Share This Page

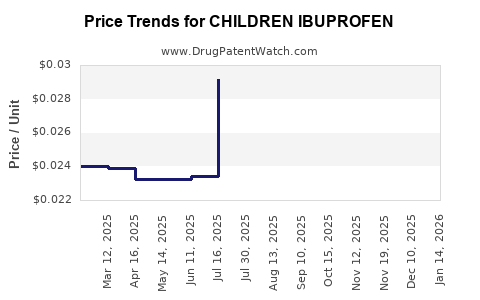

Drug Price Trends for CHILDREN IBUPROFEN

✉ Email this page to a colleague

Average Pharmacy Cost for CHILDREN IBUPROFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILDREN IBUPROFEN 100 MG/5 ML | 83474-0002-04 | 0.03429 | ML | 2025-12-17 |

| CHILDREN IBUPROFEN 100 MG/5 ML | 00904-5309-09 | 0.02414 | ML | 2025-12-17 |

| CHILDREN IBUPROFEN 100 MG/5 ML | 00904-5309-20 | 0.03006 | ML | 2025-12-17 |

| CHILDREN IBUPROFEN 100 MG/5 ML | 24385-0009-26 | 0.03006 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Children’s Ibuprofen

Introduction

Children’s ibuprofen remains a cornerstone in pediatric analgesic and antipyretic therapy. As a widely utilized over-the-counter (OTC) medication, it offers rapid relief from fever, pain, and inflammation in pediatric patients. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory environment, and forecasts future pricing trends to aid stakeholders in strategic decision-making.

Market Overview

Global Market Size and Growth Trajectory

The global pediatric analgesics market, including children’s ibuprofen, is valued at approximately USD 1.2 billion as of 2022, with a compound annual growth rate (CAGR) of about 4.8% projected through 2027[1]. The growth is driven by rising parental awareness, increased prevalence of pediatric pain-related conditions, and expanding OTC availability.

Segment Breakdown

Children’s ibuprofen accounts for a substantial share within the pediatric OTC segment, overshadowing competitors like acetaminophen (paracetamol). The segment’s prominence is due to favorable safety profiles, proven efficacy, and wide availability.

Market Segments and Regional Dynamics

- North America: Dominates due to high OTC penetration, advanced healthcare infrastructure, and consumer awareness.

- Europe: Second-largest market, with a strong preference for pediatric OTC medications.

- Asia-Pacific: Fastest-growing region, propelled by rising disposable incomes, urbanization, and expanding healthcare access.

Key Market Drivers

Increased Pediatric Healthcare Focus

Heightened awareness regarding pediatric health and safe OTC options fuels demand. Clinicians and parents prefer ibuprofen due to its efficacy and safety profile, particularly when used appropriately.

Product Innovation and Diversification

Manufacturers innovate formulations—sugar-free, liquid gels, flavored syrups—to improve compliance and appeal, expanding the market base.

Regulatory Approvals and Safety Standards

Robust regulatory frameworks in developed regions ensure product safety, fostering consumer trust and broad usage.

Pandemic Influence

COVID-19 heightened awareness of fever management, bolstering sales of children’s ibuprofen products globally.

Market Challenges

Regulatory Scrutiny

Stringent labeling, dosing guidelines, and safety monitoring can restrict product marketing and introduce compliance costs.

Competition and Brand Consolidation

Generic dominance and aggressive marketing by key players present pricing pressures and limit profit margins.

Pricing Sensitivity and OTC Market Variability

In regions where OTC pricing is regulated or sensitive to economic factors, profit margins can be constrained.

Competitive Landscape

Leading manufacturers include Johnson & Johnson, Walgreens Boots Alliance, and local generic producers. Their offerings range from branded liquids to store-branded generics, all emphasizing safety and palatability.

Market entry barriers include regulatory approval processes, formulation expertise, and distribution networks.

