOXIDE-CLIDINIUM CAP | 60219-1677-01 | 0.25439 | EACH | 2025-12-17 |

| CHLORDIAZEPOXIDE-CLIDINIUM CAP | 42571-0381-01 | 0.25439 | EACH | 2025-12-17 |

| CHLORDIAZEPOXIDE-CLIDINIUM CAP | 60687-0639-11 | 0.25439 | EACH | 2025-12-17 |

| CHLORDIAZEPOXIDE-CLIDINIUM CAP | 11534-0197-01 | 0.25439 | EACH | 2025-12-17 |

| CHLORDIAZEPOXIDE-CLIDINIUM CAP | 70700-0185-01 | 0.25439 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHLORDIAZEPOXIDE-CLIDINIUM Cap

Introduction

Chlordiazepoxide-Clidinium Cap, a combination medication primarily prescribed for gastrointestinal disorders, particularly irritable bowel syndrome (IBS) and related conditions, is gaining increasing attention in global pharmaceutical markets. This analysis evaluates the current market landscape, key drivers, competitive positioning, and projects future pricing trends to inform stakeholders aiming to optimize investment and commercialization strategies.

Market Overview

Therapeutic Indication and Dosage Forms

Chlordiazepoxide, a benzodiazepine, exerts anxiolytic and sedative properties, while clidinium acts as an anticholinergic agent to reduce gastrointestinal motility and secretions. The combination effectively manages symptoms related to IBS, such as abdominal cramping and anxiety. Available predominantly as capsules, the drug caters to adult patients, with some formulations extending to pediatric use under specific conditions.

Market Size and Growth Dynamics

The global gastrointestinal disorder therapeutics market was valued at approximately USD 6.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.2% until 2030 [1]. Amidst rising incidences of IBS globally — estimated at 10-15% prevalence — demand for combination therapies like chlordiazepoxide-clidinium is expected to escalate.

Geographical Segmentation

- North America: Dominates due to high prevalence, mature healthcare infrastructure, and favorable reimbursement policies. The U.S. accounts for over 50% of the regional share.

- Europe: Robust growth driven by increased diagnosis rates and aging populations.

- Asia-Pacific: Fastest-growing market due to urbanization, rising healthcare expenditure, and increased awareness of gastrointestinal disorders.

Competitive Landscape

Several pharmaceutical giants have marketed formulations similar to Chlordiazepoxide-Clidinium, with variations in brand names (e.g., Librax in the U.S., and various generics globally). Patent expirations are leading to a surge in generic availability, intensifying price competition. Key competitors include:

- Pfizer: Historically held the brand patent.

- Teva Pharmaceuticals: Major generic supplier post-patent expiry.

- Sun Pharmaceutical and Others: Regional generic manufacturers expanding their portfolio.

Regulatory and Patent Considerations

Patent protections for initial formulations have generally expired across major markets, exposing the drug to generic competition. However, new formulations or combination patents, where applicable, could temporarily sustain premium pricing. Regulatory approvals can vary significantly between countries, impacting market access and pricing strategies.

Pricing Landscape

Historical Pricing Trends

- Branded formulations: Typically priced between USD 2.50 - USD 5.00 per capsule in the U.S.

- Generics: Range from USD 0.50 - USD 1.50 per capsule, showing significant discounts due to competition.

Pricing is influenced by factors such as manufacturing costs, regulatory climate, competitive pressure, and reimbursement policies.

Current Price Points

In mature markets like North America and Europe, generic chlordiazepoxide-clidinium caps now dominate, with prices stabilized around USD 0.60 per capsule. In emerging markets, prices can be substantially lower, often between USD 0.20 and USD 0.50 per capsule.

Market Drivers and Barriers

Drivers

- Rising prevalence of gastrointestinal and anxiety disorders.

- Increasing acceptance of combination therapies.

- Greater healthcare expenditure and insurance coverage.

- Growing awareness and diagnosis rates.

Barriers

- Stringent regulation and approval procedures in certain regions.

- Potential adverse effects associated with benzodiazepines, prompting cautious prescribing.

- Competition from alternative therapeutic options, including newer pharmacological classes and behavioral therapies.

Price Projections (2023–2030)

Given current trends, forecasts suggest:

- Average generic capsule prices will remain relatively stable, with minor fluctuations driven by inflation and manufacturing efficiencies.

- Premium formulations with extended release or combined novel delivery mechanisms may command higher prices initially but will likely experience competitive pressure within 3-5 years.

- Emerging markets will see further price reductions driven by increased generic penetration and local manufacturing.

Overall, average retail price points for chlordiazepoxide-clidinium capsules are projected to hover around USD 0.50 – USD 0.80 per capsule globally by 2030, with regional variations based on regulatory and market dynamics.

Implications for Stakeholders

- Manufacturers should focus on optimizing manufacturing costs and securing regional approvals to maintain competitive pricing.

- Investors should assess patent status and regulatory timelines to anticipate market entry challenges.

- Healthcare providers and payers will favor cost-effective generics, emphasizing formulation safety profiles and reimbursement coverage.

Key Market Trends Impacting Pricing

- Increasing shift toward biosimilars and generics.

- Growing emphasis on drug affordability in developing countries.

- Regulatory incentivization for safer, non-benzo alternatives.

- Digital health integration influencing prescription patterns.

Conclusion

The chlordiazepoxide-clidinium capsule market is characterized by mature, highly competitive dynamics in developed regions and rapid growth in emerging economies. The pervasive availability of generics is exerting downward pressure on pricing, with projections indicating stable, low-cost pricing practices through 2030. Stakeholders must navigate regulatory landscapes, patent statuses, and regional market conditions to optimize returns and ensure product accessibility.

Key Takeaways

- The global market for chlordiazepoxide-clidinium capsules is expanding, driven by increased IBS prevalence and aging populations.

- Patent expirations have ushered in significant generic competition, stabilizing prices at low levels.

- Average price points are expected to remain between USD 0.50 and USD 0.80 per capsule by 2030.

- Strategic regional positioning and efficient manufacturing are critical for maintaining profitability amidst price pressures.

- Developing safe, innovative formulations may present opportunities for premium pricing in select markets.

FAQs

1. How does patent expiration affect the pricing of chlordiazepoxide-clidinium capsules?

Patent expiration typically leads to increased generic competition, exerting downward pressure on prices. Branded formulations often see significant discounts once generics enter the market, stabilizing average prices at lower levels.

2. Are there regional price differences for chlordiazepoxide-clidinium capsules?

Yes. Prices vary widely—developed markets like North America and Europe maintain higher prices due to regulatory standards and healthcare reimbursement models, while emerging markets experience lower pricing driven by local manufacturing and economic factors.

3. What are the key factors influencing future price trends?

Regulatory changes, patent statuses, manufacturing cost efficiencies, regional market conditions, and new formulation developments will shape future pricing trajectories.

4. Could new formulations or delivery mechanisms impact pricing?

Yes. Innovative delivery systems or combination drugs may command premium prices initially but are likely to face competition and price reductions over time.

5. What are the primary barriers to market growth for this drug?

Safety concerns related to benzodiazepine use, regulatory hurdles, and competition from alternative treatments including newer therapies and non-pharmacological options are notable barriers.

Sources

[1] Global Market Insights. "Gastrointestinal Disorders Market Forecast," 2022.

More… ↓