Pricing Trends and Projections

Current Pricing Landscape

The average retail price of a standard 4 oz (118 ml) bottle of children’s ibuprofen ranges from USD 4.50 to USD 8.00 in North America and Europe. Price variations stem from brand, formulation, and distribution channels.

Factors Influencing Price Dynamics

- Manufacturing Costs: Fluctuate with raw material prices, especially active pharmaceutical ingredients (APIs) like ibuprofen.

- Regulatory Compliance: New safety guidelines may increase compliance costs, potentially passing through to consumers.

- Market Competition: Intense competition among generics exerts downward pressure on prices.

- Supply Chain Factors: Disruptions, such as those experienced during COVID-19, can create shortages and impact pricing.

Forecasted Price Trends (2023-2028)

- Stability in Developed Markets: Prices are expected to remain relatively stable due to mature markets and regulatory safeguards.

- Potential Moderation of Prices: Increased competition, especially from store brands, might suppress prices further.

- Emerging Markets: Prices could decline as local manufacturers enter the scene, driven by regulatory harmonization and market expansion.

Projected Price Range

By 2028, retail prices of children’s ibuprofen are projected to decrease marginally by 5-10% in mature markets, stabilizing around USD 4.00 to USD 7.50 per bottle. In emerging regions, initial prices may be lower, with gradual increases as demand and regulatory standards evolve.

Regulatory and Policy Environment

FDA and EMA Guidelines

In the United States, the FDA emphasizes clear dosing instructions, safety warnings, and quality standards. The European Medicines Agency (EMA) enforces similar directives within the EU. These regulations shape formulation, packaging, and marketing strategies.

Impact on Pricing

Regulatory requirements incur costs, often reflected in retail prices, but ensure product safety and consumer confidence. Manufacturers may offset these costs through innovation and branding.

Opportunities and Risks

Opportunities

- Expansion into emerging markets offers growth potential due to increased healthcare access.

- Product diversification—such as organic or allergen-free formulations—can command premium pricing.

- Digital marketing channels facilitate direct consumer engagement and brand loyalty.

Risks

- Regulatory hurdles may delay product launches or induce additional costs.

- Price wars among generic manufacturers could compromise margins.

- Raw material shortages could increase costs unpredictably.

Key Takeaways

- The children’s ibuprofen market remains robust, driven by increasing pediatric healthcare needs and consumer preference for OTC analgesic options.

- Price stability is anticipated in mature markets, with marginal declines driven by generic competition and supply chain efficiencies.

- Emerging markets present growth opportunities, albeit with prices starting lower and with potential for upward adjustment.

- Regulatory compliance and safety standards, while increasing costs, reinforce consumer trust and can support premium product positioning.

- Stakeholders should monitor supply chain dynamics and evolving regulatory landscapes to optimize pricing and market strategies.

FAQs

-

What is the typical retail price of children’s ibuprofen today?

Currently, a 4 oz (118 ml) bottle averages USD 4.50 to USD 8.00 in North America and Europe, varying by brand and retailer. -

How will pricing evolve over the next five years?

Prices are projected to decrease slightly by 5-10% in mature markets due to intensifying competition, with stable or modestly increasing prices in emerging regions. -

Which factors most influence children’s ibuprofen pricing?

Manufacturing costs, raw material prices, regulatory compliance expenses, competition, and supply chain dynamics significantly impact pricing. -

Are branded or generic products more affordable?

Generics typically offer lower prices than branded formulations while maintaining efficacy and safety standards. -

What growth opportunities exist for manufacturers?

Expansion into emerging markets, product innovation, and leveraging digital marketing channels offer substantial prospects.

References

[1] MarketsandMarkets. "Pediatric Pain Management Market by Product (Analgesics, Anesthetics), Application (Trauma, Surgery, Pediatric Pain Management), Route of Administration (Oral, Topical), and Region — Global Forecast to 2027." 2022.

More… ↓